Bitcoin’s price has been pinned below $26,300 since June 10, reflecting a 14.8% correction in two months. Meanwhile, the Nasdaq tech stock market index gained 13.6% in the same period, indicating that investors are not exactly fleeing to the safety of cash and short-term debt. In fact, the demand for United States government bonds has been declining for the past six weeks.

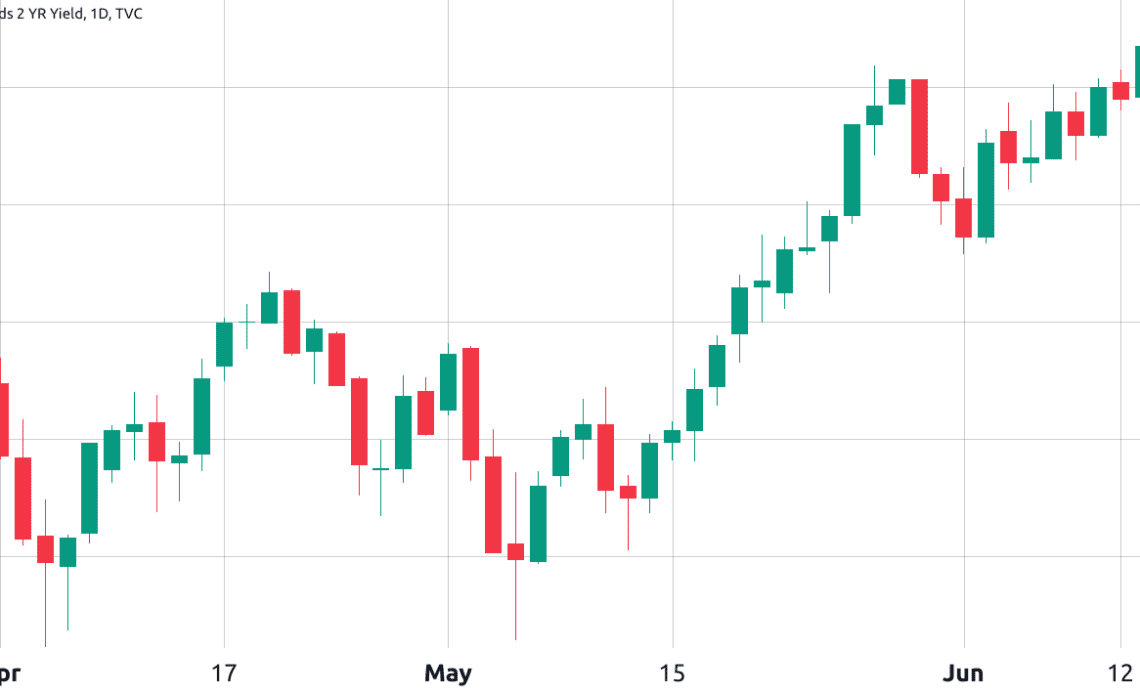

The yield on two-year U.S. Treasurys, for example, increased from 3.80% on May 4 to 4.68% on June 14. Lower demand for debt instruments increases payouts, resulting in a higher yield. If the investor thinks that inflation will continue above target, the tendency is for those participants to demand a higher yield when trading bonds.

The U.S. Treasury is set to issue more than $850 billion in new bills between June and September. As additional debt issuance tends to cause higher yields, the market expects increased borrowing costs for families and businesses. Still, that does not explain why investors have been flocking to tech companies but avoiding Bitcoin (BTC), as depicted by the past two-month performance.

Eight consecutive weeks of crypto fund outflows

According to CoinShares’ latest “Digital Asset Fund Flows Report,” the sector’s investment product outflows amounted to $88 million in the week ending on June 10. The substantial drawdown added to the ongoing eight-week streak of outflows, which now total $417 million.

The eight-week cumulative outflows for Bitcoin reached $254 million, representing approximately 1.2% of the total assets under management. Analysts at CoinShares have attributed this trend to monetary policy considerations, as interest rate hikes show no signs of slowing down, prompting investors to remain cautious.

Bitcoin has been trying to reclaim the $27,500 support for the past two weeks, but that might be harder than expected given the upcoming $600 million weekly options expiry on June 16.

A brief Bitcoin pump above $27,000 made bulls giddy

It is worth noting that the actual open interest for the options expiry will be lower since bulls concentrated their bets above $27,000. These traders likely got excessively optimistic after Bitcoin’s price gained 8% on June 6, erasing the losses that drove BTC down to $25,400.

The 0.73 put-to-call ratio reflects the imbalance between the $350 million in call (buy) open interest and the $250 million in…

Click Here to Read the Full Original Article at Cointelegraph.com News…