After years in the making, the Merge was finalized on Sept. 15, switching Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

The roll-out enacted several benefits, including cutting the chain’s energy consumption by a reported 99% and setting the groundwork for sharding to improve scaling in a future hard fork.

The Merge also picked up with EIP 1559, which rolled out with the London hard fork in August 2021. This introduced a simplification of Ethereum’s fee market mechanism, including breaking fees into base fees and tips, then burning the base fee.

Under a PoS mechanism post-Merge, burning base fees were sold as a deflationary mechanism that would cut token issuance by as much as 88%.

CryptoSlate analyzed Glassnode data to assess whether the claims hold up. Net supply issuance has not been consistently deflationary in the three months since the Merge.

Ethereum deflation fluctuates

According to Ethereum, under the previous PoW system, miners were issued around 13,000 ETH per day in block mining rewards. Now, post-Merge, stakers receive around 1,700 ETH in daily rewards – this equates to an 87% reduction in issuance.

However, with the advent of base fee burns, the scope for a daily net reduction in supply is enabled. Base fee burns depend on network usage. The busier the network on a given day, the more base fees are burnt.

The minimum activity figure for burned base fees to exceed 1,700 ETH, therefore leading to a net decrease in supply, is around 16 Gwei a day.

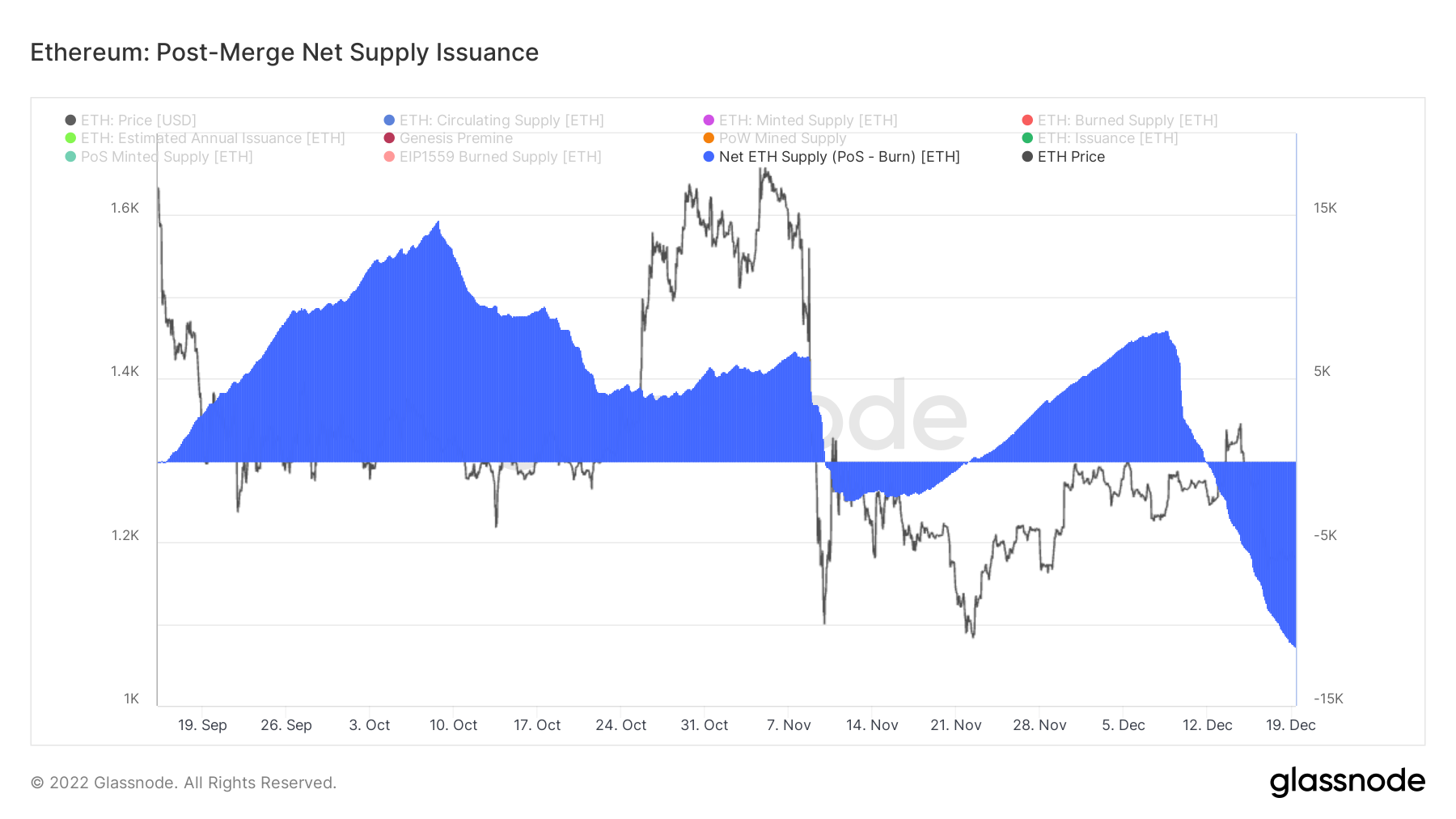

The chart below shows that net supply issuance was inflationary immediately after the Merge until Nov.9, hitting a high of 15,000 tokens in early October.

Following an approximate two-week deflationary stint from Nov. 10, net supply issuance flipped to inflationary once more before returning to a net negative supply issuance from Dec. 12 onwards, sinking to a new low of -11,000 tokens on Dec. 19.

To date, periods of supply inflation exceed supply deflation.

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…