The price of Ethereum’s native token, Ether (ETH), has surged by more than 40% year-to-date to around $1,750, the highest level in seven months. However, ETH price is not out of the woods yet despite several bullish cues such as the Shanghai upgrade in the pipeline.

Ethereum price bull trap?

Ether’s rise has appeared primarily in the wake of similar upside moves elsewhere in the crypto market, responding to lowering inflation that reduces the Federal Reserve’s likelihood of raising interest rates aggressively.

At the same time, warnings about an imminent bull trap in the risky markets have emerged, which may wipe out their recent profits. Ethereu, due to its long-term correlation with stocks and Bitcoin, faces similar risks.

Bull Trap About to confirm on $ETH and $BTC along with shooting stars on both. Failed breaks usually trigger the biggest opposing moves. You have been warned. If stocks do dump, reversal signal on crypto can follow. Close > that shooting star candle invalidates the trap. pic.twitter.com/tJ9c5N0M3J

— Cameron Fous (@Cameronfous) February 16, 2023

Let’s take a closer look at several potential bullish and bearish catalysts for the price of Ethereum below.

ETH becomes most deflationary since Merge

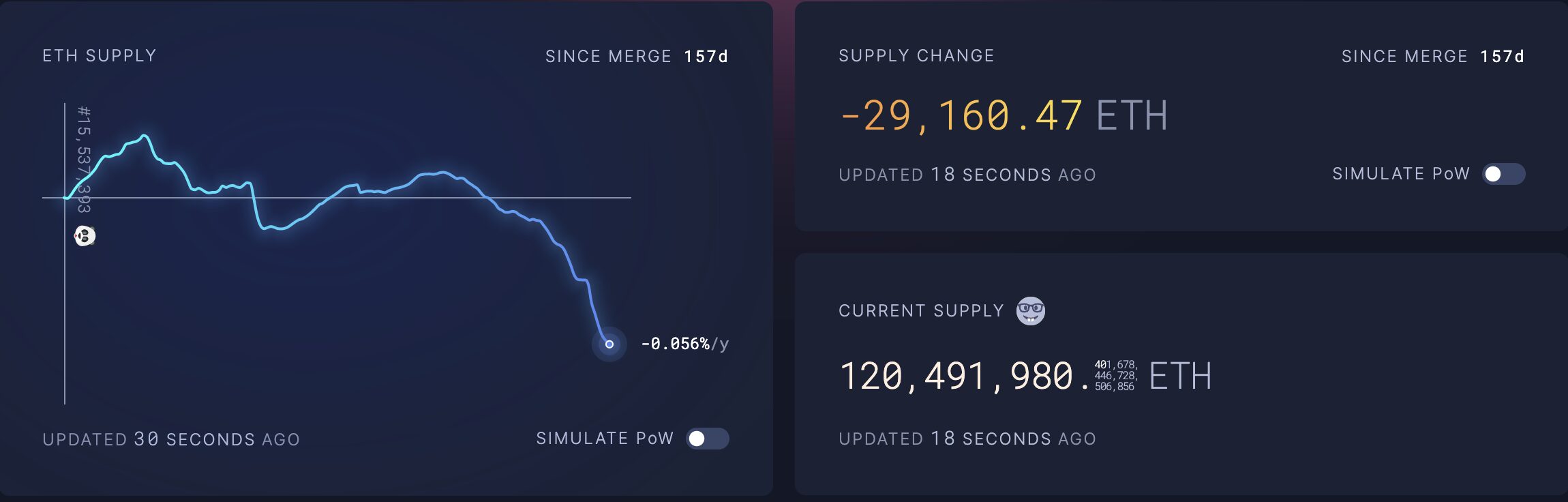

The issuance rate of Ether has dropped to its lowest level since the network’s transition to Proof-of-Stake (PoS) via “the Merge” in September.

On Feb. 20, Ether’s annual supply since the Merge shrunk to -0.056%. In other words, the Ethereum network had been minting fewer ETH tokens than were removed from the supply in the past five months.

Investors typically perceive a cryptocurrency with a fixed supply or deflationary issuance rate as bullish in the longer term.

#Ethereum‘s #deflation #rate is accelerating by the day. This has very positive impact on the supply/demand dynamics, and should send the price a lot higher as demand increases. I think this is happening very soon. #ETH #ETHE

Click Here to Read the Full Original Article at Cointelegraph.com News…