Stock and cryptocurrency markets on Thursday saw volatility, after experiencing fluctuations during the tensions between China and Taiwan on Tuesday and Wednesday. Major indexes like the S&P 500, Dow Jones, and NYSE have shed a few percentages today, while the global cryptocurrency market capitalization lost 2.5% in 24 hours, dropping to just above the $1.1 trillion range. Precious metals, on the other hand, traded higher as U.S. president Joe Biden’s administration declared that the Monkeypox virus a public health emergency in the United States.

China and Taiwan Tensions and Monkeypox Reports Cause Stock and Crypto Prices to Fluctuate, Precious Metal Markets Rise Catching ‘Safe-Haven Demand’

Stock and crypto traders faced some headwinds on August 4, the day after the American representative from California, Nancy Pelosi, visited Taiwan to discuss democracy with the Taiwanese president Tsai Ing-wen. Global markets saw some fluctuations before the U.S. diplomat visited Taipei and during the visit on Wednesday as well.

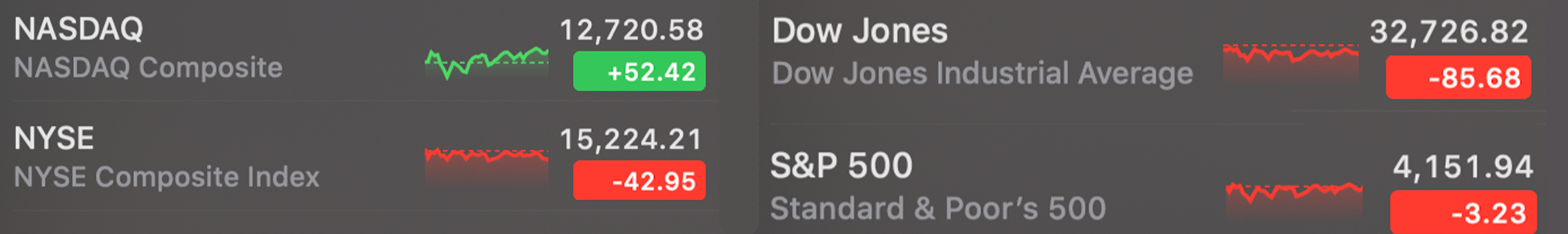

Equities and precious metals markets slid the day before on August 3, while the crypto economy managed to consolidate for another day. U.S. equities markets took a dip again on Thursday as the Dow Jones dropped 85 points lower during the afternoon (EST) trading sessions. Cryptocurrencies followed the drop in stock markets during the course of the day.

While Nasdaq was up, S&P 500, NYSE, and many other stocks saw losses during the course of the day. The crypto economy saw losses as well, as the entire lot of digital assets today lost 2.5% in the last 24 hours against the U.S. dollar.

The leading crypto asset bitcoin (BTC) slipped 5% on Thursday afternoon from $23,548 to $22,395 in value. Ethereum (ETH) too lost 5% today after tapping a 24-hour high at $1,666 per unit down to a low of $1,545 per coin. Out of the top ten crypto market cap contenders, solana (SOL) lost the most losing 5.6% during the day and polkadot (DOT) shed 5.5%.

In Europe, the Ukraine-Russia war rages on and tensions between China and Taiwan have escalated this week. While Asia deals with the tensions, Europe is dealing with an energy crisis and a recession. The U.S. is also dealing with what many believe is a recession even though American bureaucrats and their experts have stated otherwise.

Click Here to Read the Full Original Article at Bitcoin News…