Crypto analyst Jason Pizzino believes one scenario is likely to play out for both Bitcoin (BTC) and the S&P 500 (SPX) in the coming months.

In a new strategy session, Pizzino tells his 290,000 YouTube subscribers that both BTC and the S&P 500 could dip at the start of October before entering a bull market cycle.

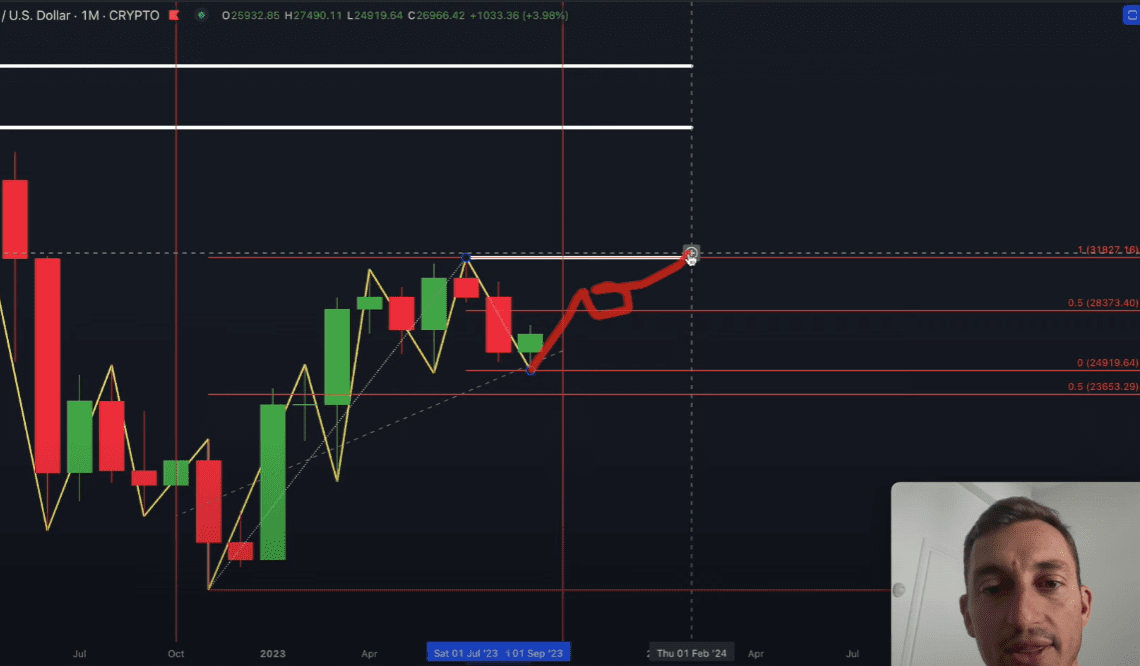

“I’m thinking this period here, that quarter three of 2023, early quarter four, might be the next best opportunities for those [Bitcoin] DCAs (dollar-cost averaging)…

Now let’s just take a quick look at the downside, because it’s not all going to be straight up and roses from here because we’ve got a lot of overhead resistance. We still have a 50% level here, the macro level at $23,600, which is the cycle low to the current first range out.

In the short term, maybe October does push lower, because, like we’ve seen in the past from the S&P 500 that we do get some of these lows here. Sometimes we get October lows, sometimes we get March lows, which both happened this time around, and maybe the S&P just touches a little bit lower [at 4,110 points] for October and it starts to work its way higher over the course of quarter four and quarter one [2024].

For Bitcoin, maybe it does have this nice green September, a quick move to [$23,630] for October and then maybe a higher close [at $28,518]. That could also be a possibility there.”

The trader is keeping also a close watch on key price levels to the upside to determine if Bitcoin will confirm a massive bull market cycle after October.

“And then let’s see if the market can overcome those key levels to the upside. $28,500 is the real big trigger that I’m looking for here for consolidation so that we can start to test $32,000, which is the white line here. And that would then drop the probabilities of further downside moves past $25,000.

Now the last white lines to the upside are at 50%. That’s the $42,000 level, or $42,200 to be more precise, and then the monthly swing top at $48,200. So they’re going to be some pretty significant levels when this market does start to break out of $32,000 and of course throw in $35,000, throw in $38,000 and of course the psychological number of $40,000 for good measure.”

At time of writing, the S&P 500 is sitting at 4,288 points. Bitcoin is trading for $27,522 at time of writing, down 1.5% in the last 24 hours.

I

Click Here to Read the Full Original Article at The Daily Hodl…