Key Takeaways

- Two Ethereum whales risk forced liquidations due to declining ETH prices.

- A combined total of 125,603 ETH on the Maker protocol could be liquidated if price thresholds are breached.

Share this article

Ethereum’s price fluctuations have placed whales on MakerDAO in a vulnerable position, with a combined 125,603 ETH worth around $238 million at risk of liquidation.

Data tracked by blockchain analytics platform Lookonchain shows that one whale, controlling around 64,793 ETH, is close to its liquidation price of $1,787.

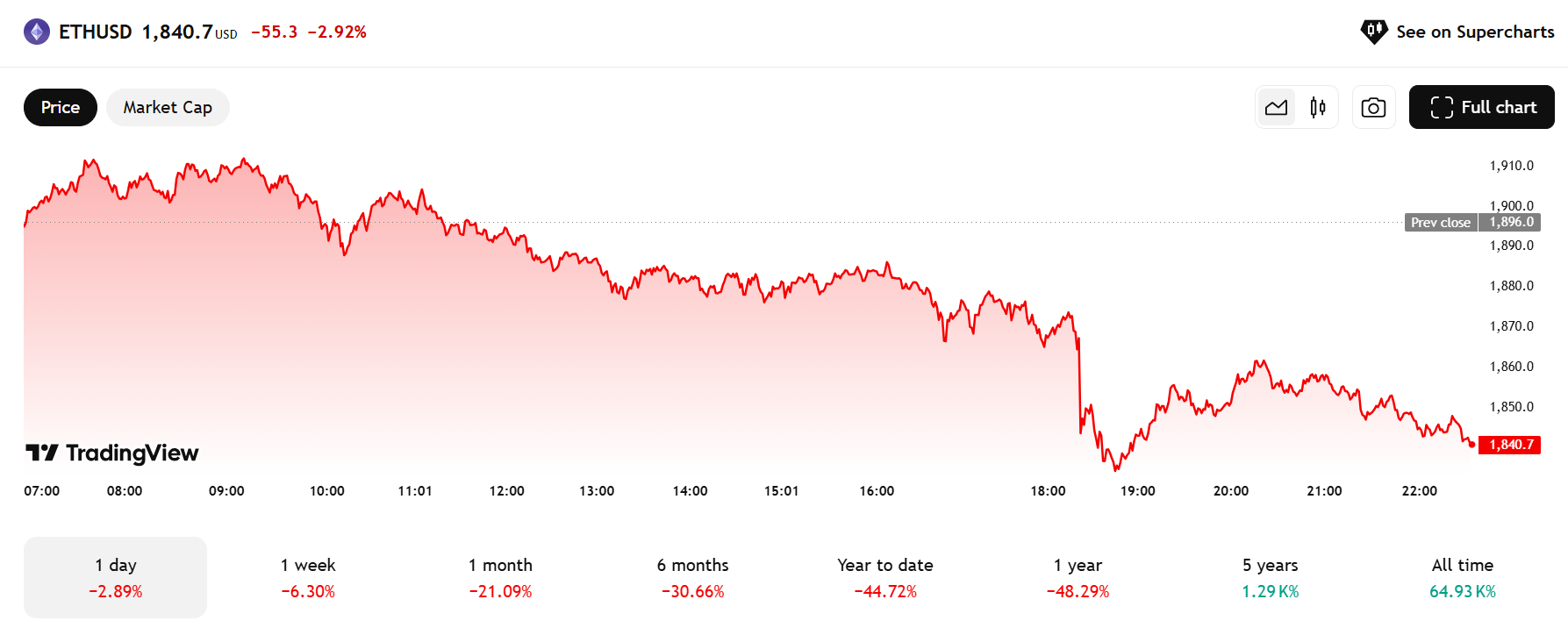

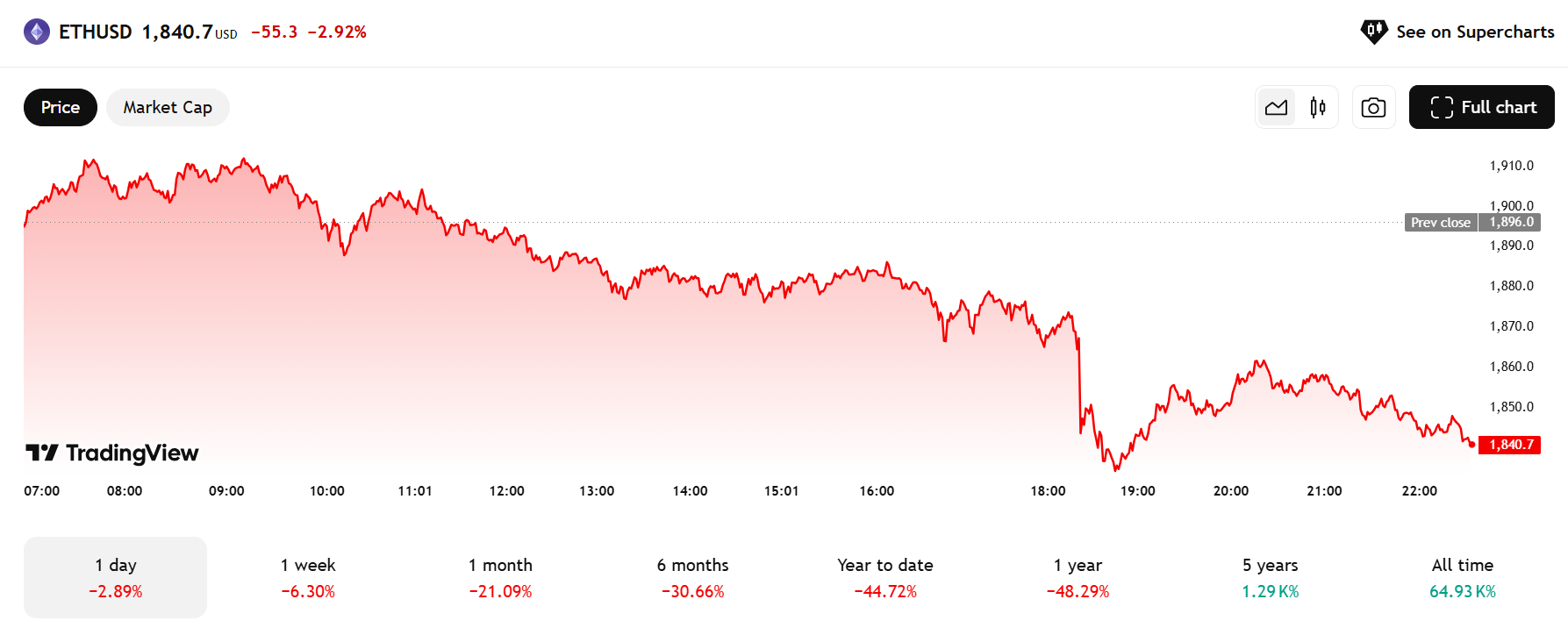

With ETH trading at $1,841 at press time, this whale is only $54 away from its liquidation price.

The trader narrowly avoided liquidation on March 11 by partially repaying their debt after a sharp ETH price drop.

However, the current downturn has put their position back in jeopardy, with the health rate now at 1.04. Continued price decreases could trigger automatic liquidation.

Another whale deposited 60,810 ETH as collateral to borrow 75.69 million DAI, with a liquidation threshold of $1,805. The position faces automatic liquidation if ETH prices fall below this level.

ETH dips below $1,900 amid ETF drag, hacker dump, and market slump

Ethereum has fallen below $1,900, registering a 6% decrease in the past seven days amid market-wide turbulence. Apart from that, a series of negative catalysts have weighed heavily on crypto’s price.

Rising inflation fears and disappointing US economic data have led investors to reduce exposure to risk assets, including crypto assets….

Click Here to Read the Full Original Article at Markets Archives – Crypto Briefing…