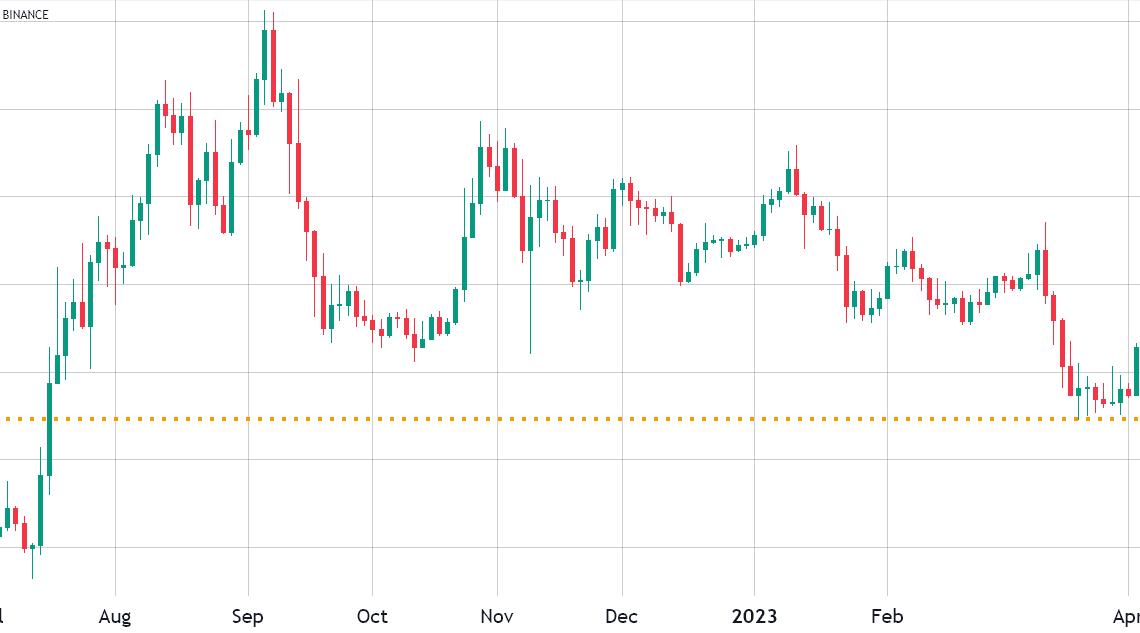

Ether (ETH) price has increased by 58% year to date, but it has far underperformed the market leader Bitcoin (BTC). In fact, the ETH/BTC price ratio has dropped to 0.063, its lowest level in 9 months.

Analysts believe that the majority of the movement can be attributed to the Ethereum network’s upcoming Shapella hard fork, which is scheduled for April 12 at 10:27 p.m. UTC.

The Ethereum network upgrade will allow stakers to unlock their Ether rewards or stop staking entirely. By April 11, over 170,000 ETH withdrawals were requested, according to the analytics firm Glassnode. However, the total staked on the Beacon Chain exceeds 18.1 million ETH, which has traders fearful until more information on ETH’s potential selling pressure becomes available.

Is the price impact of the Shapella fork already priced in?

The staking unlock was widely known and expected, so traders could have anticipated the movement. Some analysts have gone so far as to call the hard fork a “buy the news” event.

Literally everyone: “Ethereum Shanghai is a buy the news event because everyone thinks it is a sell the news event” pic.twitter.com/TpyL1TDnPj

— HORSE (@CanteringClark) April 9, 2023

Using a meme, trader @CanteringClark is likely expressing dissatisfaction with the theory, but to invalidate the hypothesis, one must investigate potential reasons for ETH’s underperformance other than the much anticipated hard fork.

For starters, the Ethereum network’s average transaction fee has been above $5 for the past five weeks and the Shapella fork does not address the issue, despite minor improvements. This alone lowers the chances of a bullish breakout following the upgrade, as most decentralized applications (Dapps) and projects will continue to prefer second layer and competing networks.

Furthermore, volume at Ethereum-based decentralized exchanges (DEX) have fallen by 84% since a weekly peak of $38.2 billion on March 5. The most recent data for the week ending April 2 was $6.4 billion, according to DeFiLlama. In the same period, competing blockchains saw 60% lower volumes on average, a sign that Ethereum lost market share.

According to Paul Brody, EY’s global blockchain leader, one reason for Ether’s price underperformance relative to Bitcoin could be “the battle to keep Ethereum sufficiently and properly decentralized.” Brody cites exchanges as highly centralized custodial validators, as well as some semi-centralized…

Click Here to Read the Full Original Article at Cointelegraph.com News…