The annual supply rate of Ether (ETH) slipped below zero for the first time since Ethereum’s transition to proof-of-stake via the Merge in September. The reason? A spike in on-chain activity amid a massive cryptocurrency market crash.

Ethereum turns deflationary for real

As of Nov. 9, more Ether tokens are being burned than created as a part of Ethereum’s fee-burning mechanism. Simply put, the more on-chain transactions, the more ETH transaction fees get burned.

On a 30-day timeframe, the Ethereum network has been burning ETH at an annual rate of 773,000 tokens against the issuance of 603,000 tokens. In other words, ETH’s supply is going down by 0.14% per year.

Overall, the Ethereum network has burnt 2.72 million ETH since the fee-burning mechanism was introduced in August 2021. That amounts to the permanent destruction of nearly 4 ETH per minute.

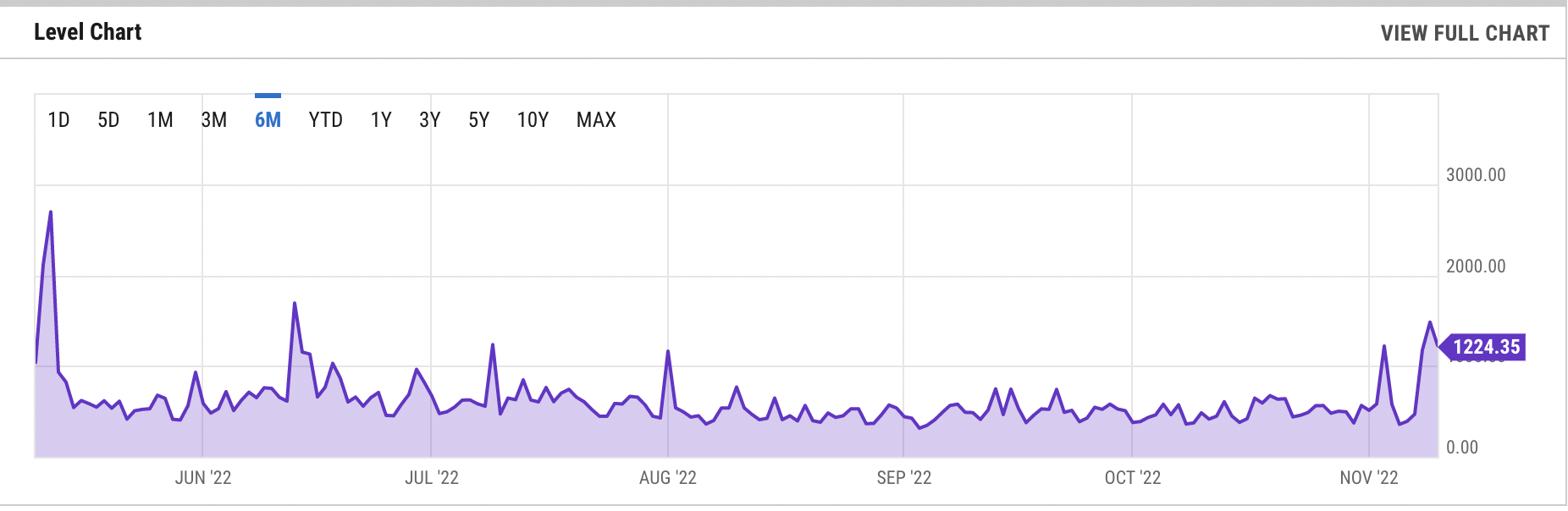

Ethereum network’s transaction fees spiked to their highest levels since May 2022 due to traders rushing to transfer their ETH to and from exchanges amid the dramatic collapse of FTX.

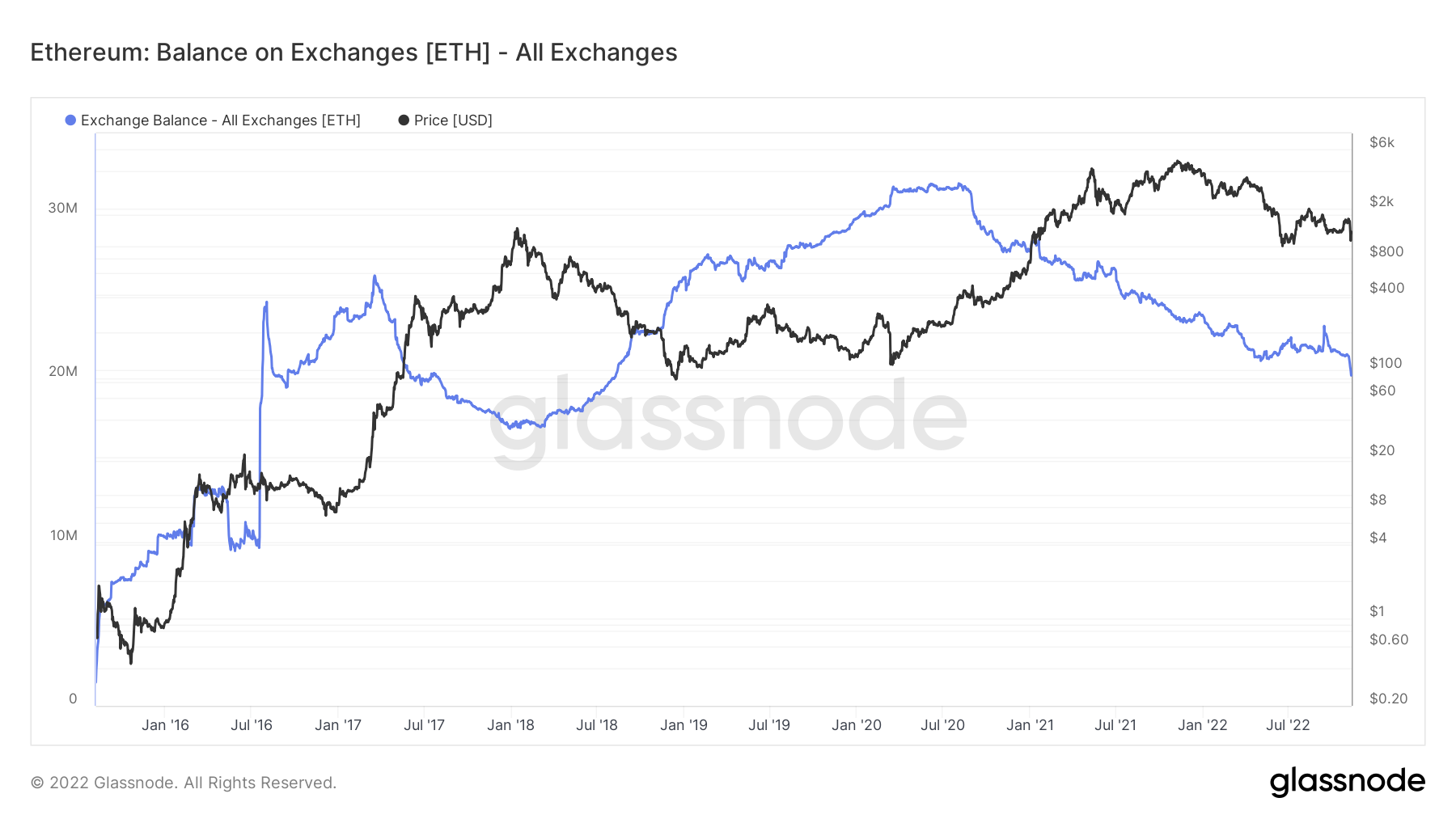

In detail, nearly 1 million ETH have left exchanges in November, according to data from Glassnode.

Many analysts see Ether’s deflationary prospects as a bullish signal for ETH, which should boost its overall scarcity. But the ongoing deflationary rate is a product of current ETH price volatility, which may hurt the its recovery prospects in the near te.

Ether price in danger of another 50% crash

Ether’s price dropped nearly 20% month-to-date and was trading around $1,250 on Nov. 11 after it rebounded from its $1,075 local low.

Furthermore, Ether’s price action has also entered the breakdown stage of its prevailing symmetrical triangle pattern, which may push the price down further by another 50% from current levels.

Related: Bitcoin price hits…

Click Here to Read the Full Original Article at Cointelegraph.com News…