Fundamental analysis is the process of finding the intrinsic value of an asset, with the goal to determine whether the asset is overvalued or undervalued. That information can then be leveraged along with technical analysis to decide whether to invest in or trade an asset.

In cryptocurrency fundamental analysis, the approach is somewhat different than that typically used to evaluate legacy market assets. Crypto assets don’t have the historical data required, because there’s usually no history of earnings reports or profit and loss statements.

For cryptocurrency analysis, all the available information on the asset needs to be sought out through research that includes investigating its use cases, its network, the team behind the project, vesting schedules, the list goes on. By looking at the right set of factors, traders can determine the fundamental value of an underlying project before investing.

Here are the 10 steps found to be most useful:

1. Read the white paper

Especially for long-term, buy-and-hold investing, it is critical to read a token’s white paper. This is the document that gives an intentional and detailed overview of a project. A good white paper explains:

- The project’s goals

- The use cases and distribution

- The team’s vision

- The technology behind the token

- Plans for upgrades and new features

- How the token provides value to users

2. Assess the claims of the white paper

Be skeptical because the people behind projects can bend, or even break, the truth.

This happens more often than most realize. For example, Michael Alan Stollery, the CEO and founder of Titanium Blockchain Infrastructure Services, raised $21 million in an initial coin offering (ICO).

He later admitted to falsifying parts of the project’s white paper.

It’s important to ask some hard questions and get complete answers before putting one’s money into a project.

Some questions to consider:

- Are the tokens really distributed the way they promise?

- Are they meeting the road map expectations?

- Are they inventing a problem just to solve it?

- What are other people saying about it?

- Are there any red flags?

- Do the goals seem realistic?

3. Look at competitors

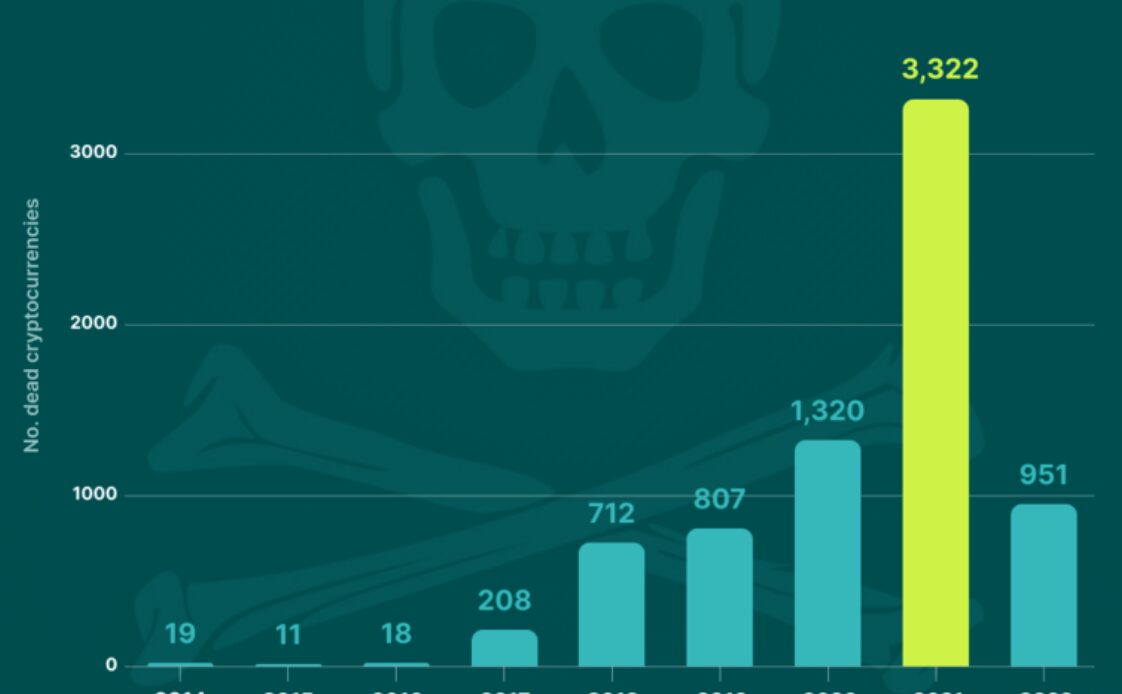

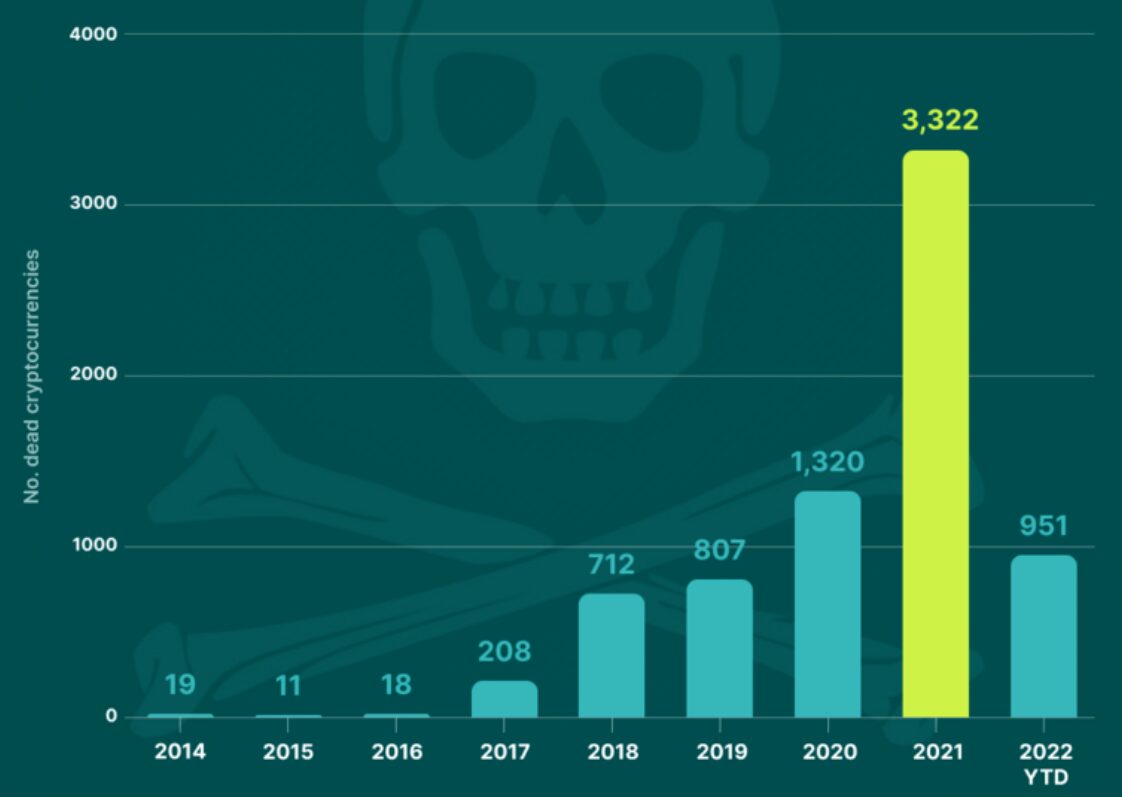

According to some industry sources, nearly 40% of cryptocurrencies that were listed in 2021 no longer exist.

That serves as an important truth investors need to take into account; a lot of projects — close to half and it could be even more — fail, and fail miserably.

Click Here to Read the Full Original Article at Cointelegraph.com News…