Ether (ETH) price experienced a 7% decline between Oct. 6 and Oct. 12, hitting a seven-month low at $1,520. Although there was a slight rebound to $1,550 on Oct. 13, it appears that investor confidence and interest in Ethereum are waning, as indicated by multiple metrics.

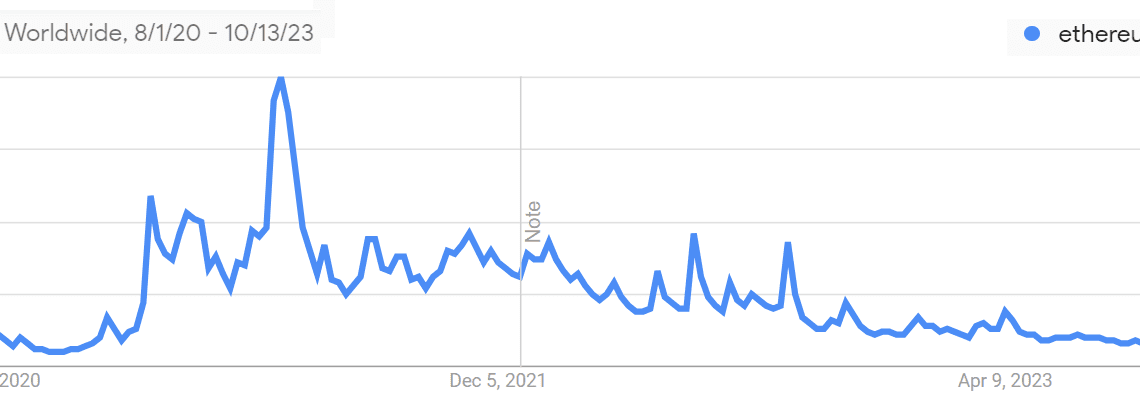

Some may argue that this movement reflects a broader disinterest in cryptocurrencies, evident in the fact that Google searches for “Ethereum” have reached their lowest point in 3 years. However, Ethereum has underperformed the overall altcoin market capitalization by 15% since July.

Interestingly, this price movement coincided with Ethereum’s average 7-day transaction fees declining to $1.80, the lowest level in the past 12 months. To put this in perspective, just two months ago, these fees stood at over $4.70, a cost considered high even for initiating and closing batched layer-2 transactions.

Regulatory uncertainty and lower staking yield back ETH’s price decline

A significant event that impacted Ether’s price was the remarks made by Cardano founder Charles Hoskinson regarding U.S. Securities and Exchange Commission director William Hinman’s classification of Ether as a non-security asset in 2018. Hoskinson, who is also an Ethereum co-founder, alleged on Oct. 8 that some form of “favoritism” influenced the regulator’s decision.

Ethereum staking has also garnered less interest from investors participating in the network validation process, as the yield decreased from 4.3% to 3.6% in just two months. This change occurred alongside an increase in ETH supply due to reduced activity in the burn mechanism, reversing the prevailing scarcity trend.

On Oct. 12, regulatory concerns escalated after the Autorité de Contrôle Prudentiel et de Résolution (ACPR), a division of the French Central Bank, highlighted the “paradoxical high degree of concentration” risk in decentralized finance (DeFi). The ACPR report suggested the need for specific rules governing smart contract certification and governance to protect users.

Derivatives data and dropping TVL reflect bears’ control

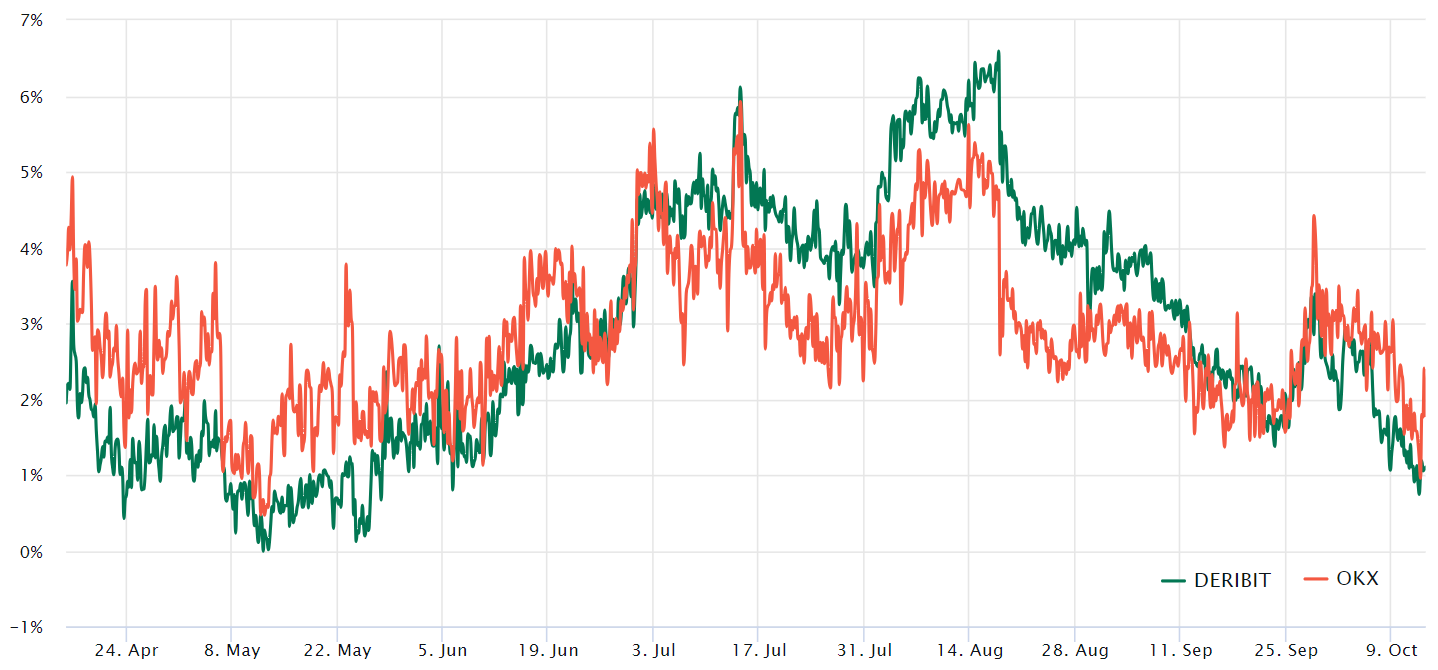

Taking a closer look at derivatives metrics provides insight into how professional Ether traders are positioned following the price correction. Typically, ETH monthly futures trade at a 5 to 10% annualized premium to compensate for delayed trade settlement, a practice not unique to the crypto markets.

The…

Click Here to Read the Full Original Article at Cointelegraph.com News…