The past few months have seen Ethereum whales, the cryptocurrency world’s Goliaths, flexing their financial muscles. According to a recent report by Santiment, on-chain data reveals a surge in whale activity, possibly fueled by the green light for spot Ethereum exchange-traded funds (ETFs) from the US Securities and Exchange Commission (SEC).

Related Reading

A Whale Of A Time: Accumulation Anchors Ahead

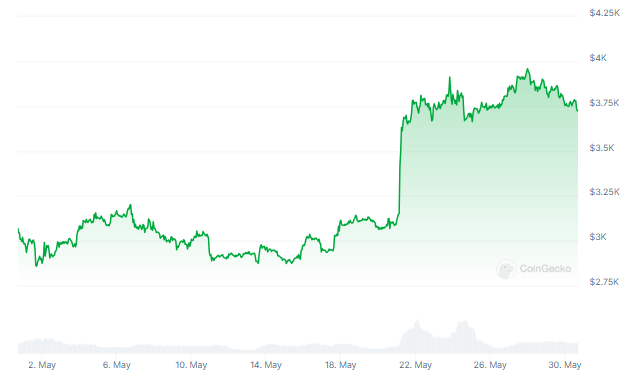

The SEC’s surprise approval on May 23rd of 19b-4 forms for ETF applications from heavyweights like BlackRock and Fidelity stirred the cryptoverse nest. This long-awaited decision, following months of radio silence from regulators, seems to have been the harbinger of a buying spree for Ethereum’s biggest players.

Santiment’s report dives deep, revealing a nearly 30% increase in holdings by wallets containing at least 10,000 ETH over the past 14 months. This translates to a staggering 21 million ETH, currently valued at a cool $83 billion, scooped up by these deep-pocketed investors.

With Ethereum even surpassing Bitcoin in terms of percentage gains last month, it’s no surprise that the accumulation party shows no signs of stopping.

Profit Feast Before The Main Course?

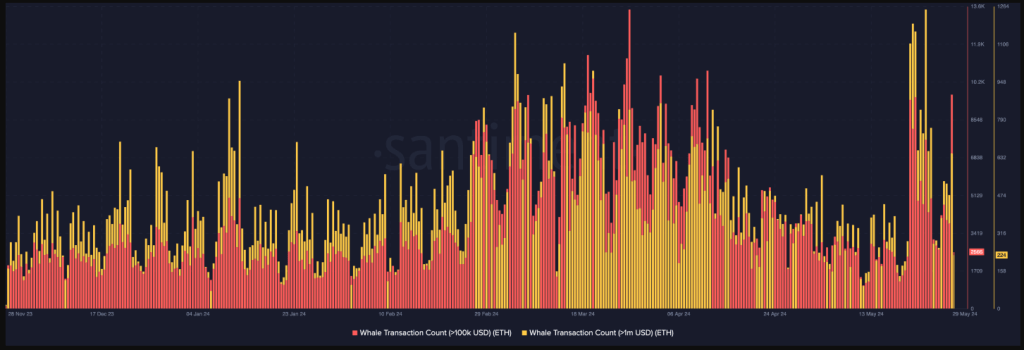

The data suggests a recent uptick in whale transactions exceeding $100,000 and a whopping $1 million, reaching year-to-date highs after the ETF approval. This surge in activity could be interpreted as whales taking advantage of the bullish sentiment to lock in some profits.

However, Santiment suggests this might be a strategic pit stop before diving back into the buying pool. As long as these “10K+ ETH wallets are still moving north,” the report argues, Ethereum’s price has the potential to continue outperforming its bigger brother, Bitcoin, even amidst market volatility.

Profitable Seas For Ethereum Sailors

The good news extends beyond whale activity. An analysis by NewsBTC revealed a positive trend in daily Ethereum transactions. Measured over a seven-day moving average, the ratio of profitable transactions to those ending in a loss sits at a healthy 1.87. This indicates that for every losing trade, there are nearly two winning ones, suggesting a wave of optimism among Ethereum investors.

Click Here to Read the Full Original Article at NewsBTC…