Popular crypto strategist Michaël van de Poppe is predicting bullish continuations for a handful of altcoins, including Avalanche (AVAX), Polygon (MATIC) and Chainlink (LINK).

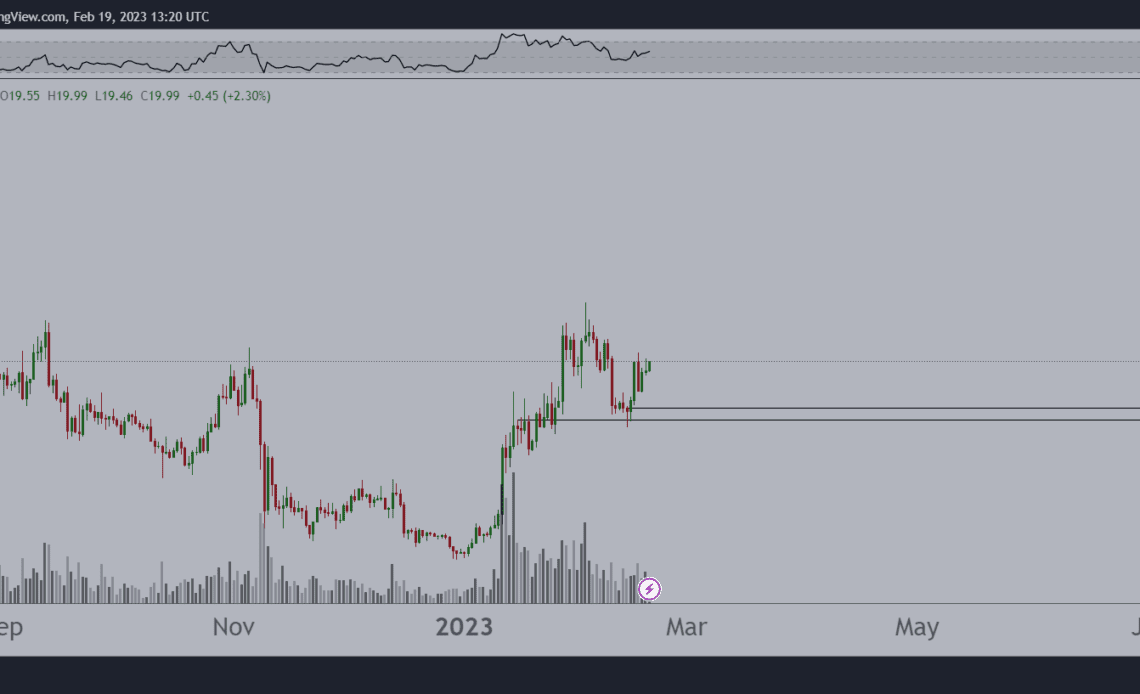

Van de Poppe tells his 649,000 Twitter followers that he believes the trend for smart contract platform Avalanche is still up, despite its recent pullback.

“Difficult chart, it’s in between levels, trend is still up. Great bounce from $18 and looks for continuation. Would be interested between $18-19, targeting $25 or higher.”

At time of writing, AVAX is trading for $20.82, up nearly 6% on the day.

Next up is the blockchain scaling solution Polygon. According to Van de Poppe, he sees a possible dip for MATIC to around the $1.25 price level before the next leg up. However, he also says that MATIC could just continue rallying to its immediate resistance.

“Slight correction took place, continuation towards next resistance around $1.65. If there’s a dip towards $1.25-1.35, then I’m assuming we’ll be buying for continuation on the rally. Trend is simple.”

At time of writing, MATIC is worth $1.48, up more than 1% in the last 24 hours.

Another altcoin on the analyst’s radar is the decentralized oracle network Chainlink. Van de Poppe says that LINK is currently presenting the “opportunity of a lifetime.”

“Slightly breaking out, if we get a retest around $7.80 I would be happy to long, resistance around $8.50-9.00, before we continue towards $15-20.”

At time of writing, LINK is trading for $7.99, a fractional increase on the day.

Van de Poppe also has his eye on smart contract protocol Fantom (FTM), which he believes will likely correct some more before resuming its uptrend.

“Gave a substantial correction towards $0.42. Massive bounce of 40% from there. Looking at a case of $0.48 as a potential entry, might already been hit at $0.52. Continuation upwards seems likely.”

At time of writing, FTM is worth $0.52, a slight decrease in the past day.

The last altcoin on the trader’s list is the native asset of the decentralized exchange GMX (GMX). Van de Poppe thinks that GMX is also likely due for a pullback before its trend continuation.

“Two levels of interest: $72 and $67.50. If we get there, we can simply continue buying the dip until trend switches. Next target could be $100 then.”

Click Here to Read the Full Original Article at The Daily Hodl…