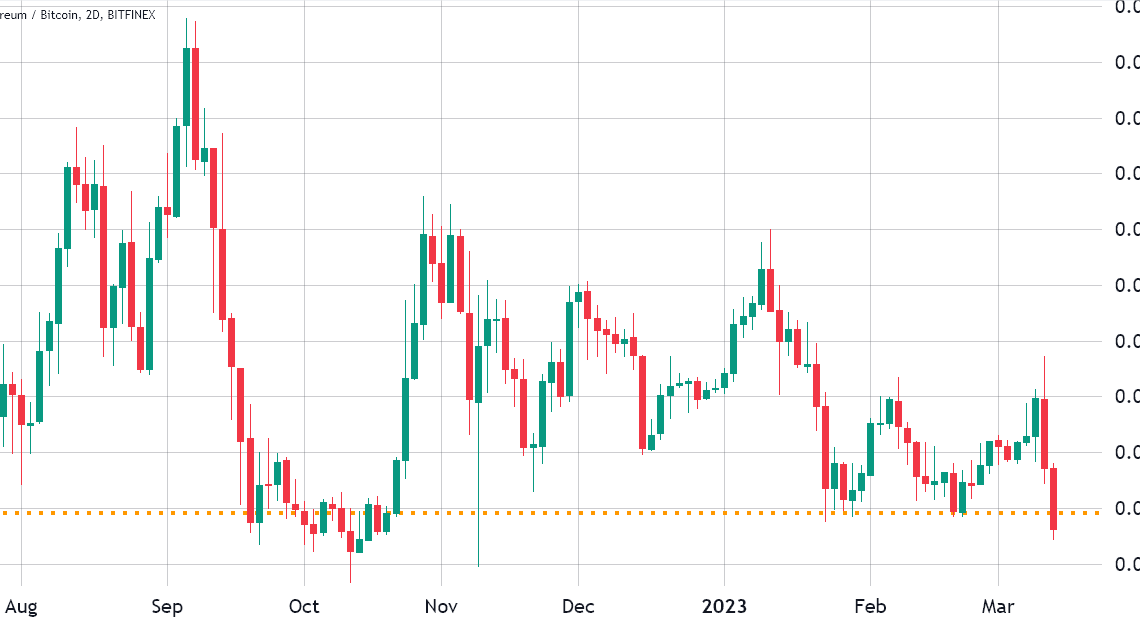

The previous six months should have been extremely beneficial to Ether’s (ETH) price, especially after the project’s most significant upgrade ever in September 2022. However, the reality was the opposite: between September 15, 2022, and March 15, 2023, Ether underperformed Bitcoin (BTC) by 10%.

The price ratio of 0.068 ETH/BTC had been holding since October 2022, a support that was broken on March 15. Whatever the reason for the underperformance, traders currently have little confidence in placing leverage bets, according to ETH futures and options data.

But first, one should consider why Ether’s price was expected to rise in the previous six months. On September 15, 2022, the Merge, a hard fork that switched the network to a proof-of-stake consensus mechanism, occurred. It enabled a much lower, even negative, coin issuing rate. But, more importantly, the change paved the way for parallel processing that aimed to bring scalability and lower transaction costs to the Ethereum network.

The Shapella hard fork, expected to take effect on the mainnet in April, is the next step in the Ethereum network upgrade. The change will allow validators who previously deposited 32 ETH to enter the staking mechanism to withdraw in part or in full. While this development is generally positive because it gives validators more flexibility, the potential 1.76 million ETH unlock is a negative consequence.

However, there is a cap on the number of validators that can exit; therefore, the maximum daily unstake is 70,000 ETH. Moreover, after exiting the validation process, one may choose between Lido, Rocket Pool, or a decentralized finance (DeFi) application for yield mechanisms. These coins will not necessarily be sold at the market.

Let’s look at Ether derivatives data to understand if the recent drop below the 0.068 ETH/BTC ratio has affected investors’ sentiment.

ETH futures recovered from a state of panic

In healthy markets, the…

Click Here to Read the Full Original Article at Cointelegraph.com News…