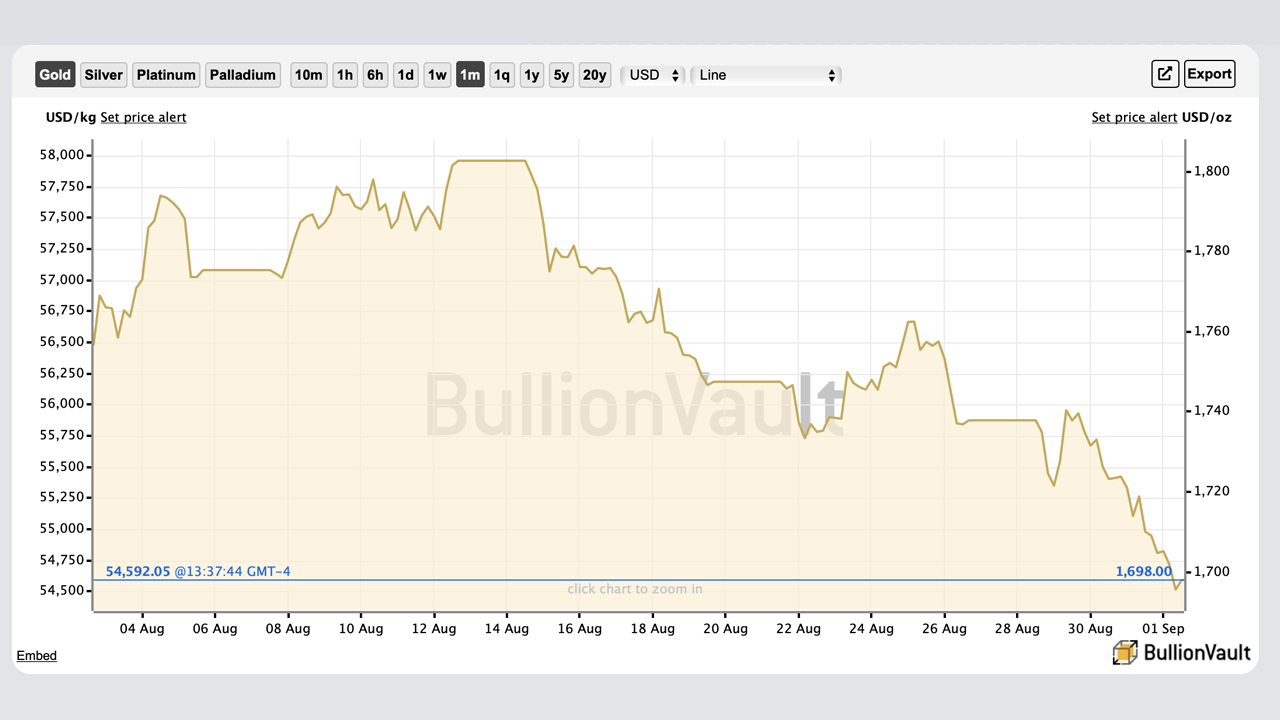

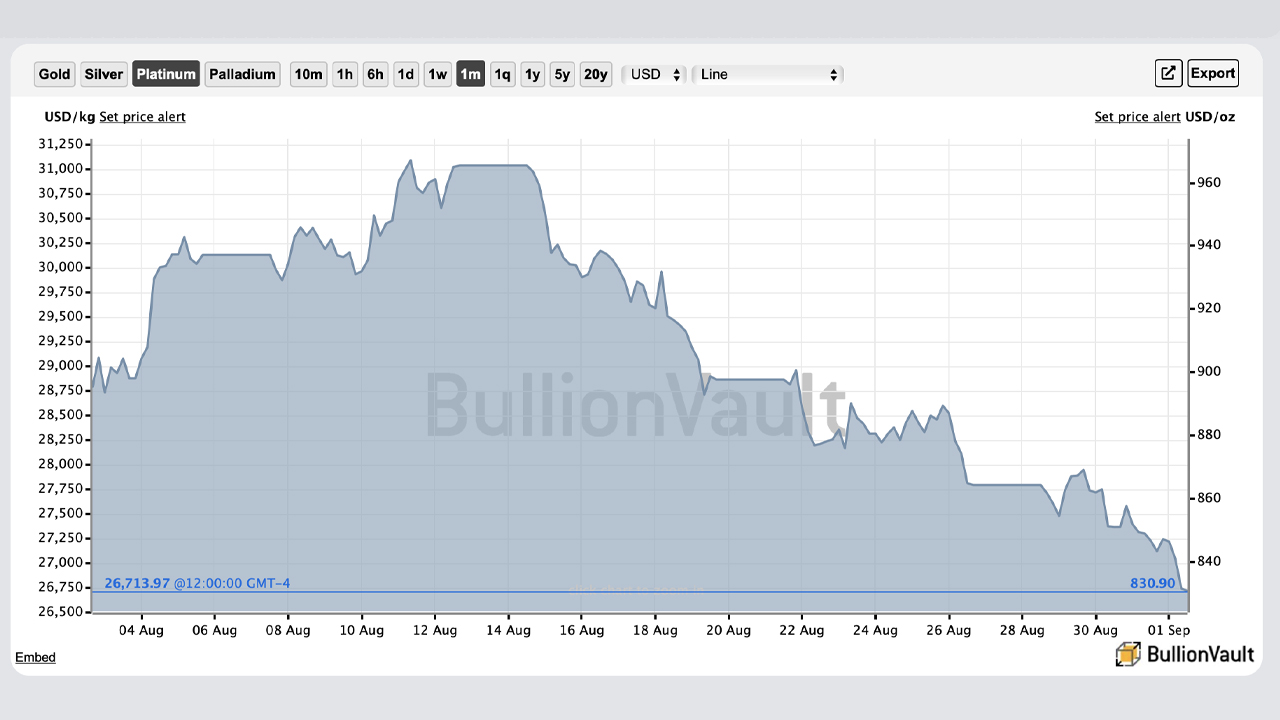

Precious metal markets have shuddered during the last few weeks, as gold’s price per ounce nears a six-week low hovering just under $1,700 per unit. Silver crashed through the $18 range slipping to $17.80 per ounce. While both gold and silver dipped between 0.85% to 0.89% against the U.S. dollar in 24 hours, platinum dropped 2.82% and palladium shed 4.18% against the USD during the last day.

Despite Scorching Global Inflation, Gold Hasn’t Been a Safe Haven in 2022

While the entire world is suffering from red-hot inflation, many would assume that the world’s precious metals would be a safe haven against the surging prices. That hasn’t been the case in 2022, despite the U.S. and the Eurozone inflation rate rising above 9% this summer.

In 2022, an ounce of fine gold managed to reach a lifetime price high against the U.S. dollar at $2,070 per ounce. On the same day (March 8, 2022), an ounce of silver tapped a 2022 high at $26.46 per ounce.

Year-to-date, silver is down 23.14% as it was trading for 23.16 nominal U.S. dollars per troy ounce on January 1, 2022. Since the high on March 8, silver is down 32% lower than the nominal U.S. dollars per troy ounce value. Gold’s nominal U.S. dollar value per troy ounce on January 1, 2022, was $1,827.49 per ounce and at today’s $1,695.45 per ounce value, gold is down 7.22%.

Furthermore, any investors who bought gold at the lifetime price high on March 8, lost roughly 18.09% in USD value since that day. Platinum, palladium, and rhodium values have seen similar declines in value and even more volatility than gold and silver.

Precious metals (PMs) have long played a key role in the global economy and traditionally, PMs like gold and silver have been seen as a hedge against inflation. However, this has not been the case in 2022, and the blame is being placed on a robust greenback and the Federal Reserve hiking interest rates.

Analysts Say Strong Dollar, Hawkish Fed Points to Lower Gold Prices, Dollar Index Taps 20-Year High

Przemyslaw Radomski, CEO of investment advisory firm Sunshine Profits told Forbes at the end of June that a “more hawkish Fed, implying higher real interest rates, and a stronger U.S. dollar, both point to lower gold prices.” The market strategist at dailyfx.com, Justin McQueen, says “a firmer USD and a renewed rally in global bond yields have dragged…

Click Here to Read the Full Original Article at Bitcoin News…