The crypto economy has slipped under the $1 trillion mark to the $970 billion range, as a large number of digital currencies have lost more than half their USD worth since November 2021. Bitcoin is down 70% from the all-time high last year, and a new report from Glassnode Insights calls the current bear market “a bear of historic proportions,” while highlighting that “it can reasonably be argued that 2022 is the most significant bear market in digital asset history.”

Glassnode Researchers: ‘Bitcoin Is Currently Experiencing the Largest Capital Outflow Event in History’

Many people understand that the crypto economy is currently in a bear market but no one knows where it will lead or when it will end. Bitcoin and the crypto economy, in general, have been through several bear markets and a recent Glassnode Insights report claims it just might be the worst on record. The analytics company Glassnode provides an analysis of bitcoin’s (BTC) current price drop and how the digital asset slipped below the 200-day moving average (DMA). The 40-week timespan gives traders perspective on whether or not the current trend will continue dropping lower and it can also identify potential floor prices.

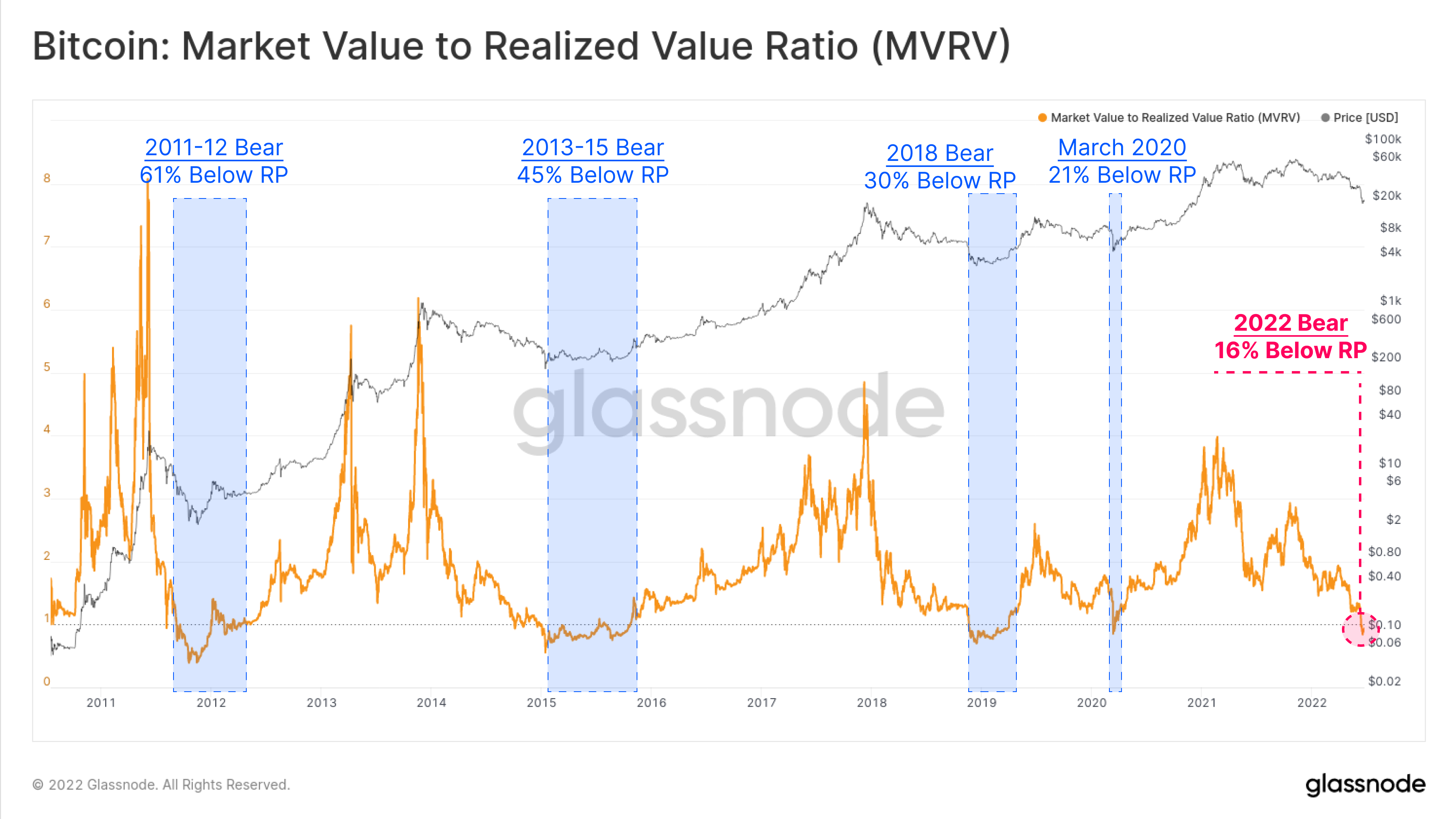

Glassnode’s post describes the Mayer Multiple and the 200DMA and how they can signal a bear or bull market. “When prices trade below the 200DMA, it is often considered a bear market,” Glassnode’s analysis notes. “When prices trade above the 200DMA, it is often considered a bull market.” Additionally, Glassnode leverages data like “realized price,” “realized cap,” and the market value and realized value oscillator (MVRV Ratio).

“The 30-day position change of the realized cap (Z-Score) allows us to view the relative monthly capital inflow/outflow into the BTC asset on a statistical basis,” Glassnode’s blog post explains. “By this measure, bitcoin is currently experiencing the largest capital outflow event in history, hitting -2.73 standard deviations (SD) from the mean. This is one whole SD larger than the next largest events, occurring at the end of the 2018 Bear Market, and again in the March 2020 sell-off.”

Glassnode has been researching and discussing the current bear market for quite some time and on June 13, it published a video called “The Darkest Phase of the Bear.” The video looks into whether or not it is the final phase or final capitulation period in bitcoin’s price cycle. Historically, BTC has dropped…

Click Here to Read the Full Original Article at Bitcoin News…