Ethereum’s switch to proof-of-stake (PoS) on Sep. 15 failed to extend Ether’s (ETH) upside momentum as ETH miners added sell-pressure to the market.

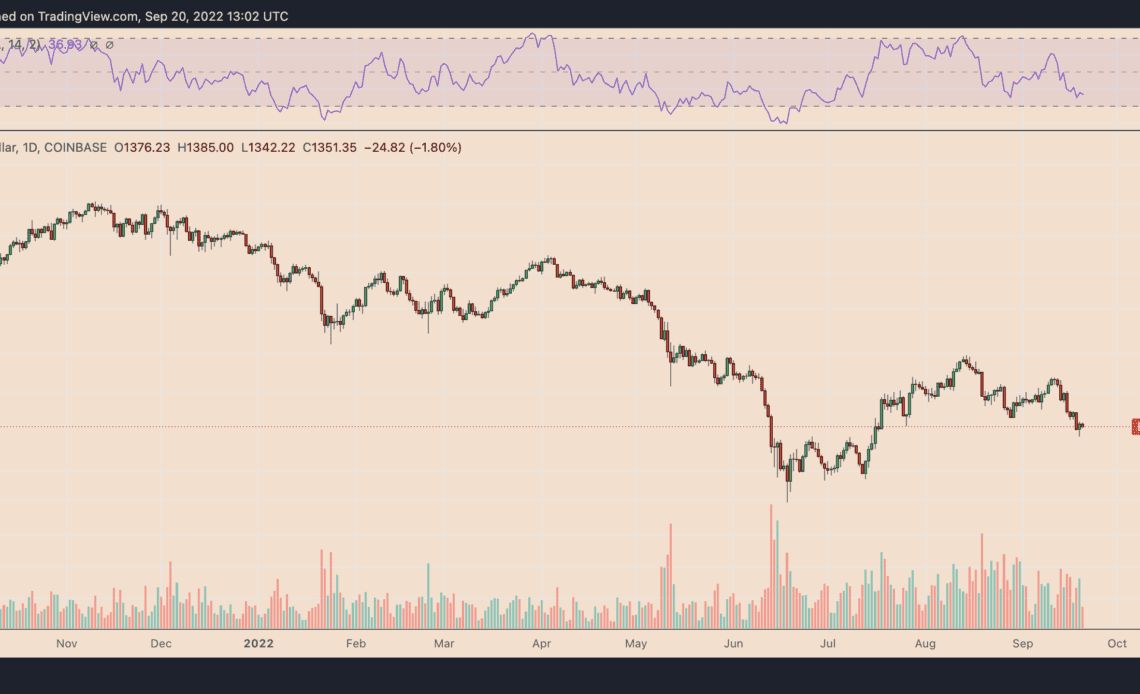

On the daily chart, ETH price declined from around $1,650 on Sep. 15 to around $1,350 on Sep. 20, an almost 16% drop. The ETH/USD pair dropped in sync with other top cryptocurrencies, including Bitcoin (BTC), amid worries about higher Federal Reserve rate hikes.

Ethereum remains inflationary

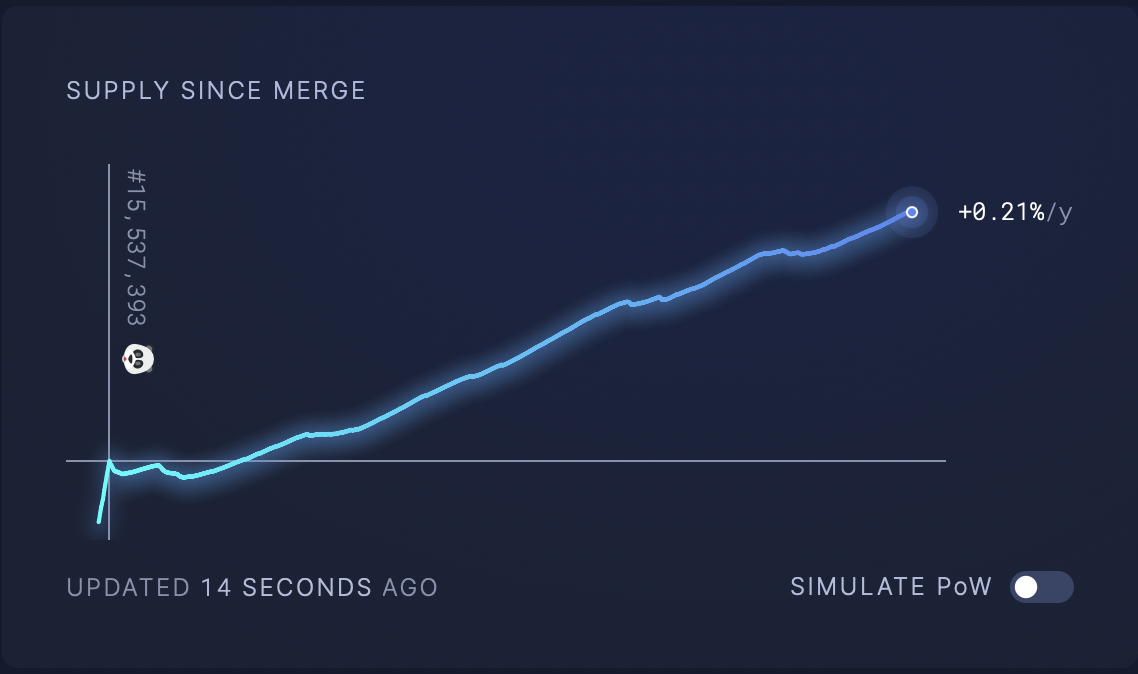

The Ether price drop on Sep. 15 also coincided with an increase in ETH supply, albeit not immediately post-Merge.

$ETH is now Ultra Sound Money pic.twitter.com/fKz6VmoWdR

— DavidHoffman.eth (@TrustlessState) September 15, 2022

Roughly 24 hours later, the supply change flipped positive once more, pouring cold water on the “ultra sound money” narrative due to a deflationary environment that some proponents expected post-Merge.

Pre-Merge, Ethereum distributed around 13,000 ETH per day to its proof-of-stake (PoW) miners and about 1,600 ETH to its PoS validators. But the rewards to miners dropped after the Merge went live by roughly 90%.

Meanwhile, validators receiving Ether rewards now only make 10.6% of the previous amount. As a result, Ether’s annual emissions have dropped by around 0.5%, making ETH less inflationary, and perhaps even deflationary under certain circumstances.

Still, the Ether supply has been rising at an annual rate of 0.2% after the Merge, according to data provided by Ultrasound Money.

The main reason behind the growing supply is lower transaction fees.

Notably, Ethereum made a change to its protocol in August 2021 that introduced a fee-burning mechanism. In other words, the network started removing a portion of the fee it charges for each transaction permanently. This system has burned 2.6 million ETH since going live.

Data shows that the Ethereum network’s gas fees must be around 15 Gwei to…

Click Here to Read the Full Original Article at Cointelegraph.com News…