The venture capital world has long been known for its traditional approach to funding and investing in startups. However, the emergence of blockchain technology can potentially disrupt this industry and revolutionize the way venture capital operates.

One significant aspect of this disruption is the tokenization of assets. Blockchain enables the creation of digital tokens representing ownership in assets or companies.

This tokenization allows for fractional ownership and liquidity of traditionally illiquid assets, such as real estate or early-stage startups. It expands investment opportunities, enabling a wider range of investors to participate in ventures by owning tokens, even with small amounts of capital.

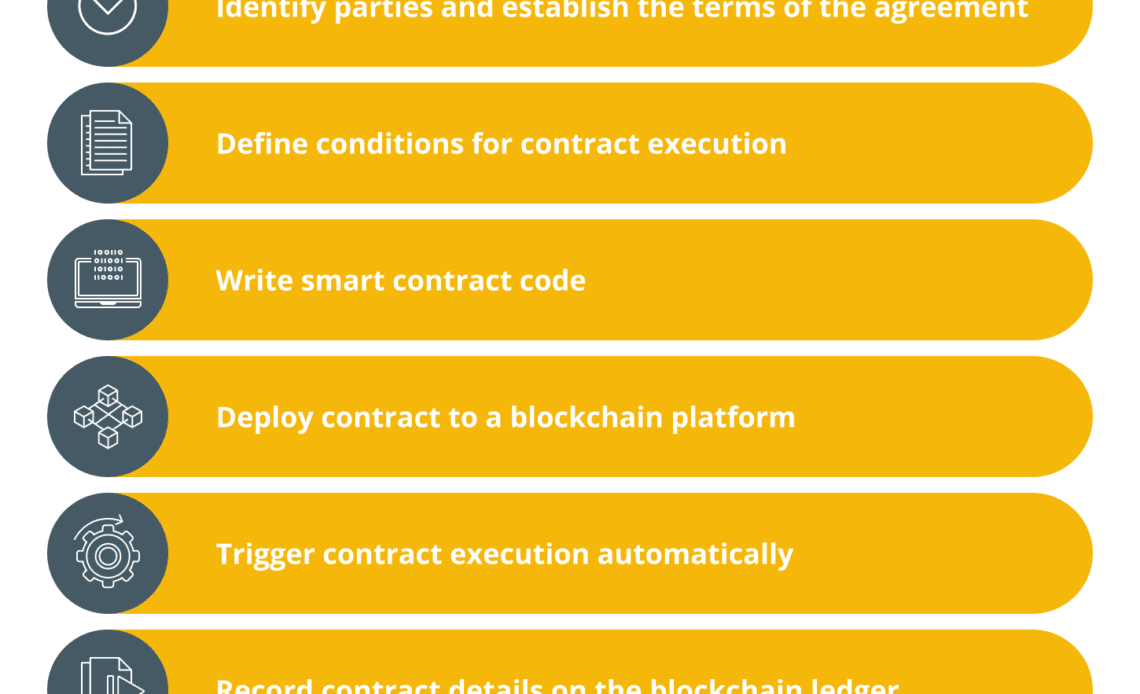

Another key aspect is the use of smart contracts. These self-executing contracts with predefined rules and conditions are encoded on the blockchain. Smart contracts can eliminate the need for intermediaries, reducing costs and increasing efficiency.

Investors and entrepreneurs can create and execute investment agreements directly on the blockchain, streamlining the investment process and fostering participant trust.

By eliminating intermediaries, blockchain democratizes access to funding, empowering entrepreneurs globally and attracting investment from a wider pool of investors.

Blockchain technology’s global accessibility transcends geographical boundaries, connecting investors and entrepreneurs worldwide. Startups and investors in emerging markets, where traditional venture capital may be limited, now have greater opportunities.

Blockchain-based platforms also facilitate the creation of secondary markets, allowing investors to trade their tokens representing ownership in ventures.

Alex Strześniewski, founder and CEO of AngelBlock — a decentralized fundraising platform — told Cointelegraph, “With blockchain-based fundraising, tokens representing equity or debt can be traded on secondary markets, allowing investors to exit their investment at any time.” He added:

“This enhances the attractiveness of venture capital investments by providing liquidity and reducing the risk associated with long-term investments.”

Secondary markets provide liquidity to early-stage investors who traditionally had to wait for exit events, such as acquisitions or initial public offerings (IPOs), to realize their investment returns. The ability to trade tokens on a secondary market enhances the overall attractiveness of venture capital investments.

Rachid Ajaja,…

Click Here to Read the Full Original Article at Cointelegraph.com News…