Funding rates are an often overlooked yet vital aspect of the crypto market. These rates are essential in perpetual futures contracts — financial instruments that allow traders to bet on Bitcoin’s price without an expiration date.

Funding rates help align the price of these contracts with the actual market price of Bitcoin through periodic payments between buyers and sellers. Buyers pay sellers if the rate is positive, showing a bullish market mood. Conversely, a negative rate indicates bearish sentiment, with sellers paying buyers.

Funding rates show the market’s leverage direction and overall sentiment. High funding rates suggest a strong bullish sentiment, with traders willing to pay more to hold onto their bets for rising prices. Meanwhile, low or negative rates hint at a bearish outlook, where expectations lean towards a price drop.

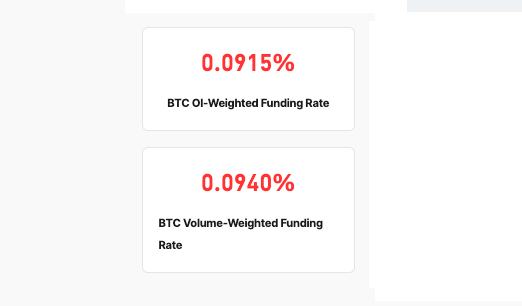

According to CoinGlass data, the open interest-weighted funding rate of 0.0921% and the volume-weighted funding rate of 0.0942% showed a high cost for traders holding long positions in perpetual futures prior to Bitcoin’s March 5 correction. The slight difference between these rates comes from the distribution of open interest and volume across different price points or times, showing a slight difference in market sentiment and leverage.

This high cost of holding long positions shows that most of the market was expecting prices to rise even further in the near future. This is especially significant as BTC had been struggling to regain its ATH of $69,000. Bitcoin briefly broke $69,000 on several exchanges on March 5, but a swift correction brought its price back to $59,500 before recovering to around $67,000.

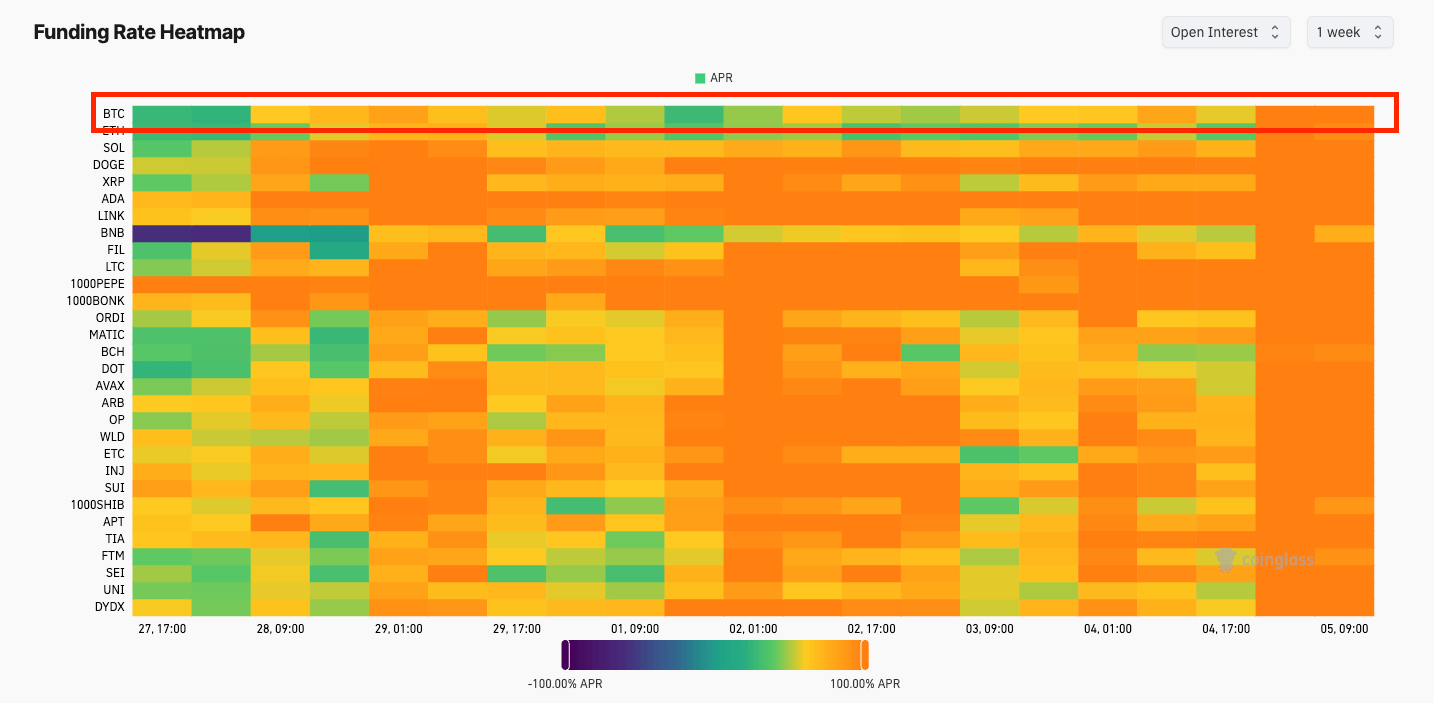

The bullish sentiment was seen in the dramatic increase in the Bitcoin APR. On March 1, Bitcoin’s price was $61,480, and the funding rate APR stood at 27.72%. And while an uptick in APR was seen in the last few days of February, it wasn’t until the beginning of March that it picked up momentum. The progression from 27.72% APR on March 1 to a sharp increase to 117.52% by the morning of March 5 followed Bitcoin’s price increase from $61,480 to $68,296 over the same timeframe.

The increase in funding rate APRs, particularly the jump…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…