The exchange stablecoin ratio (ESR) is an on-chain metric that indicates the balance of liquidity between Bitcoin and stablecoins held on exchanges.

The metric is calculated as the ratio of the total Bitcoin reserves to the total stablecoin reserves, essentially showing the market’s buying power and selling pressure.

A low ESR indicates that stablecoin reserves significantly outweigh Bitcoin reserves, suggesting an abundance of liquidity ready to flow into BTC. This disparity has historically correlated with bull markets and rallies, as stablecoins have always been preferred for purchasing BTC on exchanges.

Conversely, a high ESR suggests that BTC dominates reserves relative to stablecoins, which usually means limited buying power on exchanges and a potential for significant sell pressure.

While there are many different indicators of bull markets, ESR is particularly valuable as it captures the readiness of capital to move into Bitcoin. Unlike isolated price metrics, the ratio reflects underlying liquidity trends and mirrors investor sentiment.

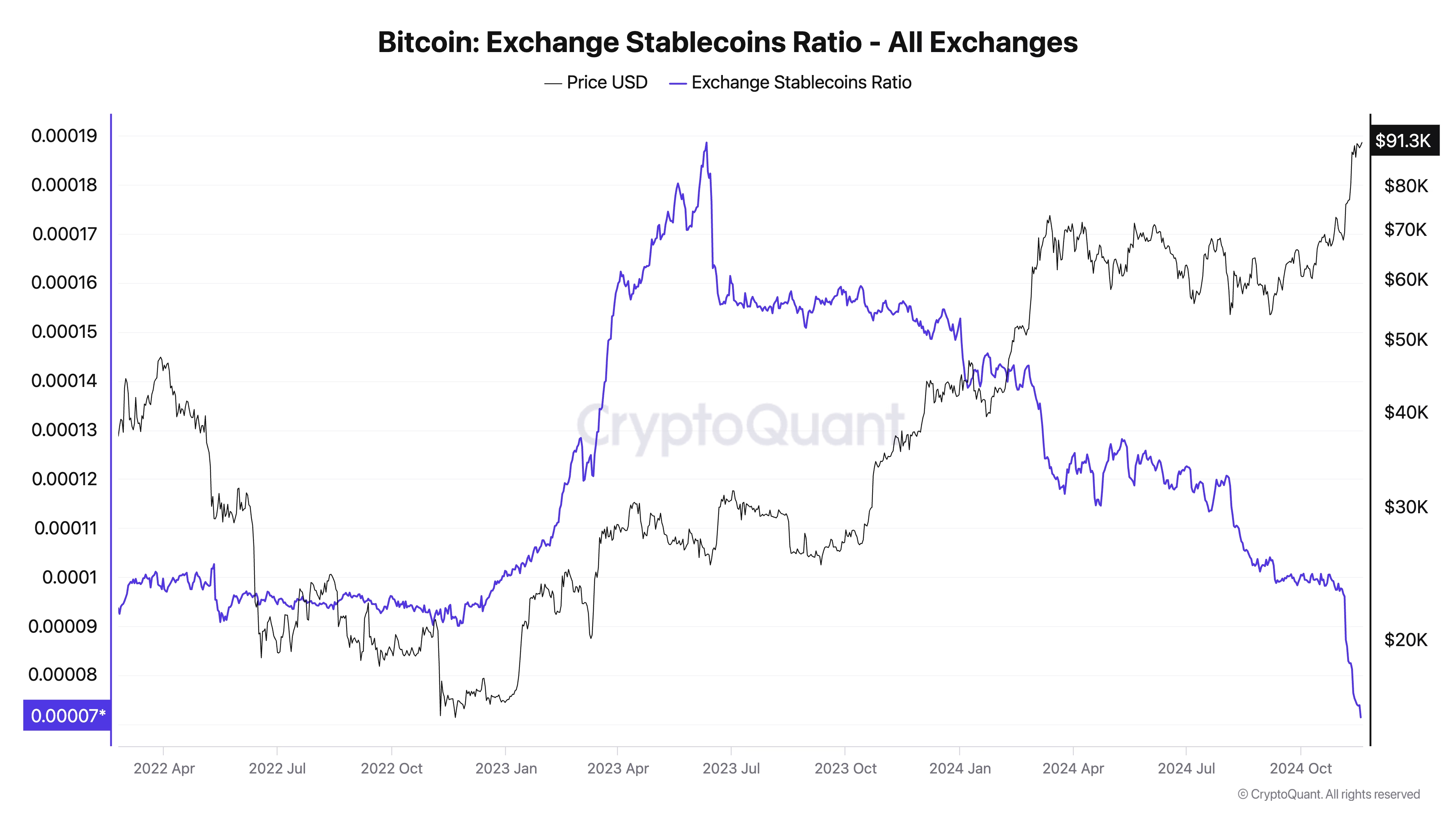

On Nov. 18, the ESR dropped to an all-time low following a declining trend that intensified in 2024. Since the beginning of the year, the ESR decreased by just over 95%, dropping from 0.0015276 on Jan.1 to an all-time low of 0.00007317 by Nov.18. During the same period, Bitcoin’s price skyrocketed from $44,200 to $90,500, showing a clear inverse relationship between the ratio and price.

The US presidential election on Nov. 5 had a profound impact on the market, acting as a catalyst for Bitcoin’s surge to its all-time high of $93,000. It triggered record trading volumes in both spot and derivatives markets as institutions and retail investors rushed to capitalize on Bitcoin’s growing narrative as a hedge and store of value. These heightened trading activities drove Bitcoin’s price higher while stablecoin reserves accumulated, further compressing the ESR.

The all-time low in ESR paired with Bitcoin trading between $90,000 and $92,000 shows a market in a unique position. A low ESR during a period of price growth shows a robust demand fueled by substantial capital reserves in stablecoins.

Such an environment limits the downside risk for Bitcoin, as the abundance of stablecoins creates a sort of liquidity cushion ready to absorb any selling pressure. At the same time, the limited BTC supply on exchanges exacerbates…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…