The ongoing cryptocurrency bear market has triggered a massive decline in Bitcoin (BTC) mining profitability as BTC mining expenses outpace the price of Bitcoin.

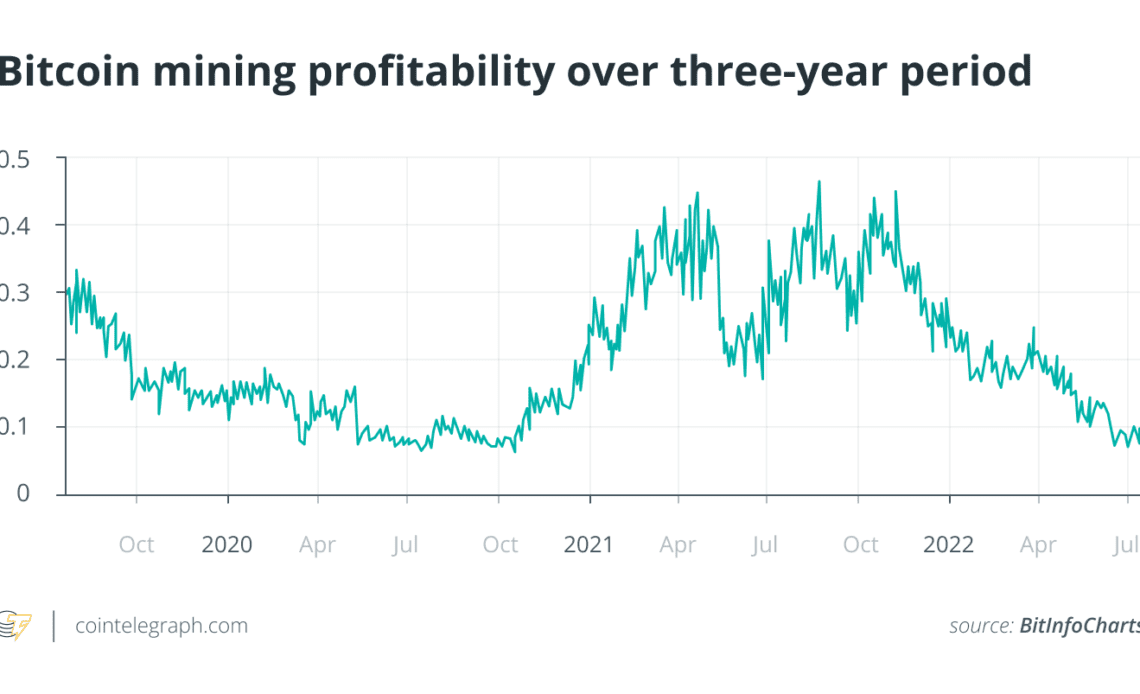

Closely tied to the drop in the BTC price, Bitcoin mining profitability has been tanking since late 2021 and reached its lowest multi-month levels in early July 2022.

According to data from crypto tracking website Bitinfocharts, BTC mining profitability tumbled to as low as $0.07 per day per 1 terahash per second (THash/s) on July 1, 2022, touching the lowest level since October 2020.

The decline in BTC mining profitability has caused some big changes in the crypto mining industry.

Lower Bitcoin prices fueled selling pressure as miners were pushed to sell their BTC to continue mining and pay for electricity. The majority of big crypto mining firms like Core Scientific had to sell a significant amount of Bitcoin in order to survive the tough market conditions.

The growing unprofitability of BTC mining has also triggered a big drop in demand for crypto mining devices, causing many miners to sell their mining hardware at a discount.

As lower prices of application-specific integrated circuit (ASIC) miners and graphics processing units (GPU) may drive more interest from new miners, it’s crucial to remember that the price of mining hardware is just one out of many factors behind BTC mining profitability.

What is Bitcoin mining profitability and how is it defined?

Bitcoin mining is an economic activity that involves the production of the digital currency Bitcoin using the computing power of GPU-based miners or specifically-designed ASIC miners.

Bitcoin mining profitability is a measure defining the degree to which a Bitcoin miner yields profit based on a wide number of factors, including the price of Bitcoin, the mining difficulty, the cost of energy, the type of mining hardware and others.

Factor 1: Bitcoin price and block rewards

The price of Bitcoin is one of the most evident factors impacting the BTC mining profitability as the value of BTC is directly proportional to profits yielded by miners.

Bear markets trigger even more attention to BTC price from miners because they risk losing money if BTC drops below a certain price level.

Miners should also take into account the amount of the block reward or the amount of BTC given to miners for mining one block on the BTC blockchain. Bitcoin’s original block reward amounted to as much as 50 BTC before it was cut to the current 6.5 BTC following three historical…

Click Here to Read the Full Original Article at Cointelegraph.com News…