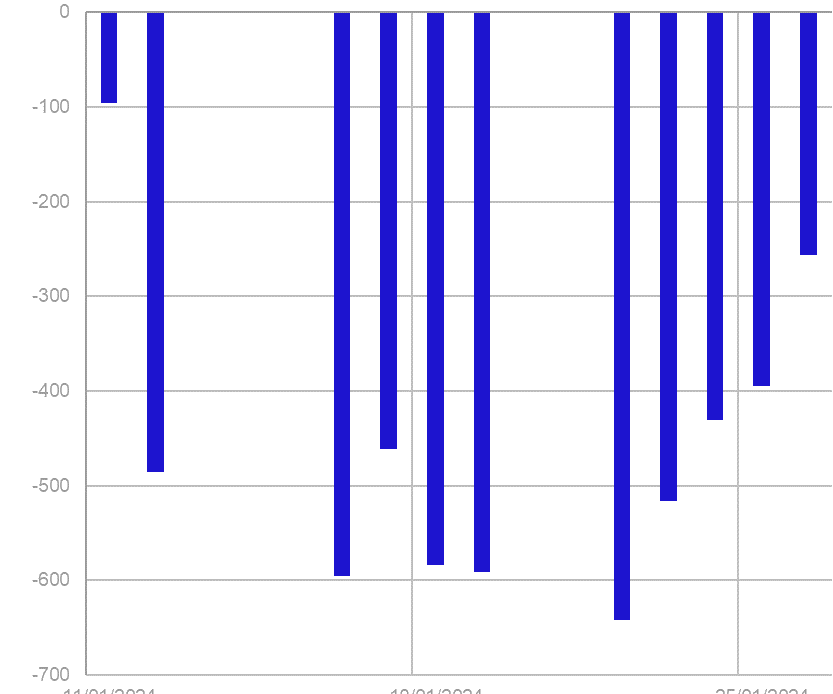

Crypto investment products saw their second consecutive week of outflow this year, with $500 million leaving the funds, according to CoinShares’ latest weekly report.

Bitcoin dominate

Bitcoin investment products experienced significant outflows last week, with a total withdrawal of $479 million.

The top cryptocurrency has faced significant headwinds since the U.S. Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETF) in the country. Its value has declined by more than 12% to around $42,500 as of press time.

This downturn has spurred bearish investors to turn to short BTC products, resulting in nearly $11 million in inflows last week.

Conversely, prominent alternative digital assets like Ethereum, Polkadot, and Chainlink also saw outflows, with $39 million, $700,000, and $600,000, respectively. However, Solana defied this trend by recording a modest inflow of $3 million.

Across regions, U.S.-based funds dominated the scene, experiencing net outflows of $409 million. Switzerland and Germany followed with outflows of $60 million and $32 million, respectively. Brazil emerged as the exception, with the most significant net inflows of $10.3 million.

“Recent price declines prompted by the substantial outflows from the incumbent ETF issuer (Grayscale) in the U.S. totaling $5 billion, have likely prompted further outflows from other regions,” CoinShares Head of Research James Butterfill explained.

Grayscale outflows ‘subside’

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…