Ethereum is the foundation of the decentralized finance ecosystem and is automatically categorized as a decentralized network. On paper, Ethereum is a decentralized and democratic network based on a deflationary currency.

In reality, it’s neither decentralized nor deflationary.

Defying deflation

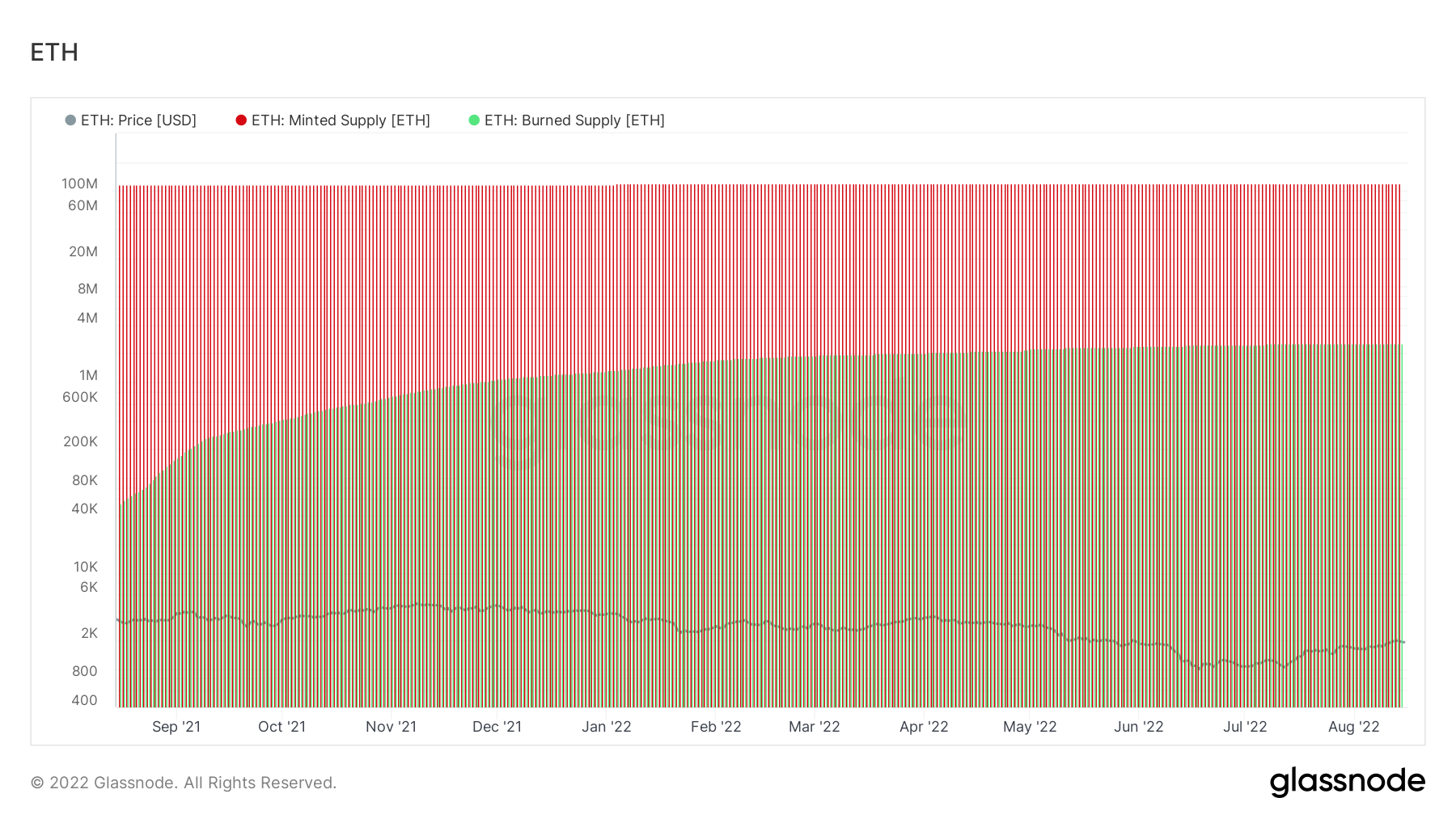

In September 2021, Ethereum’s London hard fork introduced EIP-1559, an upgrade set to drastically change how the network worked. The upgrade would enable the network to burn a portion of the gas fees paid by users, permanently reducing the supply of ETH. The constantly reducing supply of ETH was expected to exceed the daily rewards paid to miners, turning ETH into a deflationary currency.

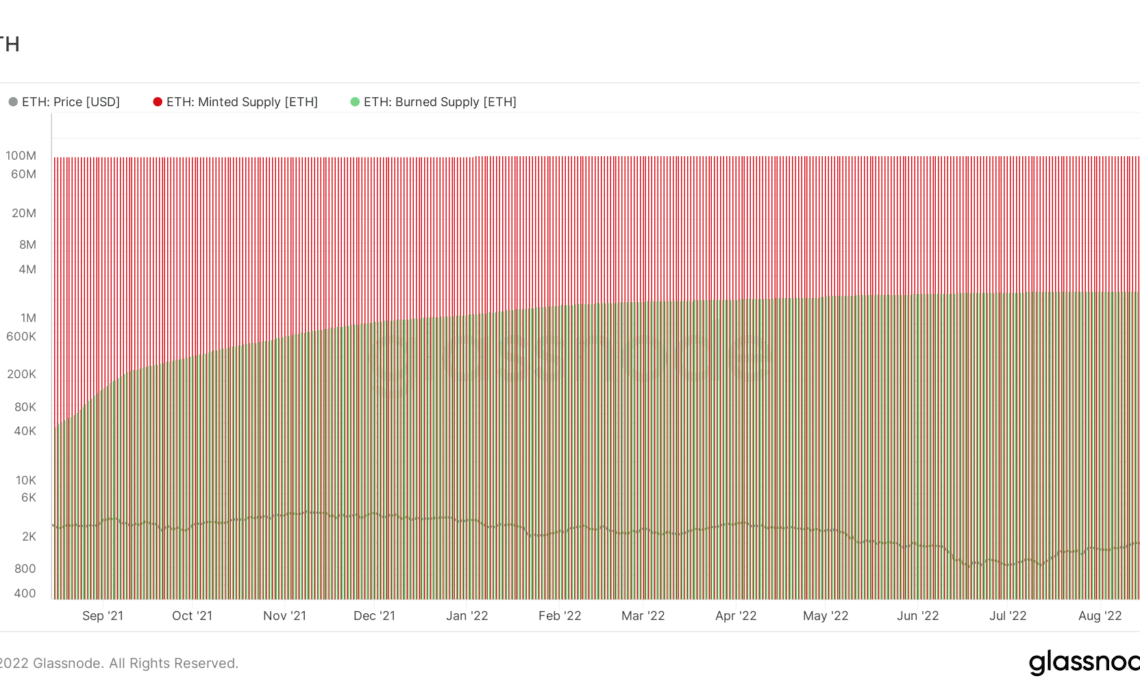

However, the rate of burning ETH never outpaced the rate of minting ETH, as indicated in the graph below.

A decreasing amount of activity on Ethereum is the biggest factor that has prevented the burn rate from overtaking the mint rate. For Ethereum to become a deflationary currency, the amount of ETH burned in gas fees would need to overtake the amount of ETH minted to be distributed as block rewards.

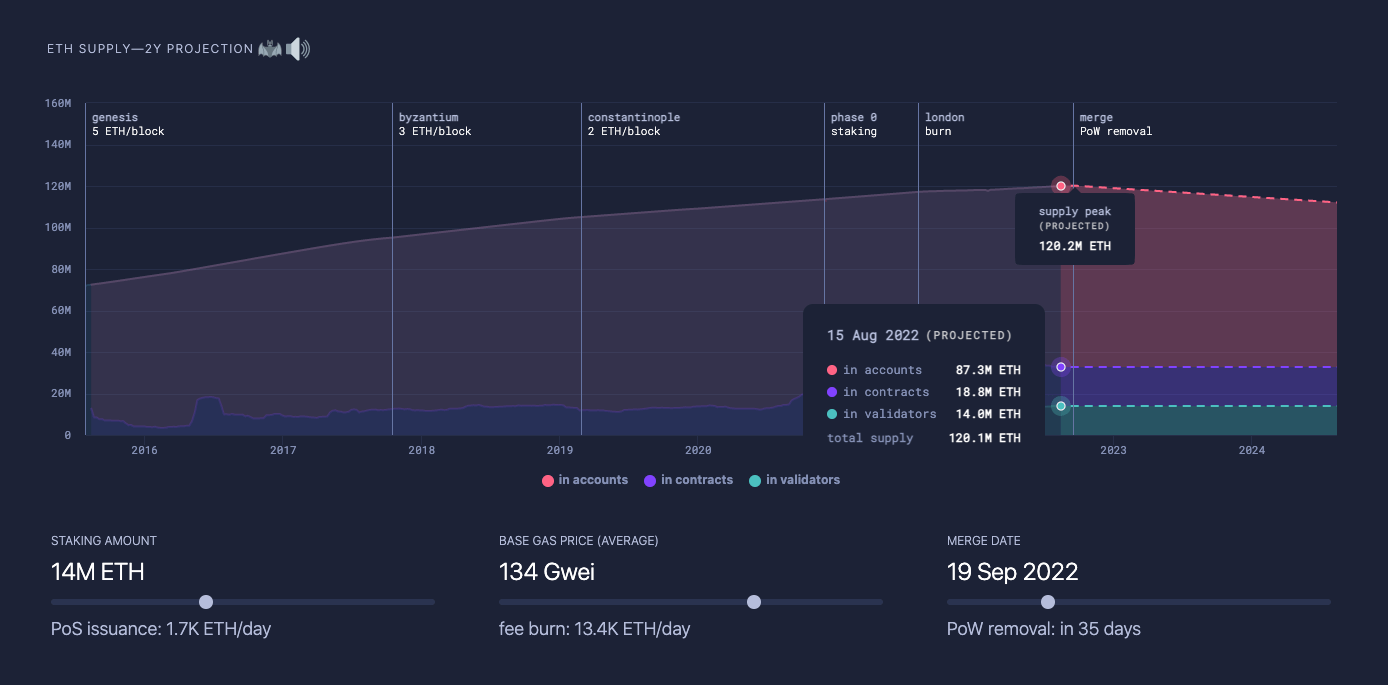

In the past year, an average of 13,000 ETH was distributed as block rewards daily. In order to burn over 13,000 ETH in gas fees, the Ethereum network would need to see an average base gas price of around 130 gwei.

However, since the beginning of the year, the average gas price on Ethereum rarely surpassed 130 gwei. According to data from YCharts, outside of the two peaks recorded in May, gas prices remained below 60 gwei since April. Since the beginning of July, the average price remained below 20 gwei.

The rising price of Ethereum, which keeps defying the general market trend, could be…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…