Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023.

Ether has a 61% chance of breaking out versus Bitcoin

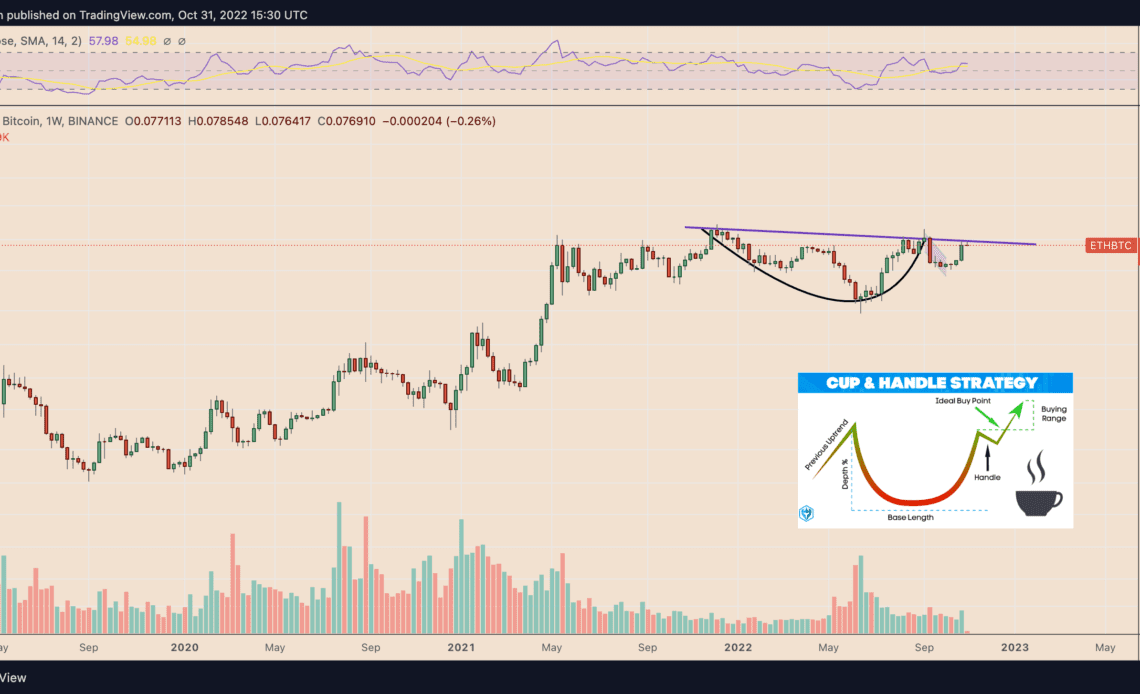

The bullish cues emerge primarily from a classic technical setup dubbed the “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline).

Traditional analysts perceive the cup-and-handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level.

The Ether-to-Bitcoin ratio (or ETH/BTC), a widely tracked pairing has halfway painted a similar setup. The pair now awaits a breakout above its neckline resistance level of around 0.079 BTC, as illustrated in the chart below.

As a result, a decisive breakout move above the cup-and-handle neckline of 0.079 BTC could push the Ethereum price toward 0.123 BTC, or over 50%, by early 2023.

Time to turn bullish on ETH?

Ether’s strong interim fundamentals compared to Bitcoin further improve its possibility of undergoing a 50% price rally in the future.

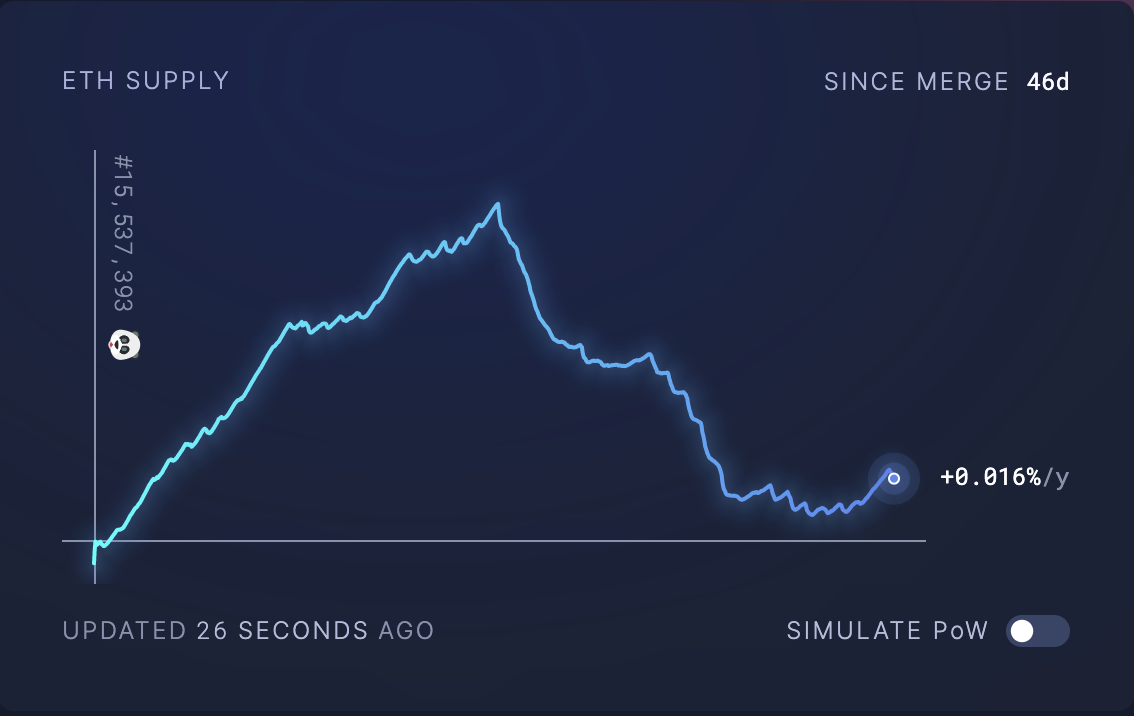

For starters, Ether’s annual supply rate fell drastically in October, partly due to a fee-burning mechanism called EIP-1559 that removes a certain ETH amount from permanent circulation whenever an on-chain transaction occurs.

XEN Crypto, a social mining project, was mainly responsible for raising the number of on-chain Ethereum transactions in October, leading to a higher number of ETH burns, as Cointelegraph covered here.

Over 2.69…

Click Here to Read the Full Original Article at Cointelegraph.com News…