Widely followed analyst and trader Michaël van de Poppe believes that Ethereum (ETH) could suddenly take off on a massive rally for one main reason.

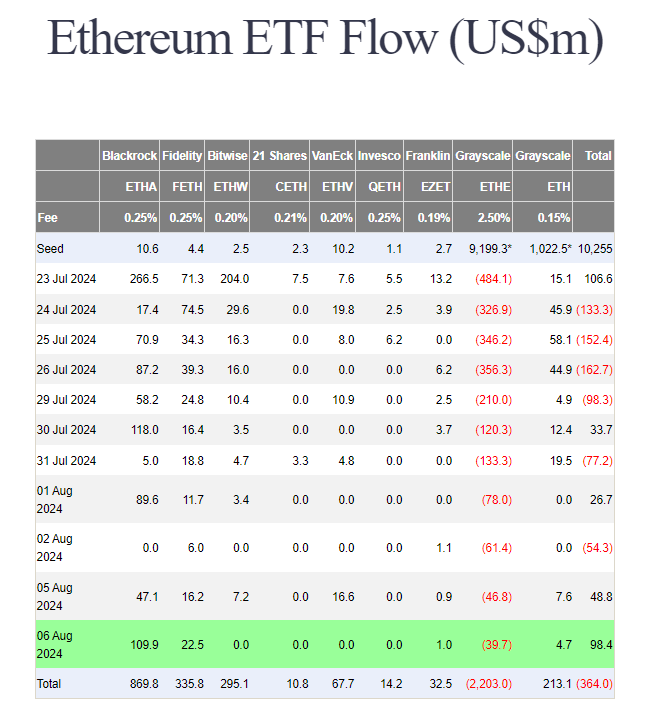

Van de Poppe tells his 722,000 followers on the social media platform X that inflows into the spot ETH exchange-traded funds (ETFs) are exceeding new supply, which he believes is a bullish catalyst.

“The ETH supply was created in 2024: $160 million. The net inflow in ETH ETF in the past two days: $150 million. The demand is exceeding the supply.”

However, the analyst suggests that ETH’s big rally will likely depend on whether the ETF inflows persist.

“I think Ethereum is super undervalued and ready for a big run if this inflow sustains.”

The analyst believes that Ethereum could soar to around $4,000 within weeks if it can hold $2,600 as support on the weekly chart.

“The second scenario took place for ETH, which was way deeper than we expected. However, I think that, if Ethereum closes above $2,600, we’ve seen the actual low and are ready for a big surge upwards. The inflows are super positive.”

Ethereum is trading for $2,496 at time of writing, up 3.7% in the last 24 hours.

The analyst also says that the crypto market may have reached a bottom after this week’s deep correction and suggests rallies could come for projects like Ethereum scaling solution Optimism (OP).

“This week is providing massive weekly candles. A deep wick, but quickly returning and some are even turning green. I think that there’s a significant chance that we’ve actually seen the low. Substantial candle on OP as well.”

Optimism is trading for $1.32 at time of writing, up 5.4% in the last 24 hours.

Lastly, the analyst predicts a big breakout for money market protocol Aave (AAVE) after consolidating around the $100 level.

“One of the most promising charts in crypto is AAVE. DeFi (decentralized finance) is looking…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…