On Dec. 2, independent market analyst Stockmoney Lizards said Bitcoin (BTC) had entered the process of bottoming out inside its current $15,500-$18,000 price range, citing Wyckoff Accumulation.

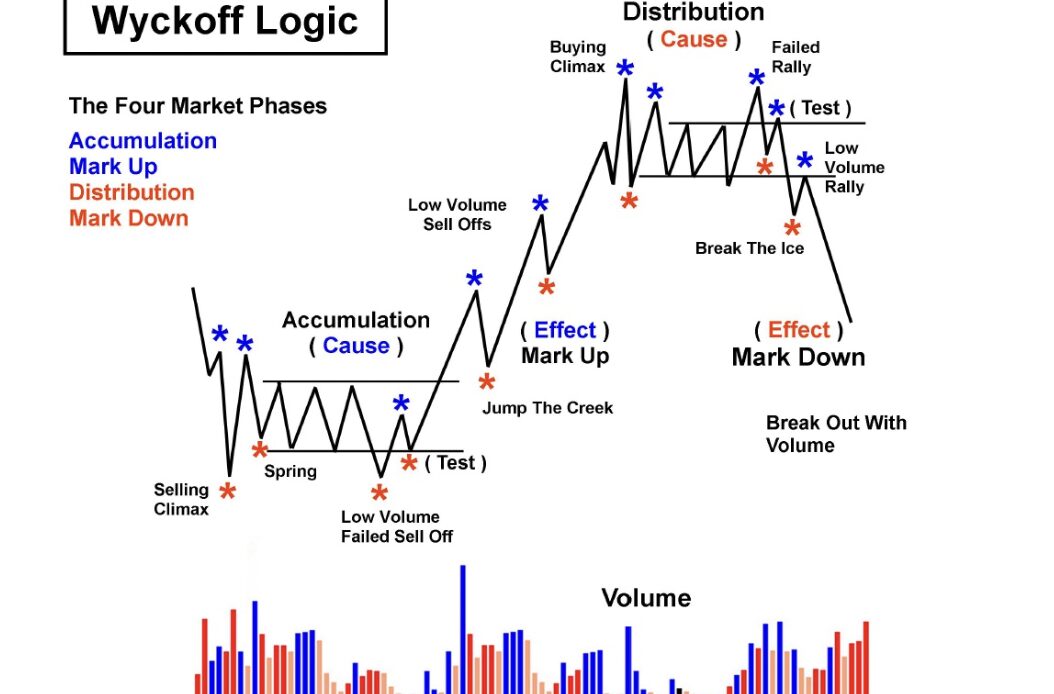

Wyckoff Accumulation is a classic technical analysis setup, named after Richard Wyckoff, a technical analysis pioneer in the first half of the twentieth century, who broke down the market cycle into four distinct phases.

But is Wyckoff a reliable pattern, particularly for trading cryptocurrency? Let’s find o.

What is Wyckoff accumulation?

Wyckoff accumulation is one of the four phases listed in the Wyckoff market cycle theory, with the other three being markup, distribution and markdown. In layman’s terms, each phase determines when large entities drive the direction of the market.

The accumulation phase correctly develops when big pockets boost their buying and drive demand.

As a result of increased interest, the price forms higher lows while trending further higher. In doing so, the price pushes above the upper trendline of its trading range, switching to the markup phase of the Wyckoff cycle.

In other words, a sustained uptrend, as shown in the diagram below.

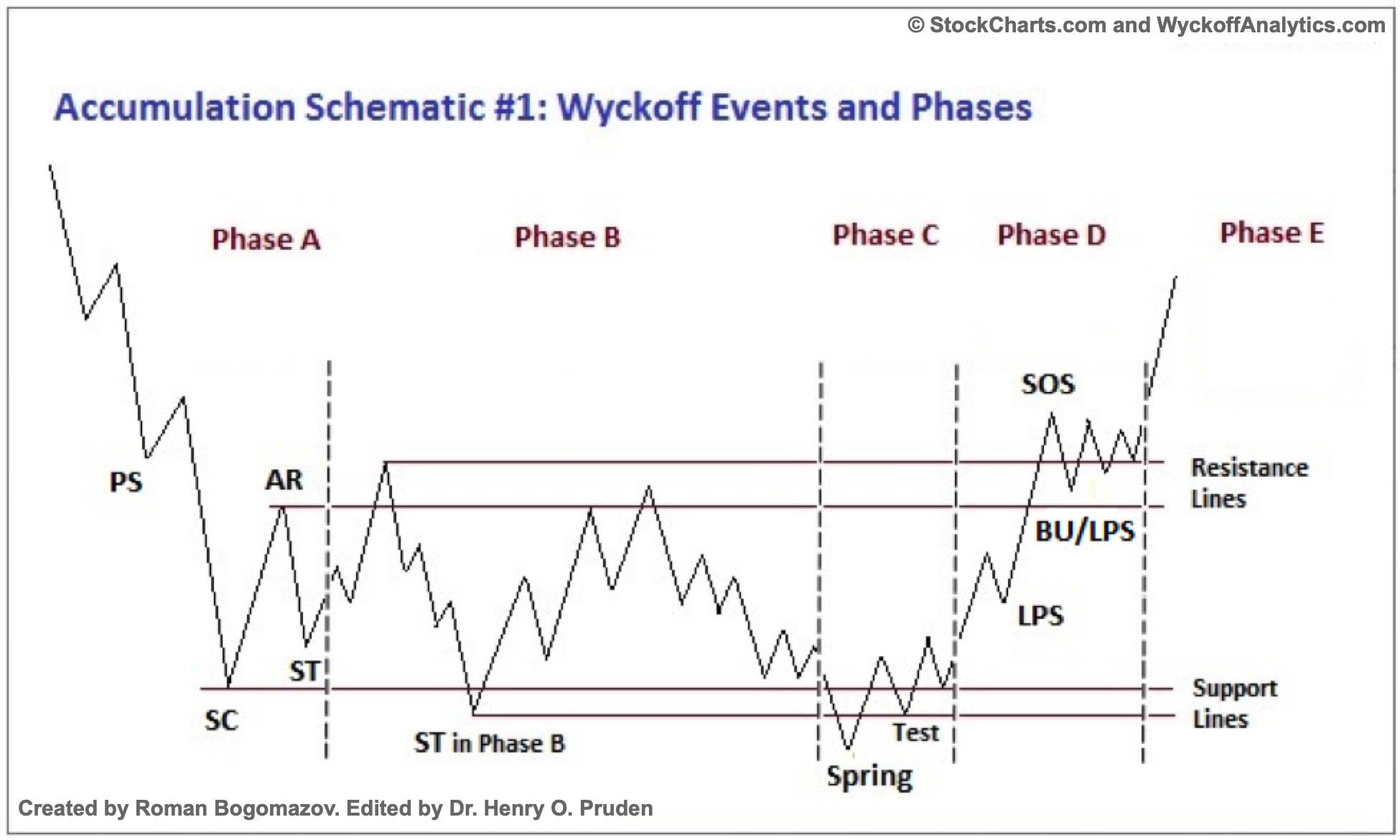

Accumulation events and phases

In the accumulation phase, big players prepare for their next bull strategy by accumulating assets within a given trading range (TR). As they do, the assets purchased outweigh the assets sold, leading to drops in available supply which, in turn, helps the price rally above the TR.

Related: What is a Doji candle pattern and how to trade with it?

Therefore, small investors undertaking the Wyckoff accumulation strategy must correctly identify the direction and the speed of the move out of the TR.

Fortunately, they can take assistance from a widely-tracked accumulation schematic created by Wyckoff in the early 1930s, as illustrated below.

Phase A reflects the previous downtrend’s exhaustion. It begins with preliminary support (PS) — a period wherein substantial buying begins alongside rising volumes — which suggests that the prevailing bearish trend is approaching its end.

The downside bias dies down after the price drops to its selling climax (SC), a point at which large professional investors start absorbing the retail side sell-pressure and traders start covering their short positions.

As a result, the price rebounds sharply…

Click Here to Read the Full Original Article at Cointelegraph.com News…