Bitcoin’s governance structure and consensus mechanisms accentuate the complexity of implementing protocol changes on a network deliberately resistant to alteration.

Bitcoin’s consensus model intentionally favors stability, with upgrades proceeding through a high-threshold process involving diverse stakeholders—miners, economic nodes, investors, developers, and media influencers—each bringing distinct motivations and pressures to the table.

Steve Lee, Lead at Spiral—a subsidiary of Block (formerly Square) —has authored a comprehensive analysis of the intricacies of Bitcoin’s consensus mechanisms and the complexities inherent in protocol upgrades.

Drawing from his extensive experience in product management and open-source development, Lee delves into the multifaceted roles of stakeholders, the potential risks associated with both soft and hard forks, and the critical importance of maintaining network stability amidst evolving technological advancements. His insights offer a nuanced perspective on the challenges and considerations essential for evaluating future modifications to the Bitcoin protocol.

BitMex Research called Lee’s paper “fantastic” for succinctly detailing the evolving history of the BlockSize wars, a pivotal moment for Bitcoin’s consensus.

Stakeholders in Bitcoin upgrade motivations evolve over time, reflecting practical and ideological concerns surrounding Bitcoin’s long-term stability. Understanding these forces is critical for evaluating potential future protocol changes.

Stakeholders in Bitcoin consensus upgrades

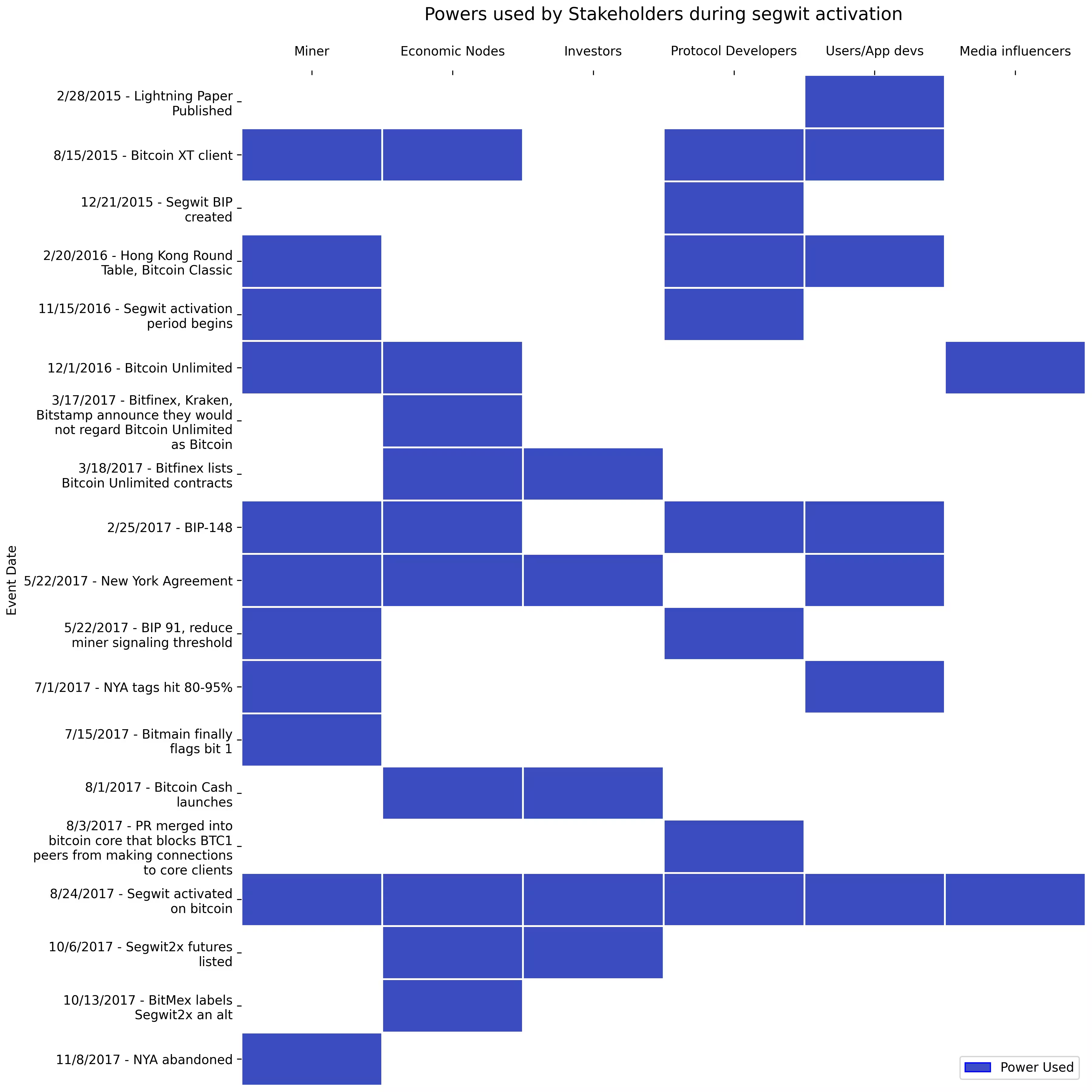

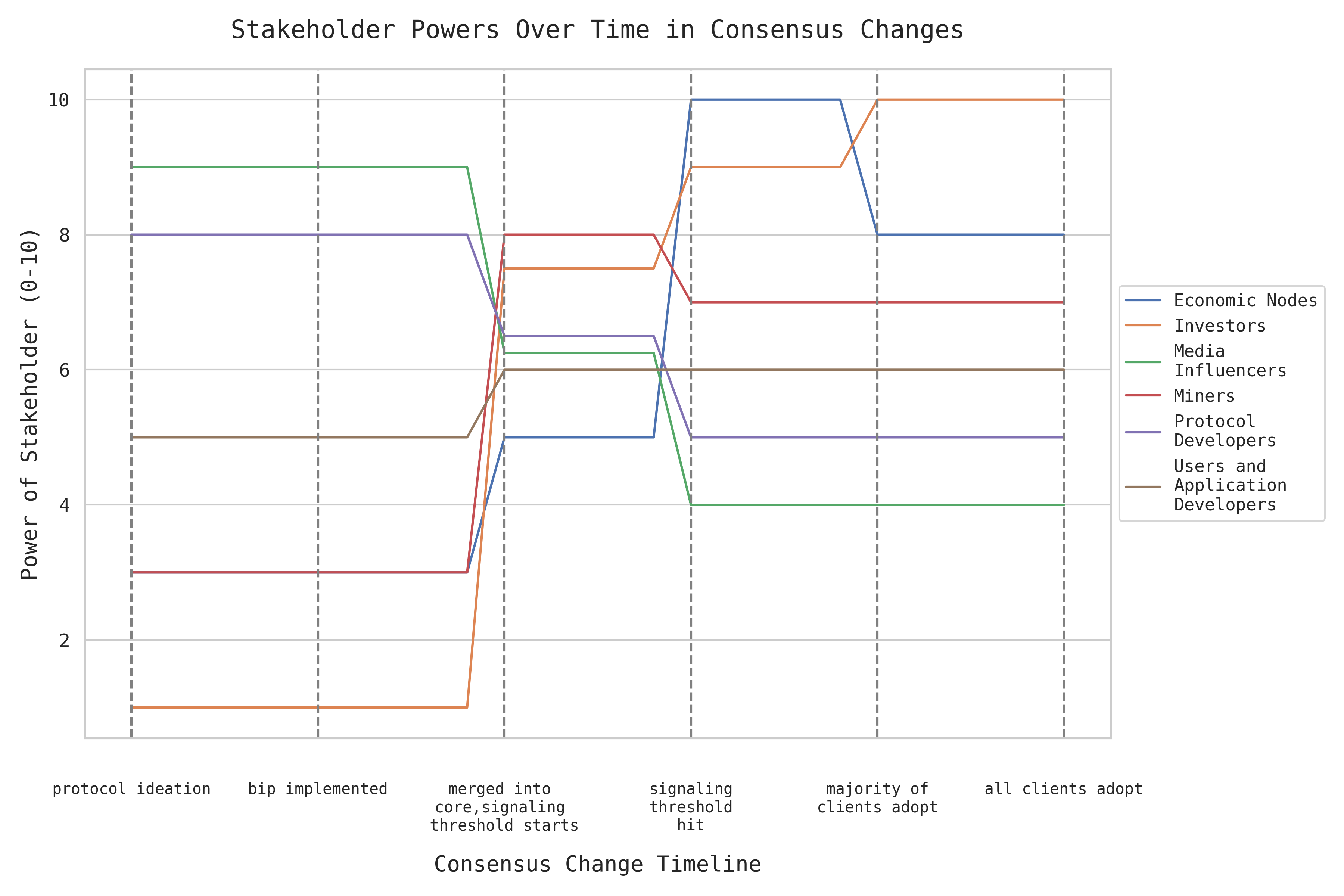

The research outlines Bitcoin’s consensus model and categorizes stakeholders according to their influence, timing, and capacity to impact protocol adjustments.

Economic Nodes, often high-volume transaction processors like exchanges, wield substantial influence when adoption rates for proposed changes become critical. These nodes determine which protocol changes are recognized as legitimate Bitcoin by selecting the client version they run.

While Economic Nodes’ influence peaks near an upgrade’s activation threshold, miners gain leverage earlier, during the signaling phase, where their readiness can advance or stall potential soft forks. Investors, developers, and media influencers, with varied interests and timelines, also shift their involvement at different stages, creating a nuanced interplay of support or…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…