In the ever-evolving landscape of cryptocurrency markets, 2023 has proven to be a year of formidable challenges. As central banks respond to inflationary pressures with rapid interest rate hikes, and geopolitical tensions cast shadows of uncertainty, the cryptocurrency world finds itself at a crossroads.

In this article, we delve into the critical factors influencing the trajectory of cryptocurrency markets: tightening monetary policies, the resurgence of the U.S. dollar, and the lingering specter of inflation. We also examine the evolving role of cryptocurrencies, particularly Bitcoin, in the context of global finance and stability.

Johnny Louey is a research analyst at LTP. This article is part of CoinDesk’s State of Crypto Week, sponsored by Chainalysis.

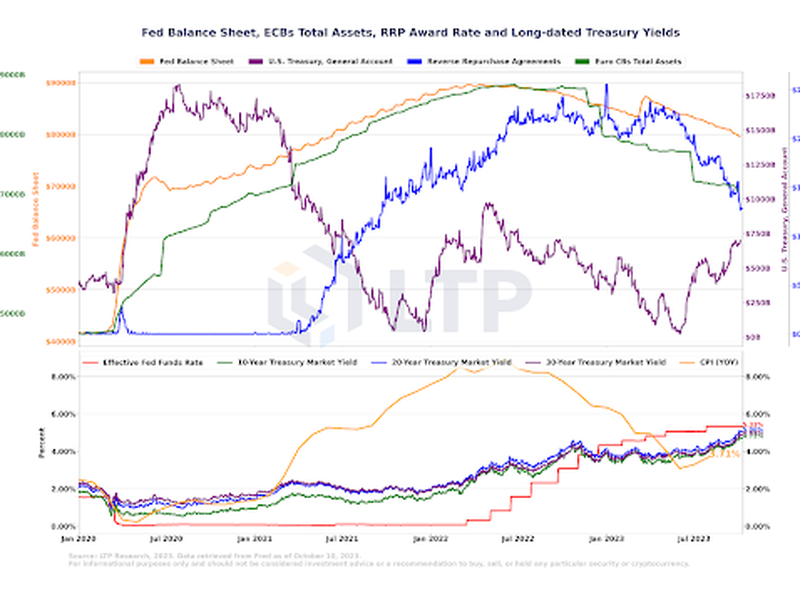

The graph below illustrates the impact of quantitative tightening by the Federal Reserve and European Central Bank in 2023. Quantitative tightening involves the selling of Treasury securities by central banks, which leads to an upward push on yields. This upward pressure on treasury yields is exacerbated by the implementation of aggressive interest rate hikes. Consequently, these yields have reached their peak levels for the year.

With long-dated treasury yields surging above 4%, capital is flowing out of riskier assets like cryptocurrencies and into these safer alternatives, strengthening the U.S. dollar and reducing demand and liquidity in the cryptocurrency markets.

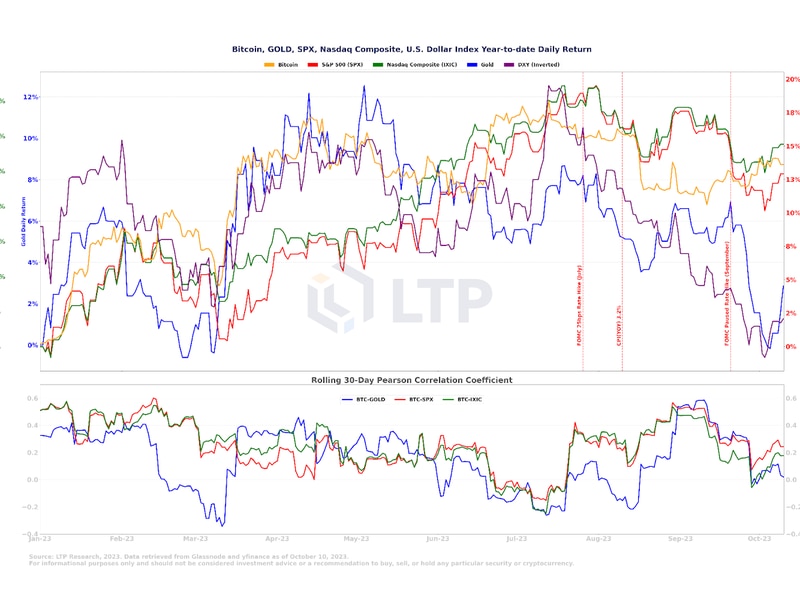

Record Treasury bond yields, observed since 2008, and the steadfast strengthening of the U.S. dollar since July have exerted downward pressure not only on equities but also on cryptocurrencies. The market correction that started in July has been broad-based, coinciding with the DXY (a measure of the dollar’s value relative to other currencies) surging to a yearly high.

Following several bank crises in March 2023, the Fed implemented the Bank Treasury Facility Program (BTFP) to provide support to banks grappling with the devaluation of their treasury holdings and a crunch in liquidity. This measure has helped alleviate the liquidity crisis. Currently, the Federal Reserve’s future course remains uncertain as there have been no indications of a pause in Quantitative Tightening or any plans to cut interest rates. Therefore, the lingering concern now revolves around…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…