Bitcoin (BTC) is enjoying what some are calling a “bear market rally” and has gained 20% in July, but price action is still confusing analysts.

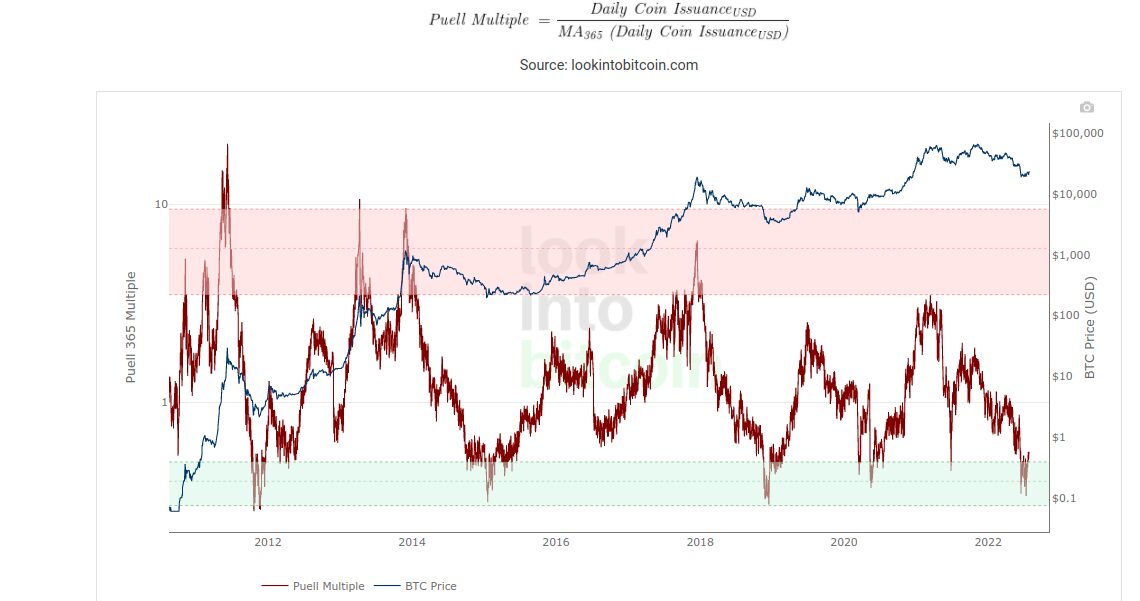

As the July monthly close approaches, the Puell Multiple has left its bottom zone, leading to hopes that the worst of the losses may be in the past.

Puell Multiple attempts to cement breakout

The Puell Multiple one of the best-known on-chain Bitcoin metrics. It measures the value of mined bitcoins on a given day compared to the value of those mined in the past 365 days.

The resulting multiple is used to determine whether a day’s mined coins is particularly high or low relative to the year’s average. From that, miner profitability can be inferred, along with more general conclusions about how overbought or oversold the market is.

After hitting levels which traditionally accompany macro price bottoms, the Puell Multiple is now aiming higher — something traditionally seen at the start of macro price uptrends.

“Based on historical data, the breakout from this zone was accompanied by gaining bullish momentum in the price chart,” Grizzly, a contributor at on-chain analytics platform CryptoQuant, wrote in one of the firm’s “Quicktake” market updates on July 25.

The Multiple is not the only signal flashing green in current conditions. As Cointelegraph reported, accumulation trends among hodlers are also suggesting that the macro bottom is already in.

“Unprecedented macroeconomic conditions”

After its surprise relief bounce in the second half of this month, Bitcoin is now near its highest levels in six weeks and far from a new macro low.

Related: Bitcoin futures data shows ‘improving’ mood’ despite -31% GBTC premium

As sentiment exits the “fear” zone, market watchers are pointing to unique phenomena which continue to make the 2022 bear market extremely difficult to predict with any certainty.

In another of its recent “Quicktake” research pieces, CryptoQuant noted that even price trendlines are not acting as normal this time around.

In particular, BTC/USD has crisscrossed its realized price level several times in recent weeks, something which did not occur in prior bear markets.

Realized price is the average at which the BTC supply last moved, and currently sits just below $22,000.

“The Realized Price has signaled the market bottoms in previous cycles,” CryptoQuant explained.

“More importantly, the bitcoin price did not cross the Realized Price threshold during the last…

Click Here to Read the Full Original Article at Cointelegraph.com News…