The derivatives market for Bitcoin (BTC) and Ethereum (ETH) experienced significant fluctuations following the incident on Jan. 9, where the U.S. Securities and Exchange Commission’s (SEC) Twitter account was compromised. This false announcement of a spot Bitcoin ETF approval led to a series of market reactions that wiped out over $50 billion in Bitcoin’s market capitalization.

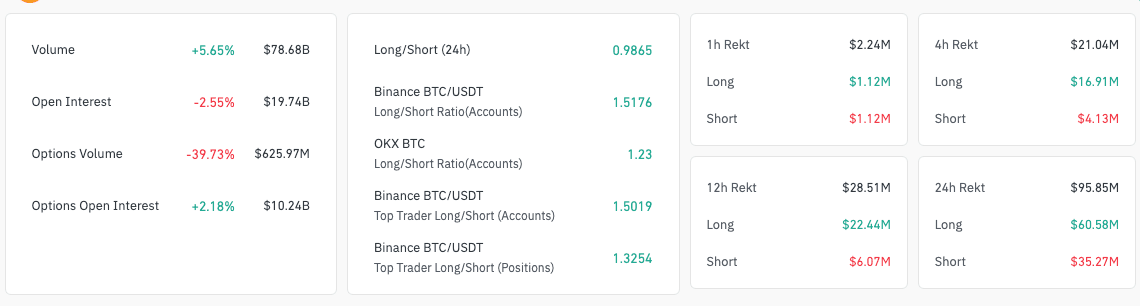

The derivatives market saw unprecedented volatility. CryptoSlate’s analysis of CoinGlass data showed an increase in overall trading volume by 8.52% to $79.02 billion. This rise in trading activity likely reflects the market’s rapid response to the fake news, as traders either sought to capitalize on the volatility or mitigate their risks.

However, this was contrasted by a 2.78% decrease in open interest, bringing it down to $19.69 billion. The decrease in open interest, representing the total number of outstanding derivative contracts, suggests that many traders were closing their positions amid the uncertainty, preferring to reduce exposure rather than engage in a highly volatile market.

While Bitcoin options volume saw a considerable drop of 39.73% to $625.97 million, the options open interest slightly increased by 2.18% to $10.24 billion. This indicates that while there was a reduction in the trading of options contracts, a number of traders held onto their positions. This could be due to a strategy to wait out the market’s fluctuations or a belief in longer-term trends unaffected by short-term volatility.

The market witnessed $95.41 million in liquidations, with long positions accounting for $59.39 million and shorts for $36.02 million. The higher liquidation of long positions suggests a bearish market reaction, where traders betting on a price increase were caught off-guard by the drop in prices following the clarification of the ETF news.

Looking into Binance and Bybit, the two largest exchanges by open interest, we see both platforms experiencing an increase in trading volume, indicating heightened activity. The decrease in open interest on these platforms further corroborates the trend of traders choosing to close positions in a volatile environment.

| Symbol | Price | Price (24h%) | Volume (24h) | Volume (24h%) | Market Cap | Open Interest | Open Interest (24h%) | Liquidation… |

|---|

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…