The concept of a Russian ruble stablecoin received special attention at a major local crypto event, the Blockchain Forum in Moscow, with key industry executives reflecting on some of the core features a ruble-backed stablecoin might require.

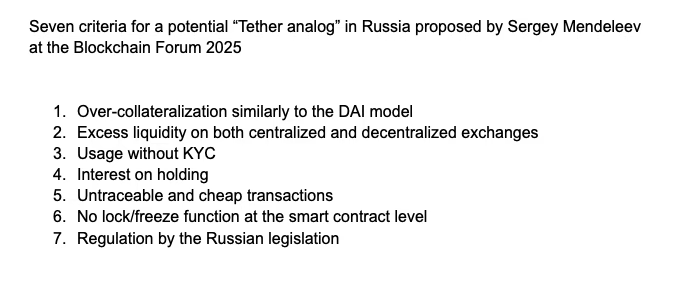

Sergey Mendeleev, founder of the digital settlement exchange Exved and inactive founder of the sanctioned Garantex exchange, put forward seven key criteria for a potential “replica of Tether” in a keynote at the Blockchain Forum on April 23.

Mendeleev said a potential ruble stablecoin must have untraceable transactions and allow transfers without Know Your Customer (KYC) checks.

However, because one of the criteria also requires the stablecoin to comply with Russian regulations, he expressed skepticism that such a product could emerge soon.

The DAI model praised

Mendeleev proposed that a potential Russian “Tether replica” must be overcollateralized similarly to the Dai (DAI) stablecoin model, a decentralized algorithmic stablecoin that maintains its one-to-one peg with the US dollar using smart contracts.

“So, any person who buys it will understand that the contract is based on the assets that super-securitize it, not somewhere on some unknown accounts, but free to be checked by simple crypto methods,” he said.

Another must-have feature should be excess liquidity on both centralized and decentralized exchanges, Mendeleev said, adding that users must be able to exchange the stablecoin at any time they need.

According to Mendeleev, a viable ruble-pegged stablecoin also needs to offer non-KYC transactions, so users are not required to pass their data to start using it.

“The Russian ruble stablecoin should have the opportunity where people use it without disclosing their data,” he stated.

Related: Russia’s central bank, finance ministry to launch crypto exchange

In the meantime, users should be able to earn interest on holding the stablecoin, Mendelev continued, adding that offering this feature is available via smart contracts.

Russia opts for centralization

Mendeleev also suggested that a potential Russian version of Tether’s USDt (USDT) would need to feature untraceable and cheap transactions, while its smart contracts should not enable blocks or freezes.

The final criterion is that a potential ruble stablecoin would have to be regulated in accordance with the Russian legislation, which currently doesn’t look promising, according to Mendeleev.

Click Here to Read the Full Original Article at Cointelegraph.com News…