sponsored

2022 was one of the roughest years in the crypto industry, which saw the collapse of Terra LUNA, Celsius, and FTX, consequently wiping out over $2 trillion from the crypto market. However, the dark horse in the face of these ugly events was the crypto exchange – Bitget.

Despite the hardships in the market, Bitget grew in all aspects; the company made great strides in building our team, brand, and business over the last 12 months during the crypto winter. The exchange expanded its services to the global Web3 market for the first time in 2022. This effort pushed its business velocity beyond bounds, making it one of the fastest-growing exchanges with the best business momentum.

Some key development areas of the company included:

- Climbing the chart ranked as the Top 3 exchange according to the Boston Consulting Group report, in terms of the crypto derivative trading volume.

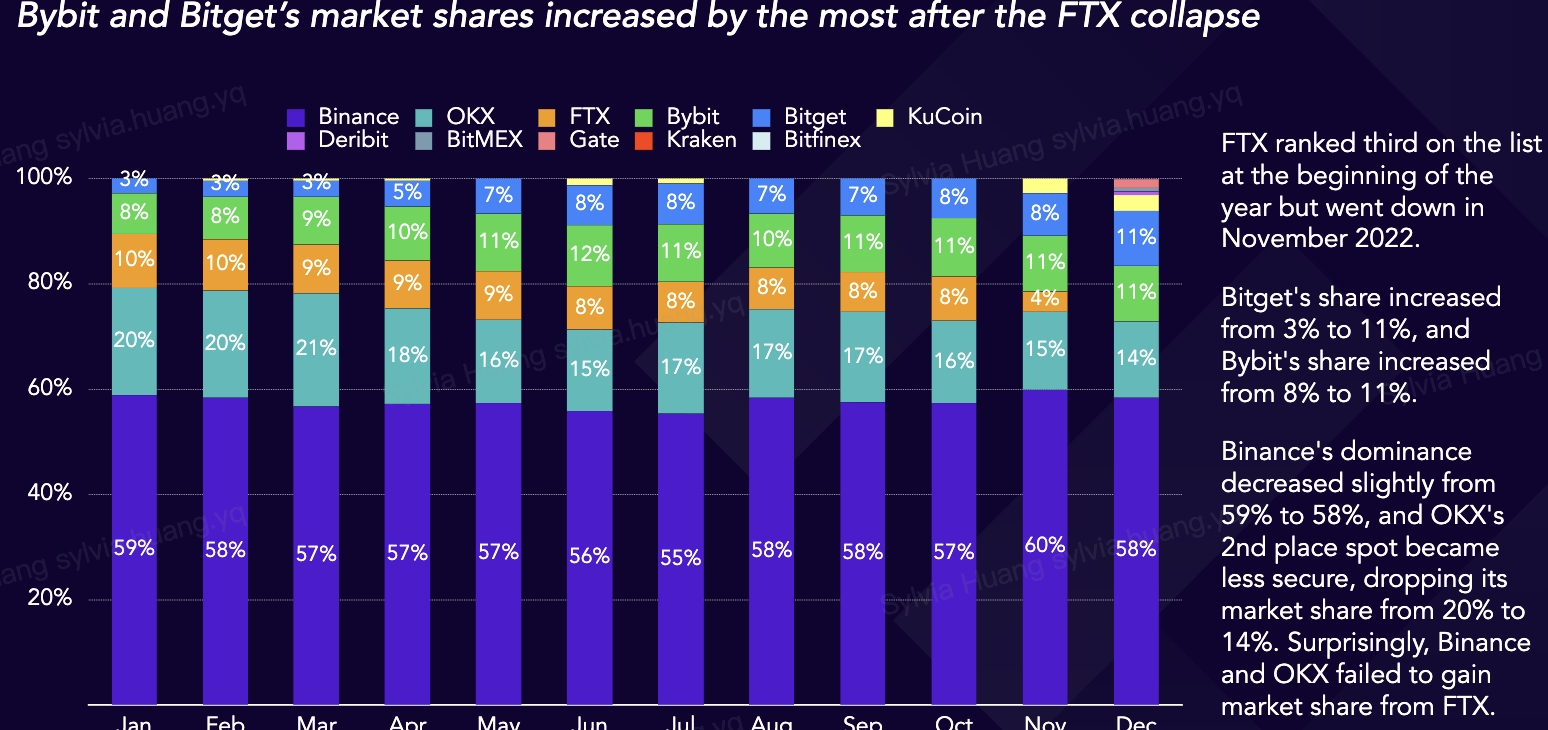

- According to the latest TokenInsight report, Bitget’s market share in the derivative market increased from 3% to 11% after the collapse of FTX

- Over 300% increase in total transaction volume, with the popularity of copy trading products

- The workforce grew from barely 200 people at the beginning of 2022 to over 1100 employees in Jan 2023

- Became the exclusive crypto exchange partner with Lionel Messi

Looking at the Numbers

Previously, the company focused on serving customers from a few Asian countries alone. However, by the end of 2022, the exchange had acquired over 8 million users in more than 100 countries, with footprints in Turkey, Southeast Asia, Latin America, and Europe.

Bitget saw an over 300% increase in total transaction volume with more than 4.2 million profitable trades. The platform’s on-chain data shows that 100,000 plus traders shared a profit of over 9.7 million US dollars with its copy trading products.

According to the latest data shared by the TokenInsight report, Bitget’s market share increased dramatically from 3% to 11% after the collapse of the former second-largest exchange, FTX, which marked the single largest market share growth in the crypto derivatives sector. At the end of 2022, the top 10 exchanges’ total daily open interest had dropped by 27.1% from January and 41% from its peak in April of the same year. Among the exchanges, only Bitget achieved a significant increase in open interest, from $841 million to $3.74 billion, representing a 344% total increase.

Regardless of the bearish market, the exchange attained these numerous…

Click Here to Read the Full Original Article at Bitcoin News…