The FTX Contagion effects do not even stop at the largest institutional Bitcoin product on the market, the Grayscale Bitcoin Trust (GBTC). As a result of the bankruptcy of Sam Bankman-Fried’s crypto exchange, the discount to the NAV of Grayscale’s GBTC fund has fallen to around -40%.

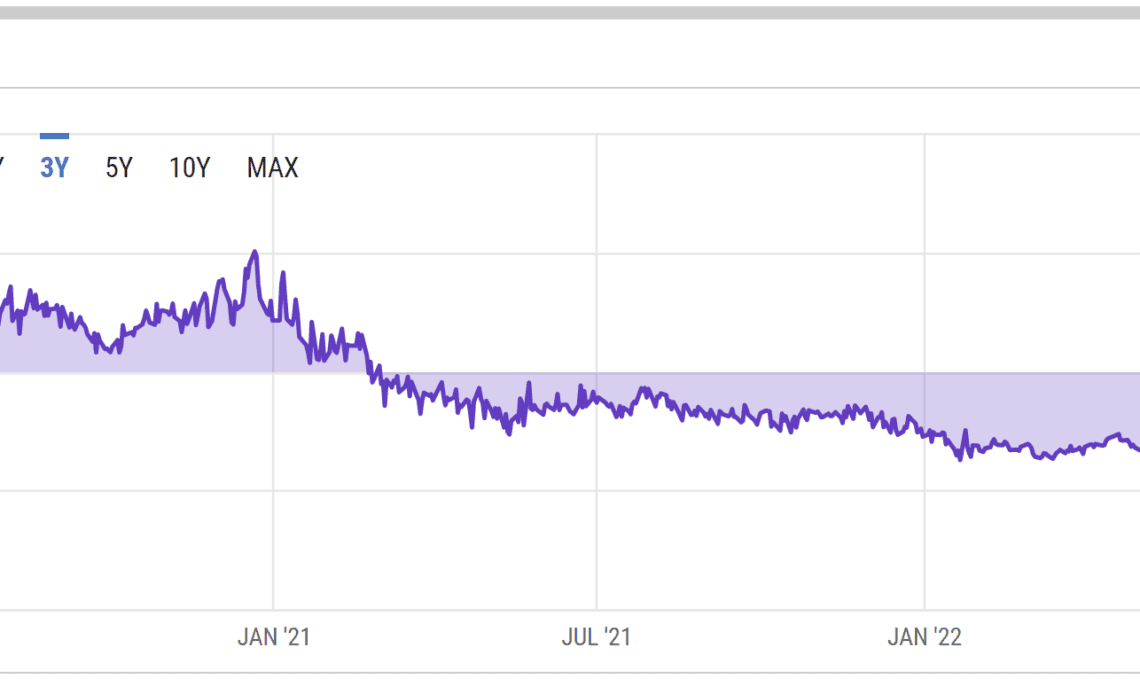

As recently as the end of 2020, GBTC was trading at a premium of +40%. However, in January 2021, the trend reversal occurred when Grayscale’s Bitcoin fund traded at a discount for the first time. Since then, GBTC has been on a downward slide.

GBTC’s largest owners include Cathie Wood’s ARK Invest (0.85%), Horizon Kinetics (0.34%), Simplify Asset Management (0.06%) Systelligence (0.04%), Parkwood (0.04%), Emerald Mutual Fund (0.03%) and Rothschild Investment (0.01%), according to CNN Business.

Doomsday for Bitcoin

Recent events have led Grayscale Bitcoin Trust to become potentially the single biggest risk to the Bitcoin market. As NewsBTC reported, Genesis Global had to pause all withdrawals for its lending business on Wednesday due to “unprecedented market turmoil.”

This is concerning for the Grayscale Bitcoin Trust in that Genesis Global served as the liquidity provider for the trust. Genesis Global’s parent company is Digital Currency Group (DCG). This in turn is also the parent company of Grayscale.

Shortly after the Genesis announcement, Digital Currency Group clarified that the matter would have no impact on its own business. DCG stated that Genesis is not a service provider “for any” Grayscale product.

Furthermore, the company asserted that it does not lend, borrow, or pledge Bitcoin, and that its custodian – Coinbase – is prohibited from engaging in such activities. In addition, SEC and OTC markets reports and audited financial statements are filed.

Grayscale products continue to operate business as usual, and recent events have had no impact on product operations.

The assets underlying $GBTC and all Grayscale products remain safe and secure, held in segregated wallets in deep cold storage by our custodian Coinbase .

Still, the community is bellyaching. A dissolution of GBTC could mean Armageddon for Bitcoin. The collapse of Terra Luna, on the other hand, would have been fun.

The Grayscale Bitcoin Trust currently holds 634,000 BTC. The Terra Luna Foundation “only” liquidated 80,000 Bitcoins, and still managed to crash the BTC price from $40,000 to $20,000.

As Ryan Selkis reported, DCG is in a liquidity…

Click Here to Read the Full Original Article at NewsBTC…