Ethereum (ETH) has been on a downward trend with the $2,000 level forming a crucial resistance level in recent months.

While Bitcoin (BTC) recorded 11.94% gains moving past $30,000 in June after BlackRock filed an ETF application with the U.S. Securities and Exchange Commission, the upside in ETH stayed around 3.16%.

In the first week of July, buyers attempted to move the price past crucial resistance at around $1,900, however, a failed breakout exposed the price to further correction.

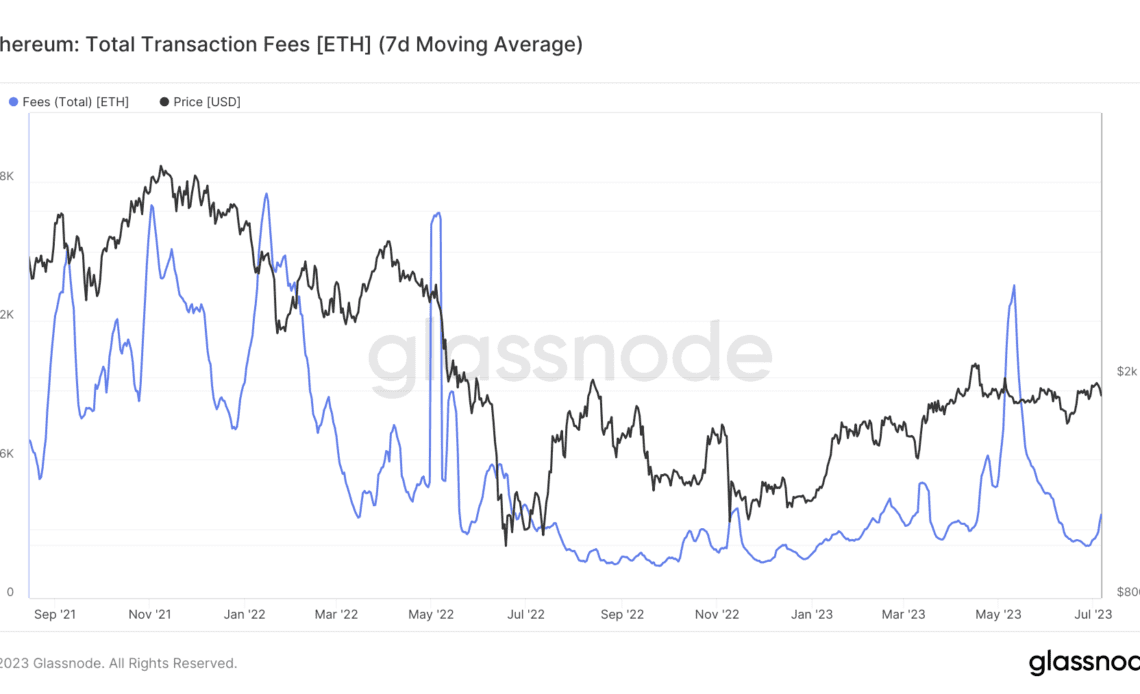

The Ethereum network also witnessed a decline in activity, evident in the one-year low levels in total transaction fees. The price of leading NFT collections on Ethereum plummeted, while DeFi activity stalled due to low yields.

However, the downside may be restricted as the demand for liquid staking derivatives (LSD) like Lido’s stETH continue to grow, rising faster than investors are moving to sell.

LSD activity is on the rise

While the primary use cases on Ethereum in NFT trading and DeFi activity suffered a downturn in June, the LSD narrative continued to grow.

On-chain analytics firm Glassnode wrote in its latest report that deposits to the staking contract have “been higher, or equal in scale to exchange inflows since Shanghai went live,” suggesting that more ETH is being moved toward staking than selling on exchanges.

The total ETH deposited on staking contracts is 19.7% compared to the centralized exchange balance of around 12.8%. LSD platforms captured most of the inflow, followed by independent validators and staking-as-a-service clients.

Ether staking deposits increased significantly after the Shanghai upgrade in April as confidence increased with active redemptions. Among LSD platforms, Lido led the sector, followed by Rocket Pool and Frax.

Click Here to Read the Full Original Article at Cointelegraph.com News…