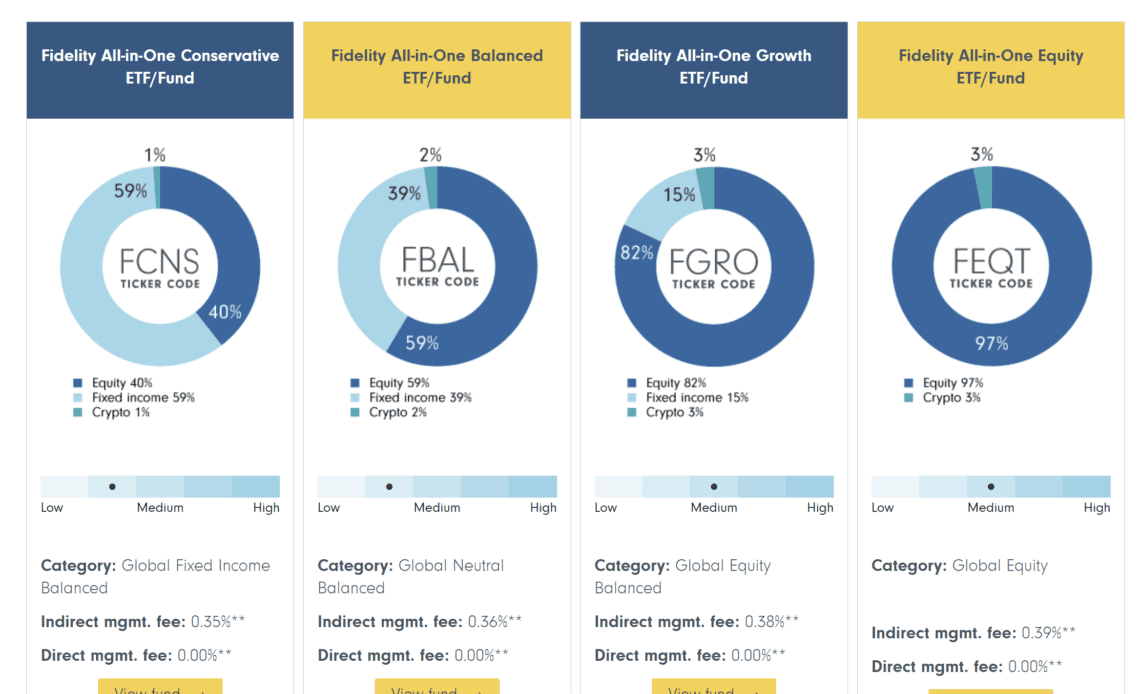

In a major shift within the financial industry, Fidelity Investments, with its colossal $12.6 trillion in assets under administration, is now recommending that the traditional 60/40 portfolio model should evolve to include a 1-3% allocation to crypto, specifically through its spot Bitcoin ETF (FBTC). This groundbreaking move is not just a nod to the burgeoning crypto market but a potential catalyst for unprecedented demand, potentially channeling hundreds of billions of dollars into Bitcoin.

Matt Ballensweig, Head of Go Network at BitGo, took to X (formerly Twitter) to express his anticipation, stating, “I’ve said this since the day of ETF approval – now that Pandora’s box has been opened, the multi-trillion dollar asset managers will sell BTC and crypto through their massive distribution channels for us. Fidelity now creates blueprint portfolios with 1-3% crypto.”

Echoing this sentiment, Will Clemente III, a renowned analyst, remarked on the potential ripple effects of Fidelity’s recommendation. “Fidelity now recommending a 1-3% crypto allocation in your portfolio. Gateway drug. What happens when that 1-3% becomes 3-6%? Slowly then suddenly,” Clemente noted, highlighting the potential for growth in crypto allocation.

What This Could Mean For Bitcoin Price

Adam Cochran, a partner at CEHV, further elaborated on the implications of Fidelity’s move for Bitcoin’s adoption and price trajectory. In a detailed analysis shared on X, Cochran laid out an ambitious future where the inclusion of crypto in traditional portfolios could lead to a substantial reevaluation of Bitcoin’s value. “How fucking wild is this to see. 60/40 portfolios are now 59/39/2,” Cochran began, underlining the historic milestone of crypto becoming a core asset class.

Cochran compares the adoption rates of the internet to cryptocurrency, stating, “Hell, the internet was 30 years in the making and didn’t reach 10m users till 1995. But the most non-conservative estimates put crypto ownership at 450M worldwide (conservative is more like 200M) that’s like the internet in 2001.”

He highlights the outsized economic impact of digital advancements, “Today the internet has somewhere around 5.5B users – 12x what it did in 2001. But according to BEA, the impact of the digital economy has been exponentially outsized with each year of growth.” By drawing…

Click Here to Read the Full Original Article at NewsBTC…