Key Takeaways

- The Fed is expected to lower interest rates by 25 basis points to a range of 4.25% to 4.5%.

- Increased market instability is possible as the event looms.

Share this article

The Federal Reserve is scheduled to announce its interest rate decision during its meeting on Wednesday. Economists widely predict that the Fed will cut rates for the third time in a row, bringing the federal funds rate down to a target range of 4.25% to 4.5%.

Another 25-basis-point rate cut would result in a total reduction of one full percentage point since September. The federal bank first reduced interest rates by 0.5 percentage points in September and then made another cut of 0.25 percentage points in November.

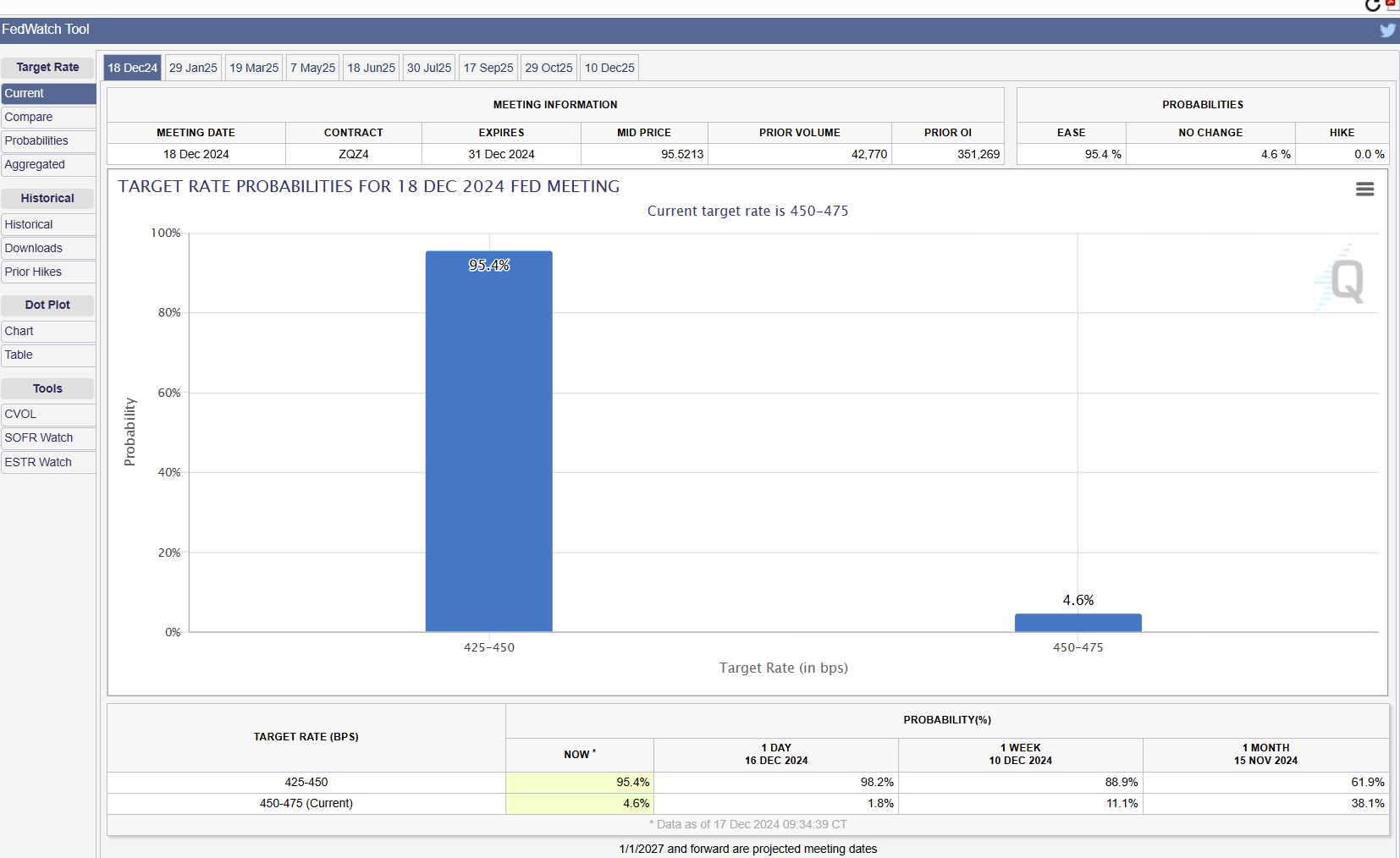

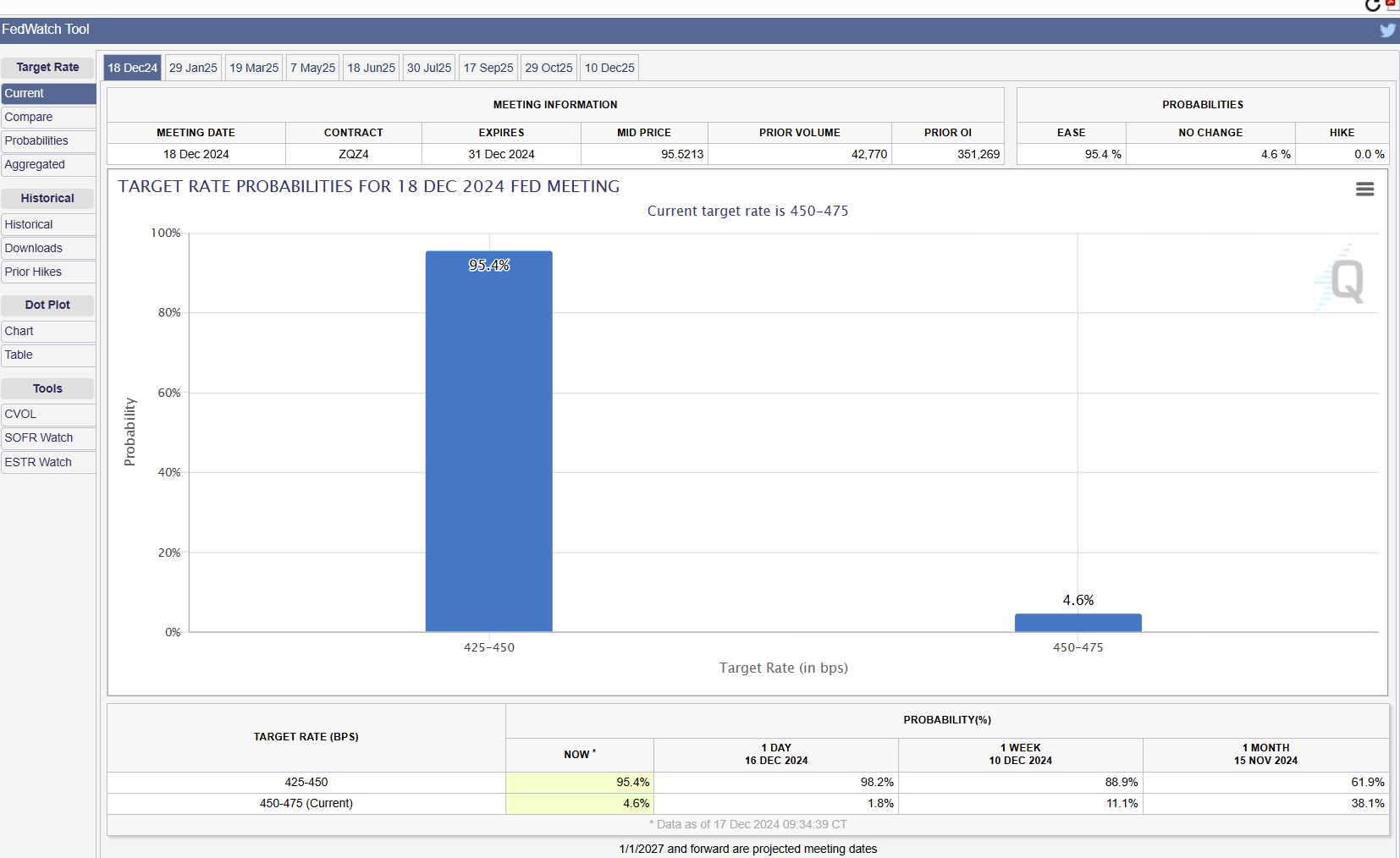

According to the CME FedWatch Tool, there is now a 95.4% chance of a 25-basis-point rate cut, while the probability of maintaining current rates stands at 4.6%. This reflects a slight adjustment from yesterday, when the likelihood of a rate cut was around 98%.

Nevertheless, compared to last week, expectations for a rate reduction have strengthened, particularly after November’s inflation data met expectations and job figures showed strength.

According to the Bureau of Labor Statistics (BLS), the US economy added 227,000 jobs in November, exceeding expectations and showing a rebound from months disrupted by hurricanes and strikes.

Job growth has been robust, particularly in sectors such as health care and tourism. Solid job gains contribute to a positive economic outlook, which can influence the…

Click Here to Read the Full Original Article at Markets Archives – Crypto Briefing…