Ethereum’s upcoming Shanghai upgrade will allow users to withdraw staked Ether (ETH), increasing the network’s liquidity and competitiveness while also boosting its staking ratio closer to its competitors.

The Shanghai upgrade is a hard fork of Ethereum tentatively scheduled to occur in March. It implements five Ethereum Improvement Proposals, the headliner being EIP-4895, which allows users to withdraw their locked-up tokens representing staked Ether from the Beacon Chain.

The ability to withdraw staked Ether could increase market liquidity and make it easier for users to access their funds. Ethereum liquid staking platforms, which largely emerged to alleviate the blockchain’s prohibitive lock-up and staking requirements, could also benefit from the upgrade.

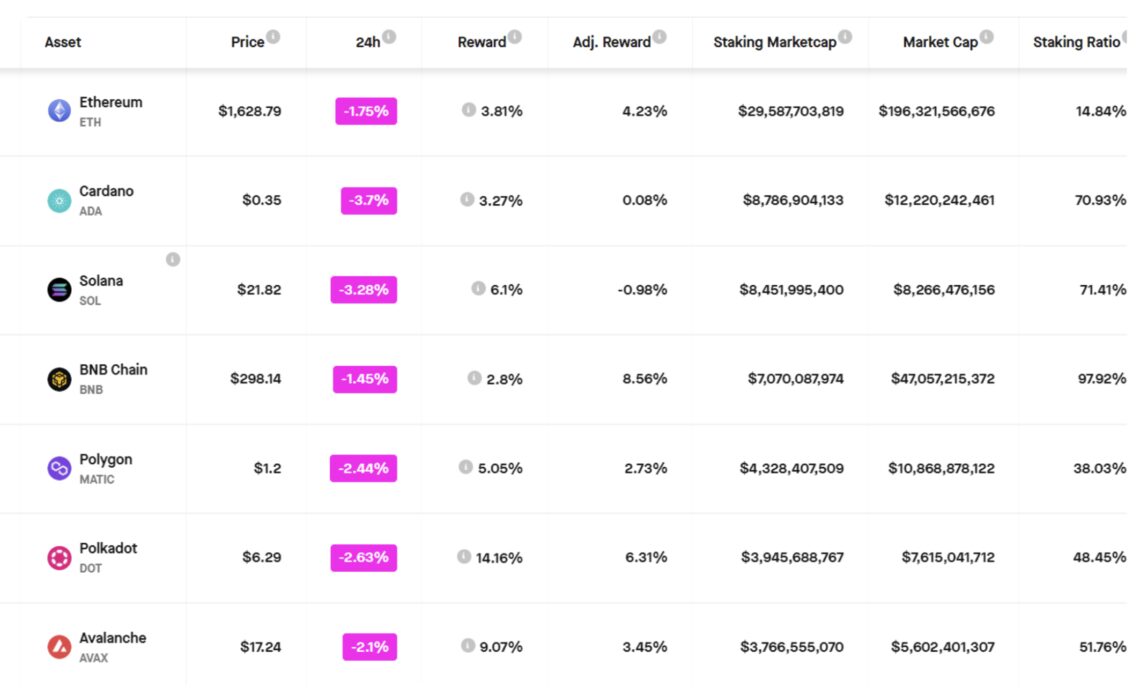

Since the Ethereum network moved to proof-of-stake (PoS) in September 2022, increasing the percentage of staked Ether has become important to help secure the protocol. But many have hesitated to stake their ETH due to the unavailability of withdrawals. Consequently, only around 15% of ETH is currently staked, while all other major layer-1 networks have a staking ratio above 40%.

According to The DeFi Investor, many investors will opt for a liquid staking option following the Shanghai upgrade, as they can utilize liquid staking derivatives on other decentralized finance networks without forfeiting their staking yield.

Why?

Because liquid staking derivatives can be used across DeFi without giving up the staking yield.

After withdrawing staked $ETH becomes available, the revenue of liquid staking providers will likely take off.

revenue goes up -> their tokens benefit as well

— The DeFi Investor (@TheDeFinvestor) January 4, 2023

The DeFi Investor went on to say that once staked ETH becomes available for withdrawal, the revenue of liquid staking providers will likely significantly increase, which may positively impact their token prices.

Furthermore, the increased competition between these platforms will likely benefit their users through lower fees and additional perks in exchange for their loyalty.

Lido is the largest liquid-staked ETH provider and is a market leader in its segment. Other notable liquid staking providers include Rocket Pool, Ankr, Coinbase and Frax Finance, all of which are anticipated to enjoy an increase in usage post-Shanghai.

Ethereum leads in liquid staking activity

Ethereum Beacon Chain deposits across all staking…

Click Here to Read the Full Original Article at Cointelegraph.com News…