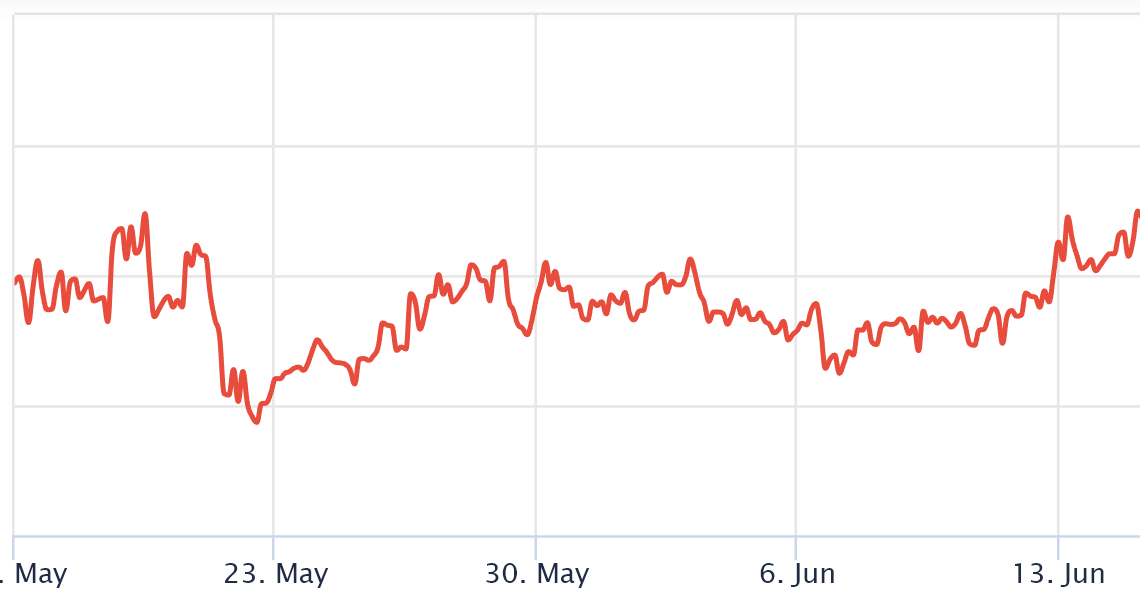

Ether (ETH) price is down 37.5% in the last 7 days and recent news reported that developers decided to postpone the network’s migration to a proof-of-stake (PoS) consensus. This upgrade is expected to end the dependency on proof-of-work (PoW) mining and the Merge scalability solution that has been pursued for the past 6 years.

Competing smart contracts like BNB Token (BNB), Cardano (ADA) and Solana (SOL) outperformed Ether by 13% to 17% since June 8 even though there was a market-wide correction in the cryptocurrency sector. This suggests that the Ethereum network’s issues also weighed on the ETH price.

The “difficulty bomb,” feature was added to the code in 2016 as plans for the new consensus mechanism (formerly Eth2) were being formed. At the peak of the so-called “DeFi summer,” Ethereum’s average transaction costs surpassed $65 which was frustrating for even the most fervent users. This is precisely why the Merge plays such an important part in investors’ eyes and, consequently, Ether price.

Options traders remain extremely risk-averse

Traders should look at Ether’s derivatives markets data to understand how whales and market makers are positioned. The 25% delta skew is a telling sign whenever professional traders overcharge for upside or downside protection.

If traders expected an Ether price crash, the skew indicator would move above 10%. On the other hand, generalized excitement reflects a negative 10% skew. This is precisely why the metric is known as the pro traders’ fear and greed metric.

The skew indicator improved on June 16, at least for a brief moment, as it touched 19%. However, as soon as it became evident that climbing above the $1,200 resistance would take longer than expected, the skew metric climbed back to 24%. The higher the index, the less inclined traders are to price downside risk.

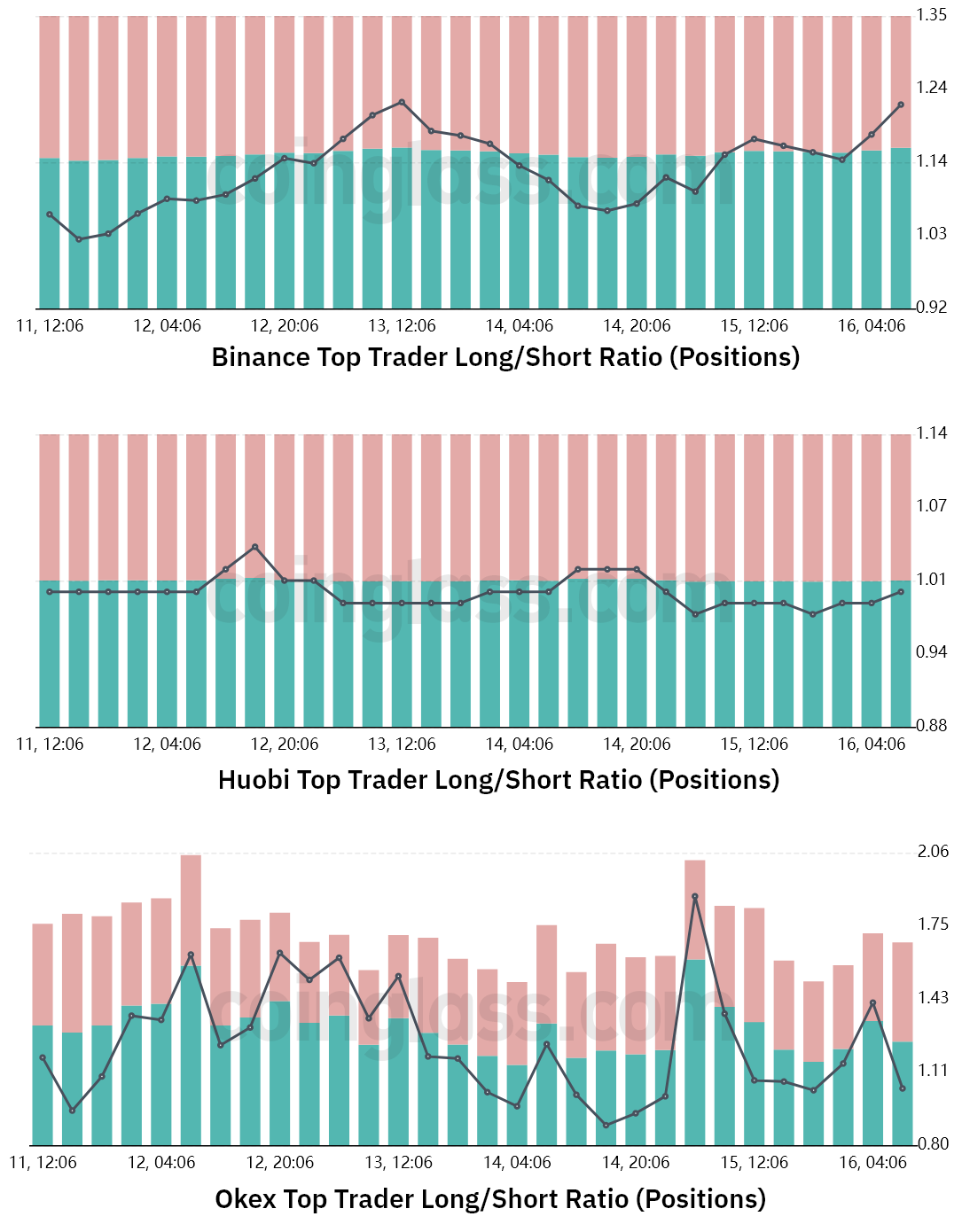

Long-to-short data show traders are not interested in shorts

The top traders’ long-to-short net ratio excludes externalities that might have solely impacted the options markets. By analyzing these positions on the spot, perpetual and quarterly futures contracts, one can better understand whether professional traders are leaning bullish or bearish.

There are occasional methodological discrepancies between different exchanges, so viewers should monitor changes instead of absolute figures.

Even though Ether has failed to sustain the $1,200…

Click Here to Read the Full Original Article at Cointelegraph.com News…