Ethereum founder Vitalik Buterin has been in a contemplative mood recently. After posting a series of “open contradictions” in his “thoughts” and “values,” Buterin has now taken his musings to the arena of “automated stablecoins.”

Commonly referred to as algorithmic stablecoins, Buterin wrote a blog post this week assessing the viability of such unbacked tokens amid the fallout of the Terra catastrophe.

An evaluation of automated stablecoins

Buterin wrote the blog post in collaboration with Paradigm head of research Dan Robinson, Uniswap creator Hayden Adams, and Ethereum researcher Dankrad Feist.

Buterin began the post by citing the UST de-peg events and said he would welcome a “greater level of scrutiny on Defi financial mechanisms, especially those that try very hard to optimize for “capital efficiency.”

The Ethereum founder continued with a call to “return to principles-based thinking,” which he proposed through two thought experiments:

Thought experiment 1: can the stablecoin, even in theory, safely “wind down” to zero users?

Thought experiment 2: what happens if you try to peg the stablecoin to an index that goes up 20% per year?

What is an automated stablecoin?

Notably, the definition of an automated stablecoin used by Buterin is a “stablecoin, which attempts to target a particular price index… [using] some targeting mechanism, … is completely decentralized… [and] must not rely on asset custodians.”

He explained that the current thinking is the targeting mechanism must be some form of a smart contract. Buterin then explained how Terra Classic worked “by having a pair of two coins, which we’ll call a stablecoin and a volatile-coin or volcoin (in Terra, UST is the stablecoin and LUNA is the volcoin).”

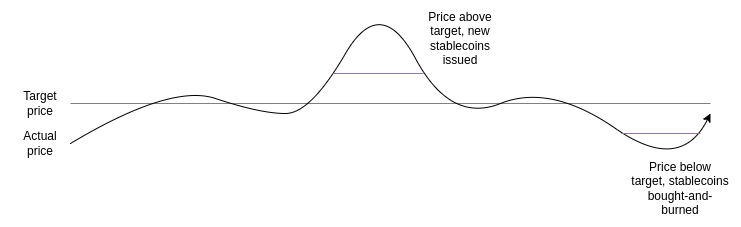

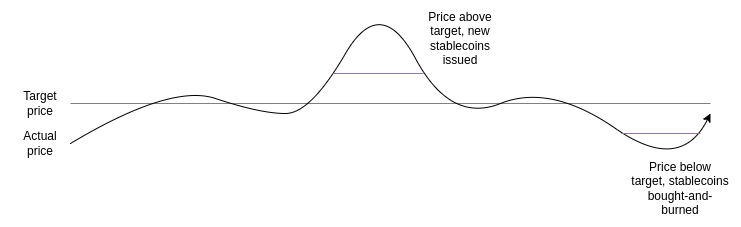

The below chart visualizes the method by which Terra maintained UST’s peg.

In comparison to UST, Buterin also described RAI, an…

Click Here to Read the Full Original Article at Ethereum – CryptoSlate…