Stablecoins are a foundational part of the crypto market. Tracking their distribution across blockchains is essential for understanding the underlying trends in DeFi, as they represent the market’s liquidity.

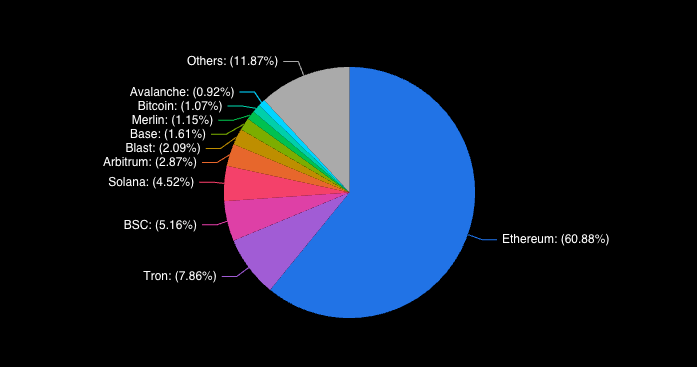

The total value locked (TVL) across all DeFi protocols currently stands at $107.427 billion. This TVL represents the dollar value of all the assets locked in DeFi protocols, showing just how much of the market is invested in this sector. Ethereum’s dominance over this value is evident in its share of the TVL—61.01%. Ethereum’s chokehold on this sector is further seen in the share of TVL Tron, the second-ranked blockchain, which has—just 7.76%.

Looking at TVL fails to paint a clear picture of liquidity trends in DeFi. While Ethereum’s share of TVL shows the value of all tokens locked in the protocol, we need to look at the distribution of stablecoins to understand where most of the liquidity lies.

The market capitalization of all stablecoins currently stands at $160.407 billion, with Tether’s USDT holding a dominant 69.56% share of that market cap.

When looking at the distribution of the total stablecoin market cap across blockchains, Ethereum still comes up as a winner, holding 49.87% of the stablecoin market cap, amounting to $79.947 billion. However, Tron follows closely with 35.52% of the stablecoin market cap, amounting to $56.929 billion. BSC, Arbitrum, Base, and Solana hold significantly smaller shares at 3.21%, 2.45%, 1.97%, and 1.92%, respectively.

| Blockchain | Market Cap Share (%) | Total Market Cap ($) |

|---|---|---|

| Ethereum | 49.87 | $79.947b |

| Tron | 35.52 | $56.929b |

| BSC | 3.21 | $5.141b |

| Arbitrum | 2.45 | $3.923b |

| Base | 1.97 | $3.156b |

| Solana | 1.92 | $3.085b |

Examining the distribution of stablecoins within these chains provides further insights. On Ethereum, USDT leads with $44.517 billion, followed by USDC at $21.688 billion, DAI at $4.746 billion, USDe at $2.905 billion, and FDUSD at $2.447 billion. Tron’s stablecoin market cap is predominantly USDT at $55.981 billion, with smaller contributions from USDD, USDC, TUSD, and USDJ.

To better understand the difference in liquidity across blockchain, it’s important to differentiate between the market cap of stablecoins issued directly on each chain and those bridged from other chains. On Ethereum, $89.375 billion worth of stablecoins are issued on-chain, whereas only $15.04 million are bridged. Tron’s stablecoin…

Click Here to Read the Full Original Article at Stablecoins News | CryptoSlate…