press release

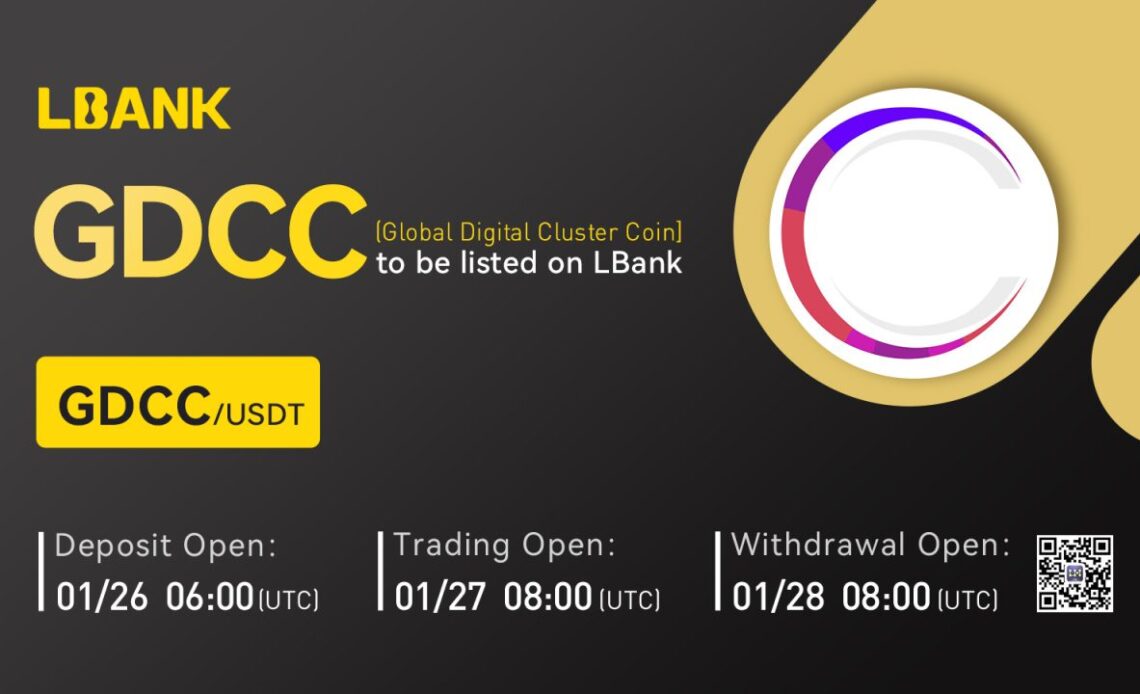

PRESS RELEASE. LBank Exchange, a global digital asset trading platform, has listed Global Digital Cluster Coin (GDCC) on January 27, 2023. For all users of LBank Exchange, the GDCC/USDT trading pair is now officially available for trading.

With its new-age protocol and peer-to-peer network, Global Digital Cluster Coin (GDCC) restructures the concept of money and assets with cutting-edge technologies that have the potential to transform various industries and allow people to adapt crypto assets. Its native token GDCC will be listed on LBank Exchange at 8:00 UTC on January 27, 2023, to further expand its global reach and help it achieve its vision.

Introducing Global Digital Cluster Coin

Global Digital Cluster Coin (GDCC) is a new-age protocol that caters to web3.0 services and community-driven technology, allowing users to build their dApps and serving as a hub for digital assets, international payments, and applications. Because the protocol is open to all, anyone in the world with an internet connection can access the system at any time.

As a peer-to-peer network that allows users to conduct transactions directly with the person in question, GDCC eliminates the need for intermediaries. Because no entity or institution controls it, no one can impose restrictions on the process of receiving payments or using on-chain services.

On Global Digital Cluster Coin, blockchain developers can create a wide range of applications, including decentralized applications and wallets. Utility applications have unlimited privileges because the network allows them to deploy and execute smart contracts.

Global Digital Cluster Coin will also launch its own decentralized exchange, to provide direct custody of funds to users. Hopium, GDCC’s decentralized exchange, will provide a seamless and hassle-free crypto trading experience to its community as a protocol developed by the community for the community. Because of the non-custodial nature, users will be fully responsible for all of their funds/transactions, and the platform will not interfere at any cost.

The platform uses the Automated Market Maker model, which is made up of self-executed protocols capable of managing the liquidity pool on its own. These pools will be supported by liquidity providers, who will provide the tokens used to create the pairs. These liquidity providers will be compensated with “liquidity tokens” based on their contribution to the liquidity pool. These liquidity tokens…

Click Here to Read the Full Original Article at Bitcoin News…