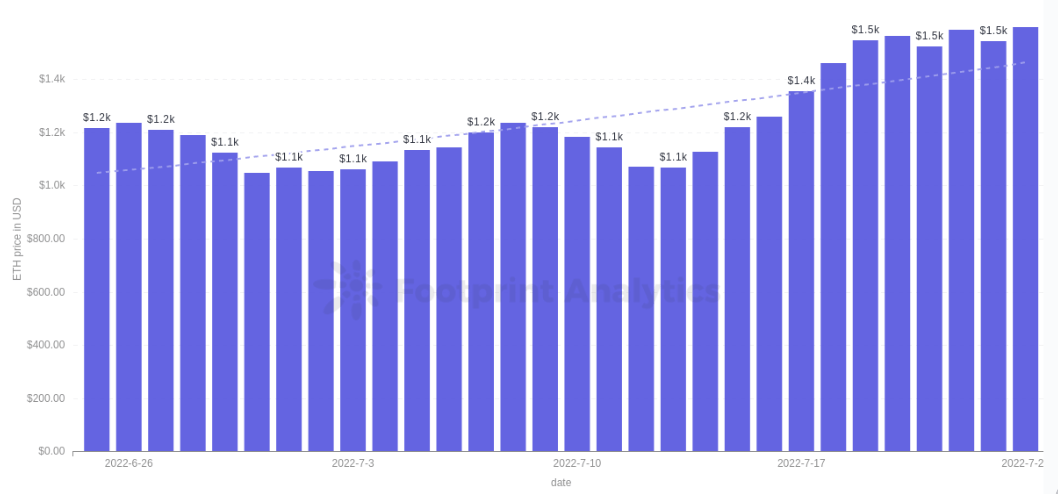

Last week, ETH saw a significant uptick in its price, following the release of the notes from the last dev’s meeting that hinted at the timeline for its upcoming upgrade, known as The Merge.

This upgrade will change how the network is secured, its energy consumption, and tokenomics. Staking will play an essential part in it. So how should the investor prepare for the upcoming events?

What is The Merge?

A series of upgrades are happening on the Ethereum blockchain to change it from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. For this to be completed, the milestones are:

- The creation and launch of the Beacon Chain happened on Dec. 1, 2020. The Beacon Chain is what introduces the PoS on Ethereum. Because of this, it is called the “consensus layer.”

- Replace the consensus mechanism of the current chain from PoW to PoS (current estimate: happening in September.) The existing chain, Mainnet, will then act as the “execution layer”, as the current PoW running it will be replaced by the Beacon Chain.

The consensus layer will take care of the security of the network. The execution layer is where the smart contracts run and the transactions are created.

As the upgrade will connect these two chains to act as one, the name of this event was updated from ETH 2.0 to “The Merge.”

Why The Merge Matters

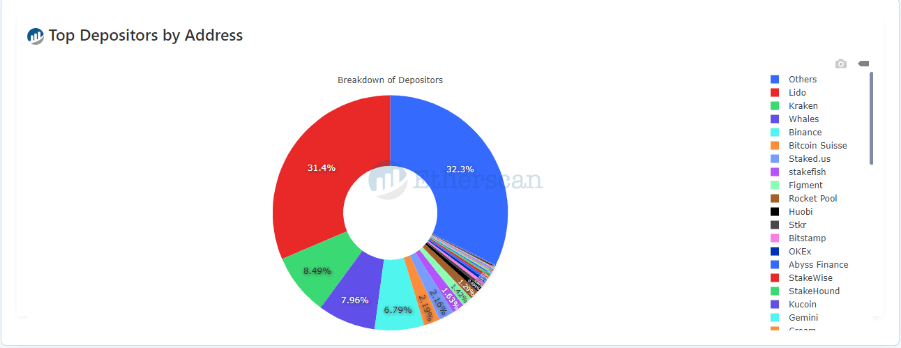

As the Beacon Chain is already running since December 2020, a good part of the ETH supply is already being staked on it, receiving rewards for running the network. Currently, there is over 12 million ETH staked on the Beacon Chain smart contract:

That number is almost 10% of the current ETH supply. Furthermore, this ETH is locked long-term, as there is no date for deploying the unstaking capability under the PoS ETH chain.

How it affects the ETH emissions

After the change for PoS, there will be no more mining rewards. Therefore, the ETH emissions will drop…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…