Bitcoin (BTC) starts a new week still riding high near $37,000 as macroeconomic data returns to the fore.

The largest cryptocurrency continues to circle its highest levels in 18 months, with excitement over a possible exchange-traded fund (ETF) approval in the United States driving sentiment.

That is getting increasingly greedy, however, as according to the Crypto Fear & Greed Index, conditions match those seen as BTC price action hit its current all-time highs in late 2021.

What could shake up the status quo to produce volatility in the coming days?

The odds of an external trigger are more significant this week. A raft of U.S. macro data, including the Consumer Price Index (CPI), has the potential to disrupt any sideways trading activity across risk assets.

Multiple officials from the Federal Reserve are also due to speak, while the precarious geopolitical situation in the Middle East grinds on in the background.

On the institutional side, meanwhile, the future looks firmly bullish for Bitcoin — ahead of the prospective ETF approval, the Grayscale Bitcoin Trust (GBTC) is closing in on parity with net asset value.

Can Bitcoin markets stay the course and avoid a significant retracement? Cointelegraph takes a look at conditions in the weekly rundown of BTC price volatility catalysts waiting in the wings.

Funding rates flash warning with BTC price stuck at $37,000

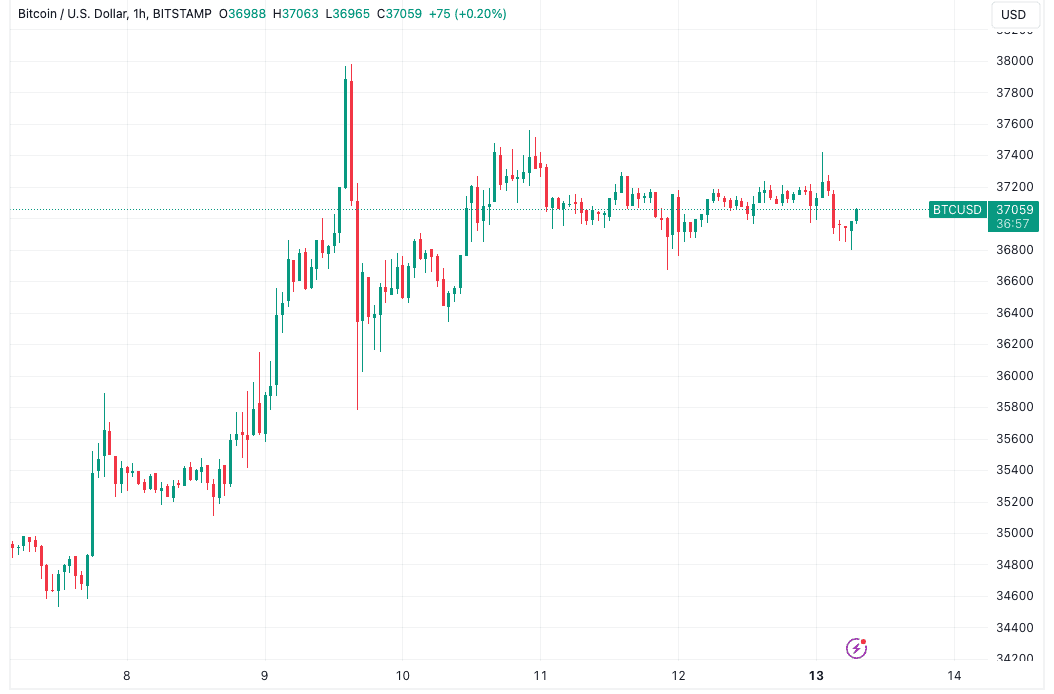

Bitcoin’s weekly close set a new 18-month high on Nov. 12, but what followed was not the gains seen after other recent closes.

During the Asia trading session, BTC/USD instead fell below $37,000, sticking firmly to the trading range in place throughout the weekend, per data from Cointelegraph Markets Pro and TradingView.

Monitoring the situation, popular trader and analyst Credible Crypto suggested that this would soon change. The reason, he said, was open interest (OI), now at multi-day highs and apt to spark volatility.

“OI has ramped right back up off the lows which means more positions to squeeze out,” part of an X post read.

Credible Crypto gave a target of $36,600 for a potential local low, with another post adding that Bitcoin was “very close” to further upside.

Countering the optimism over short-term market action was funding rates. These were not only positive, but at their highest since Bitcoin’s November 2021 all-time highs, indicating an overall disadvantage of being long BTC at current levels.

Click Here to Read the Full Original Article at Cointelegraph.com News…