Yield Basis, a protocol developed by the decentralized finance (DeFi) platform Curve Finance, mitigates impermanent loss for tokenized Bitcoin (BTC) and Ether (ETH) liquidity providers (LPs), while also creating a market-based approach to token inflation and emissions, according to Curve founder Dr. Michael Egorov.

Impermanent loss in crypto occurs when the price of assets deposited in a liquidity pool dips or deviates in a way that leaves the user with fewer funds than if they had simply held their crypto and not engaged in liquidity provisioning.

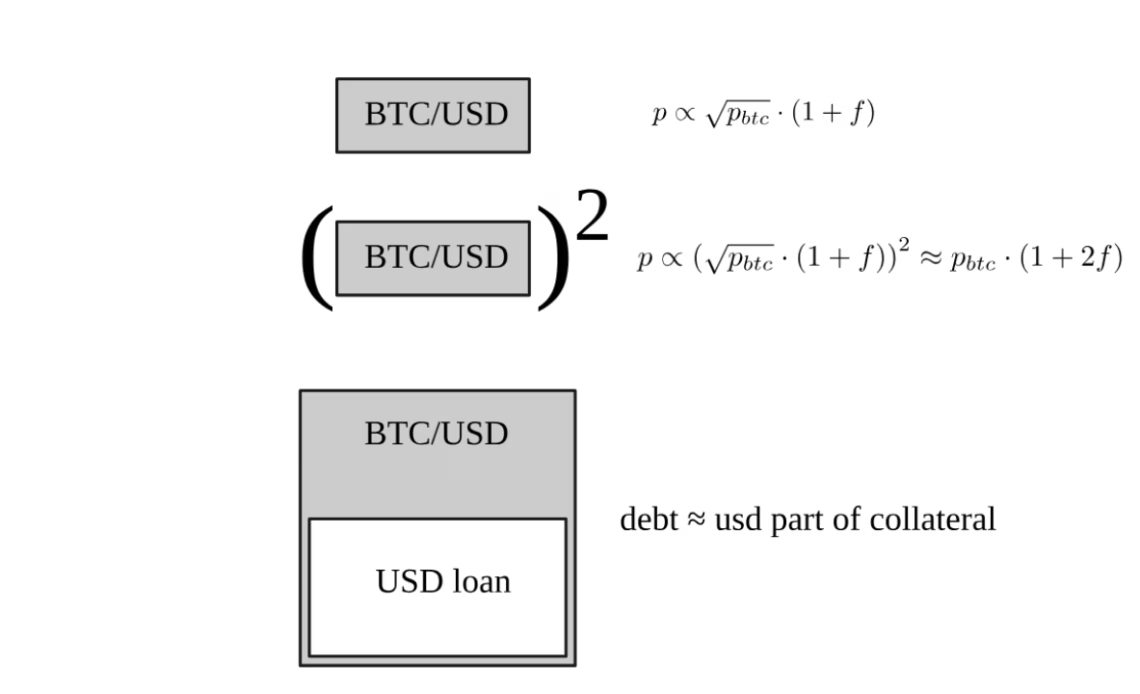

Dr. Egorov told Cointelegraph that when funds deposited in a liquidity pool are proportional to the square root of Bitcoin’s price, it creates impermanent loss. The Curve Finance founder said:

“Impermanent losses happen because of this square root dependency. So, we really want to get rid of the square root. How do we get rid of the square root? The best way mathematically to get rid of the square root is to square it.”

Yield Basis works through compounding leverage, which keeps a position overcollateralized by exactly 200% at all times by supplementing the positions with borrowed crvUSD, the DeFi platform’s US dollar-pegged decentralized stablecoin.

This keeps the price of the position at exactly double the collateral deposited, eliminating the square root problem at the heart of impermanent loss, Egorov said.

Impermanent loss has plagued liquidity providers for years and also repels prospective LPs from entering the game.

Related: Solv Protocol targets over $1T in idle Bitcoin with institutional yield vault

Bifurcated yield options help to set inflation rates and reduce token emissions

Users have the option of receiving yield denominated in either tokenized Bitcoin or the Yield Basis token, which creates a market-oriented solution for setting inflation rates and controlling token emissions, the Curve…

Click Here to Read the Full Original Article at Cointelegraph.com News…