Jurrien Timmer, Fidelity’s director of global macro, has argued that Bitcoin (BTC) may be “cheaper than it looks”, highlighting evidence on Tuesday that the cryptocurrency may be both undervalued and oversold.

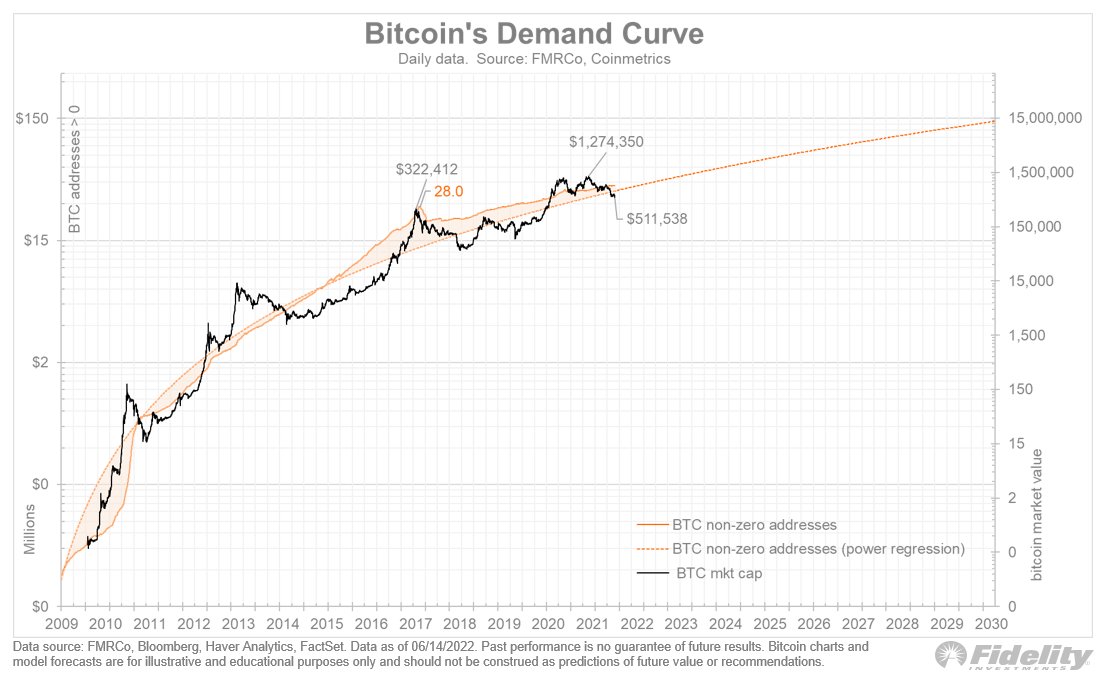

Addressing his 126,000 Twitter followers, Timmer explained that while Bitcoin has fallen back to 2020 levels, its price-to-network ratio has reeled all the way back to 2013 and 2017 levels, which he said may indicate it is undervalued.

Is BTC cheaper than it looks? If we consider a simple “P/E” metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. Valuation often is more important than price. /THREAD pic.twitter.com/6XMPrtRUzF

— Jurrien Timmer (@TimmerFidelity) June 15, 2022

Bitcoin undervalued

The price-to-network ratio is a crypto-riff on a popular metric used by traditional stock market investors called the price-to-earnings (P/E) ratio, which is used to determine whether a stock is over or undervalued.

A high ratio could suggest an asset is overvalued, whilst a low ratio could signal an undervalued asset.

Timmer highlighted a chart of Bitcoin’s demand curve overlaid with Bitcoin’s non-zero addresses against its marketcap, noting that the “price is now sitting below the network curve.”

Technically oversold

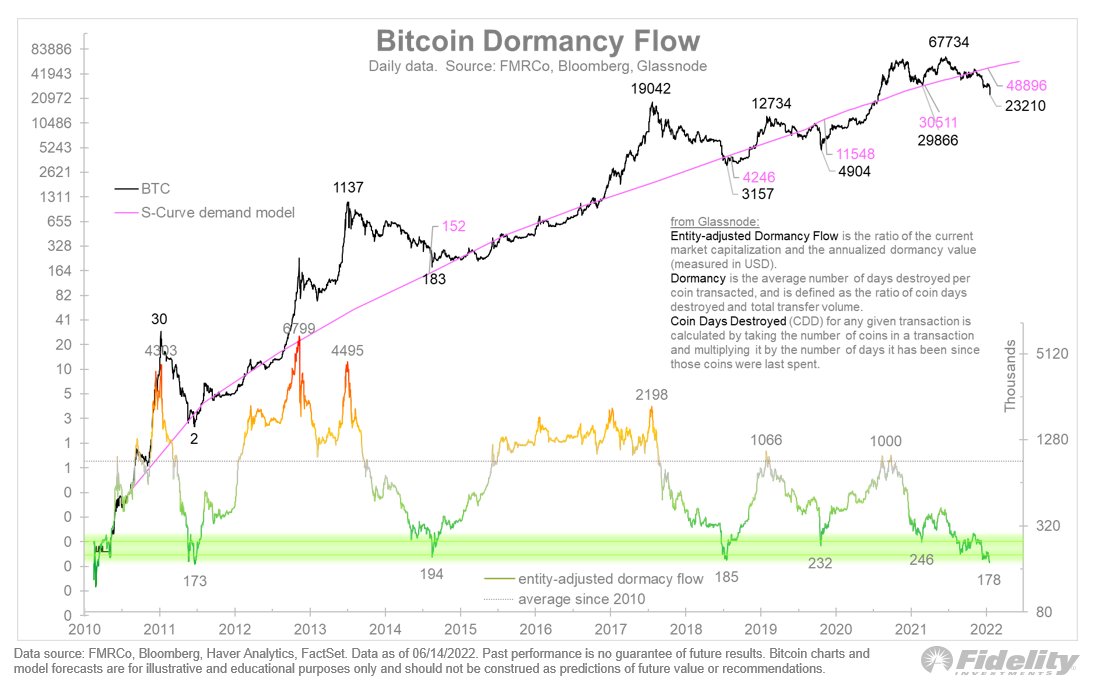

The macro analyst also shared a graph making use of Glassnode’s dormancy flow indicator, which he said suggests “how technically oversold Bitcoin is.”

Entity-adjusted Dormancy Flow is a popular metric for judging Bitcoin value by comparing the price to spending behavior.

According to Glassnode, a low dormancy flow value can suggest increased long-term holder conviction — meaning long-term Bitcoin HODLers are buying up from queasy short-term sellers.

“Glassnode’s dormancy flow indicator is now to levels not seen since 2011.”

Morgan Creek Digital co-founder and Youtuber Anthony Pompliano gave a similar view to Fox Business Monday, explaining that Bitcoin’s “value and price are diverging” and that “weak hands are selling to strong hands.”

“What we’re watching right now is the transfer from weak, short-term oriented people with weak hands into the long-term oriented strong hands.”

Bitcoin’s Fear and Greed Index fell to 7, indicating “Extreme Fear” on Wednesday, falling to its lowest levels since Q3 2019. In the past, low index numbers have often suggested a buying opportunity.

Related: Bitcoin…

Click Here to Read the Full Original Article at Cointelegraph.com News…