The funding rate for perpetual futures serves as a proxy for market sentiment and shows the balance between long and short positions. Significant deviations from the average funding rate across exchanges can signal potential imbalances in positioning. A spike in the funding rate on a particular exchange shows a large number of long positions, which could lead to a potential squeeze or long liquidations if the market turns.

Another observation that can be made from the changes in funding rates is arbitrage opportunities. A significant divergence between exchanges or contract types enables traders to capitalize on temporary market inefficiencies. This is why even the slightest changes in funding rates can be important, as they can act as early warning signs of potential market shifts or changes in sentiment.

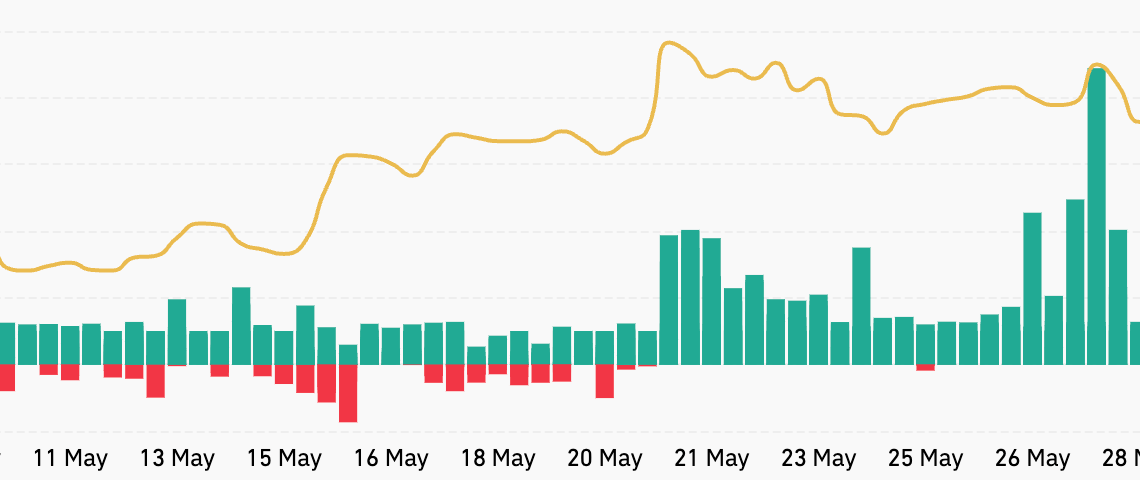

The funding rate for USDT and USD-margined perpetual futures has been relatively stable throughout May. This is indicative of a relatively stable market that’s leaning bullish. This stability was briefly broken on May 27, when the funding rate for USDT and USD-margined perpetual futures on dYdX spiked to 0.0889%. This was a sharp deviation from the average rate of around 0.0120% across other exchanges, indicating a significant imbalance between long and short positions. More traders taking on long positions could have resulted from Bitcoin’s brief price spike to over $70,000. However, as other exchanges saw less volatility in their funding rate, there could have been a particular inefficiency that dYdX traders were rushing to exploit.

The funding rate for token-margined perpetual futures has experienced similar stability in the past 30 days, hovering between 0.0100% and 0.0140% throughout May. In the early hours of June 4, Bitmex saw a significant drop in funding rate for token-margined perpetual futures from a stable 0.0100% to -0.0352%. Such a sharp drop in 24 hours showed a robust bearish sentiment among traders. However, with other exchanges seeing their rates stable at 0.0100%, the bearish sentiment seems to be concentrated among Bitmex users alone. Bitmex’s morning funding rate was close to the lower limit of -0.0375% set by many exchanges, which showed extreme positioning in these contracts compared to USDT or USD-margined contracts.

Throughout the day, the funding rate managed to consolidate at around -0.0150%, further…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…