Ethereum ETFs (exchange-traded funds) began trading on Tuesday, generating significant volume within the first 2 hours of trading. Interestingly, the Ethereum ETFs ranked among the top 1% regarding ETF volume.

Related Reading

Ethereum ETFs Surpass Traditional Launch Volumes

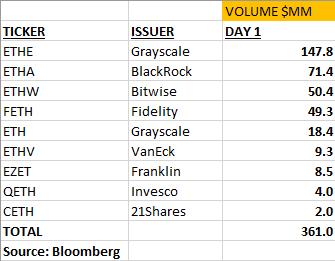

According to Bloomberg ETF expert Eric Balchunas, the ETH ETFs traded $361 million in the first 90 minutes on launch day, surpassing the typical volume seen at the launch of traditional ETFs. Blachunas said:

Here’s where we at after 90 minutes. $361m total. As a group that number would rank them about 15th overall in ETF volume (about what $TLT and $EEM trade), which is Top 1%. But again compared to a normal ETF launch, which rarely see more than $1m on Day One, all of them have cleared that number and then some.

Matthew Sigel, head of digital asset research at asset manager VanEck, highlighted the significance of these figures in the first hours of trading, noting that Ethereum ETFs saw more than 50% of trading volume compared to Bitcoin’s $610 million on day one, indicating strong investor interest in Ethereum.

However, how these numbers will fare at the close remains to be seen. Bitcoin ETFs saw $4.6 billion in volume on their first day of trading in January, which may indicate the future performance of these newly approved index funds for the second-largest cryptocurrency on the market.

ETH’s Price Targets Soar

Crypto analyst Doctor Profit shared a report highlighting a potentially massive parabolic move for Ethereum’s price this year in the wake of the expected inflows in the new Ethereum ETF market.

While some anticipate a correction due to the “sell the news” phenomenon, Doctor Profit argues that the market has already factored in the ETF launch but has yet to consider the significant inflows of USD that will flood into the Ethereum ETFs.

With Ethereum’s market cap being three times smaller than Bitcoin’s, Doctor Profit believes that every dollar invested in ETH is expected to have three times the price impact compared to Bitcoin, positioning Ethereum favorably for substantial price gains.

Furthermore, the analyst contends that while Ethereum’s Grayscale ETH Fund sell pressure is comparable to the Bitcoin ETF launch, the impact is expected to be less severe.

Related Reading

Looking ahead, Doctor Profit has set expected price targets for…

Click Here to Read the Full Original Article at NewsBTC…