As the crypto market holds its breath for the U.S. Securities and Exchange Commission’s (SEC) impending decision on the first spot Bitcoin Exchange-Traded Fund (ETF), a close analysis of Bitcoin’s on-chain data reveals a market in a state of cautious anticipation.

Between Jan. 4 and Jan. 8, 2024, Bitcoin’s price increased from $44,230 to $46,944 after weeks of sideways and choppy movement. This increase, marked by a peak on Jan. 8, indicates an optimistic but pent-up market. Such price behavior could be attributed to speculative positioning in response to the upcoming SEC decision, as the market seems to be leaning towards a positive outcome.

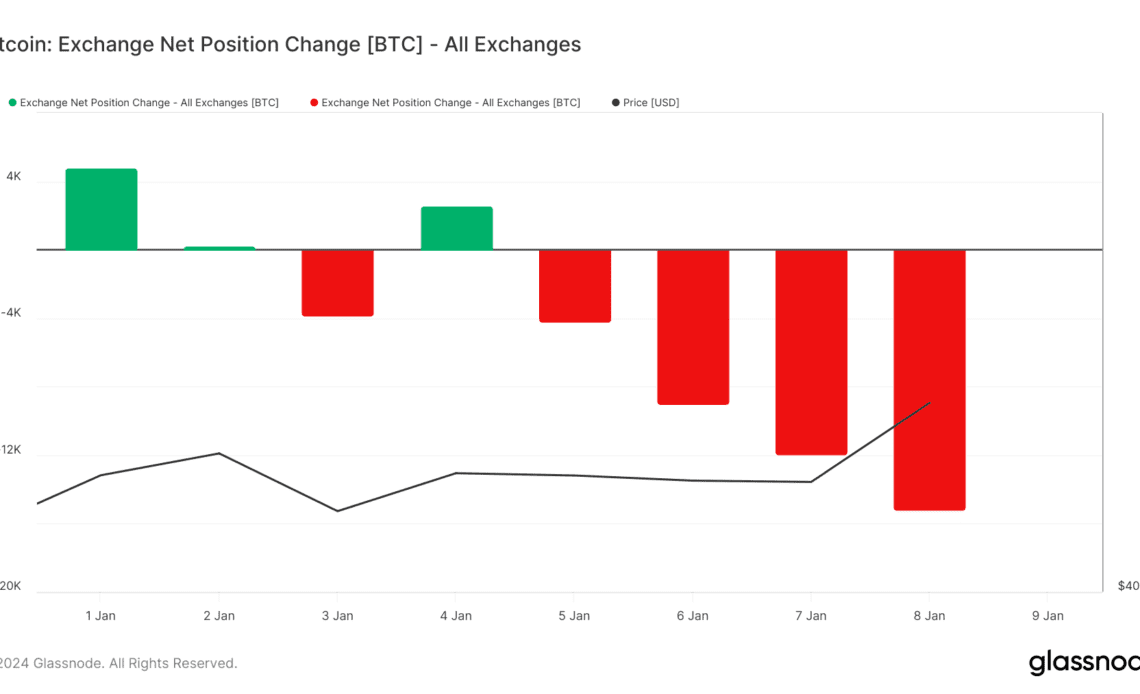

The 30-day change in Bitcoin supply held in exchange wallets shows that most of the market isn’t looking to sell. Starting at 2,571 BTC on Jan. 4, the balance shifted to a negative 15,183 BTC by Jan. 8. This consistent decrease in exchange-held Bitcoin suggests a growing preference among holders to withdraw their assets. This behavior often indicates a preparation for long-term holding, possibly in anticipation of a post-ETF approval surge in Bitcoin’s value.

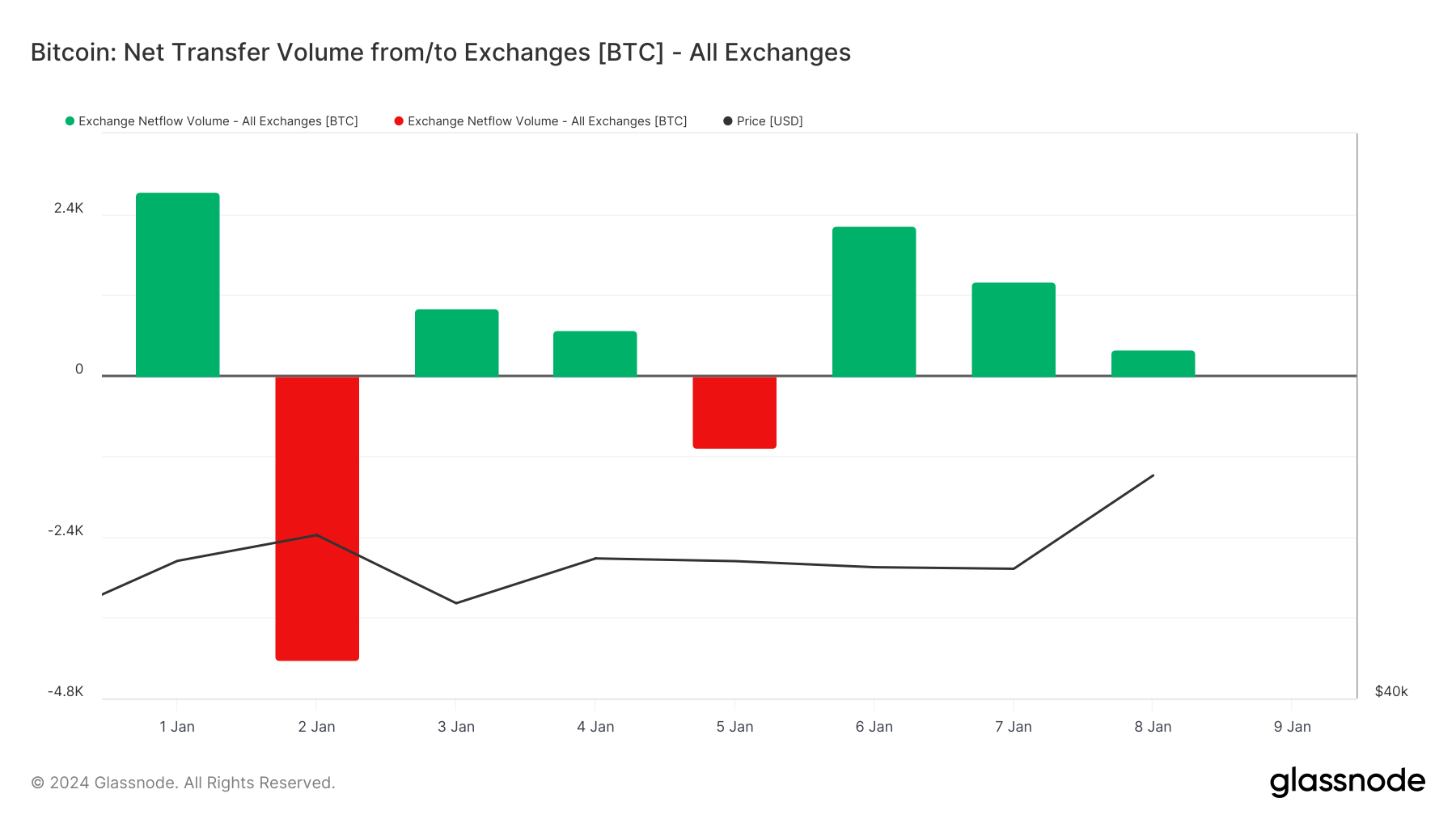

The total amount of BTC transferred to and from exchange addresses between Jan. 4 and Jan. 8 indicates consolidation. The high volume observed on Jan. 4 (52,116 BTC to exchanges and 51,432 BTC from exchanges) tapered off mid-week, only to spike again on Jan. 8 (53,196 BTC to exchanges and 52,798 BTC from exchanges). Such a pattern is characteristic of investors repositioning their portfolios in anticipation of significant market movements.

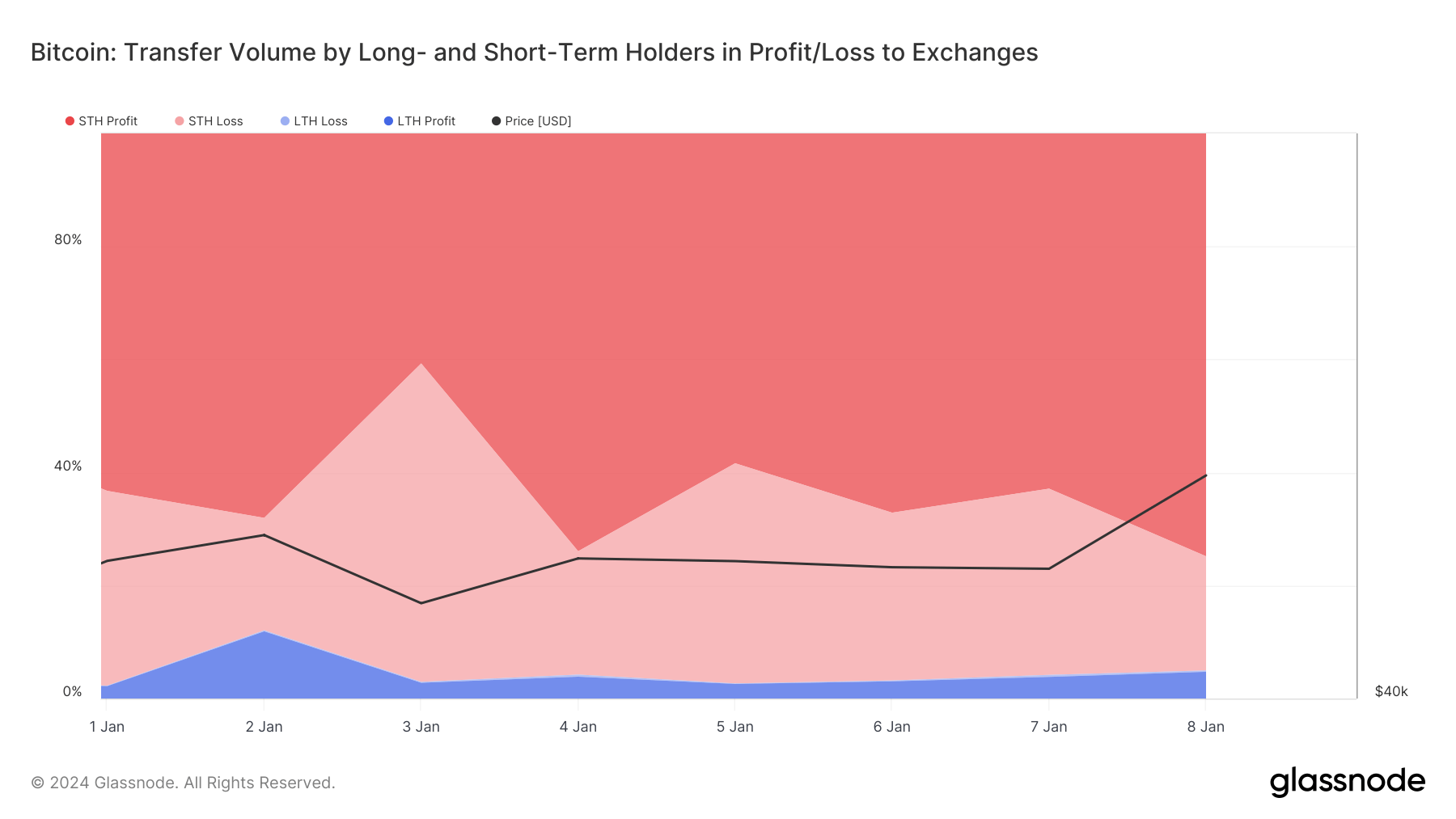

The movement of coins by short-term (STH) and long-term holders (LTH) shows where the selling pressure could come from. On Jan. 8, 74.82% of all coins moved to exchanges came from short-term holders, likely capitalizing on the recent price increase to realize gains. This behavior suggests a preparatory stance for expected short-term volatility or a price correction post-ETF decision. In stark contrast, long-term holders in profit made up only 4.73% of the total exchange inflows. This indicates long-term holders’ belief in the cryptocurrency’s resilience irrespective of short-term regulatory outcomes.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…