Ethereum’s native token Ether (ETH) slumped on June 16, suggesting that its relief rally coinciding with the Federal Reserve announcing it will hike the benchmark rate by 0.75%, is at risk.

Ether bulls trapped?

Ether’s price slipped by 9.2% to around $1,120 per token a day after it rebounded by 23% after dropping to almost $1,000, its worst level since January 2021.

The ETH/USD pair’s upside move, followed by a sharp correction, appeared in tandem with U.S. stocks, confirming that it traded like a risk-asset.

The decline means that Ether has shed 77% of its value since November 2021 and is now trading below its “realized price” of $1,740, data from Glassnode shows.

In addition, a higher interest rate environment adds more selling pressure, with investors leaving high-risk trades and seeking safety in traditional hedging assets, such as cash.

Investors’ faith in cryptocurrencies has also eroded following the collapse of Terra, a $40 billion algorithmic stablecoin project, and lending platform Celsius Network’s decision to halt withdrawals.

Atop that, Three Arrow Capital, a crypto hedge fund that oversaw nearly $10 billion in May 2022, reportedly faces insolvency risks. Fears about systemic risks have further limited the crypto market’s recovery bias, hurting Ether.

ALERT: 3AC $250 Million $ETH Position Will Be Liquidated at ≈1000

— Market Meditations (@MrktMeditations) June 15, 2022

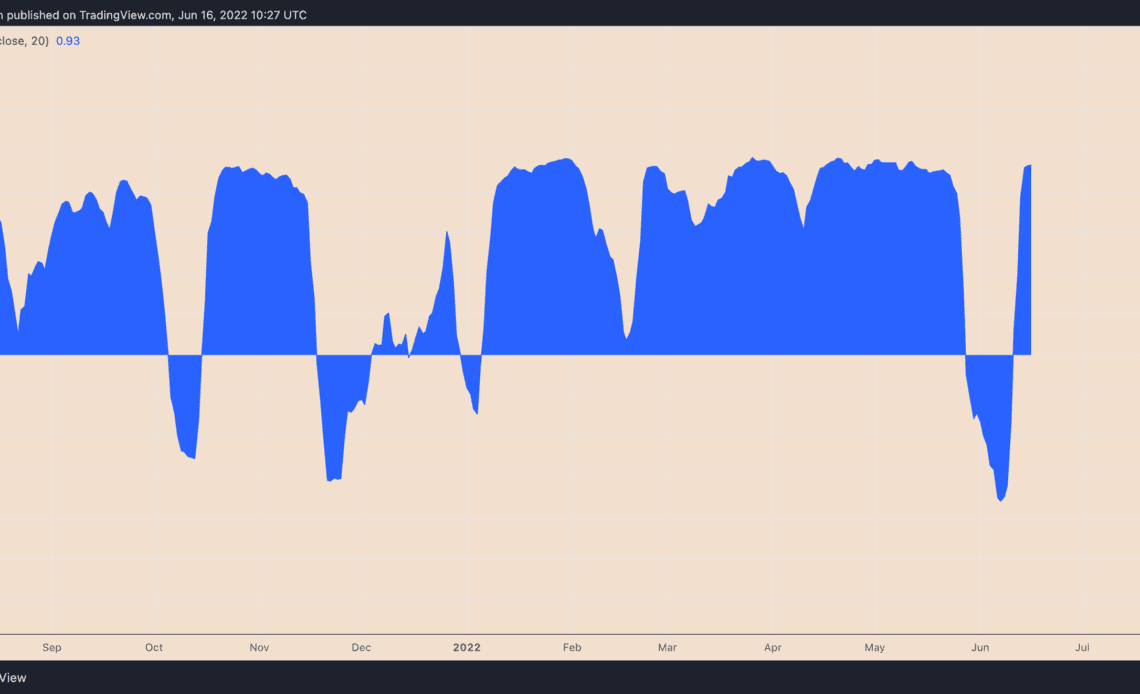

From a technical perspective, Ether’s recent gains look like a bear market rally, which could be due to investors covering their short trades.

In detail, investors close their short positions by buying the underlying asset back on the market—typically at a price lesser than the one at the time of borrowing—and returning them to the lender. That prompts the asset to rally between large downside moves, but it does not signify a bullish reversal.

Related: Bitcoin…

Click Here to Read the Full Original Article at Cointelegraph.com News…