A decision from the United States Fed to pause and possibly lower interest rates next year will likely serve as a “positive boost” for cryptocurrencies and crypto stocks.

In a Dec. 13 interview with Bloomberg, Blackrock fund manager Jeffrey Rosenberg described the Fed’s rate pause — and its hint at rate cuts next year — as a “green light” for investors, with the S&P 500 rallying 1.37% on the decision.

“This bullish sentiment can go on for a while, at least until we get a new round of economic data, and until then the message is clear: the fed is more than willing to see an easing in financial conditions.”

Crypto stocks have witnessed significant gains on the back of the announcement too, with shares of Coinbase (COIN) and MicroStrategy (MSTR) respectively spiking 7.8% and 5% on the day, while Bitcoin miner Marathon Digital (MARA) jumped 12.6%.

Perfect storm ⛈️: #Bitcoin Halving;#Bitcoin Spot ETFs;

Fed stops raising rates while signaling 3 cuts in 2024;

Good Court outcomes in @Ripple / @Grayscale cases;

Binance settlement;

Election year = rates cuts, coupled with ️ go brrrrr and increased liquidity.— John E Deaton (@JohnEDeaton1) December 13, 2023

Henrik Andersson, chief investment officer at investment fund Apollo Crypto told Cointelegraph that he expects today’s pause and the expectation of lowered interest rates in the coming year to be a “positive boost” for cryptocurrencies and crypto-related stocks, adding:

“If we see the likes of BlackRock and Fidelity launch Bitcoin ETFs we can expect a lot of other traditional financial institutions to enter the crypto markets as well.”

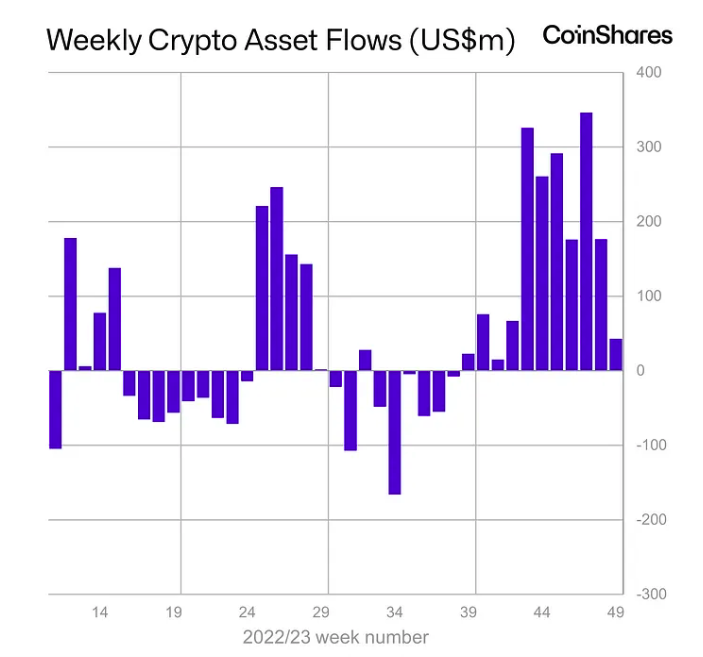

Notably, blockchain equities recently experienced their largest weekly inflows on record, with a staggering $126 million flowing into crypto-related stocks, according to a Dec. 11 report from CoinShares.

CoinShares’ head of research, James Butterfill, also found that digital asset investment products experienced their 11th straight week of inflows, posting another weekly gain of $43 million.

Tina Teng, market analyst at CMC Markets, told Cointelegraph the Fed’s rate pause would undoubtedly increase market enthusiasm for crypto products.

“The pivot boosted broad risk-on sentiment and improved expectations for future liquidity conditions, thereby buoying crypto stocks in the same manner.”

Related: Bitcoin to surge to $80K as stablecoins overtake Visa…

Click Here to Read the Full Original Article at Cointelegraph.com News…