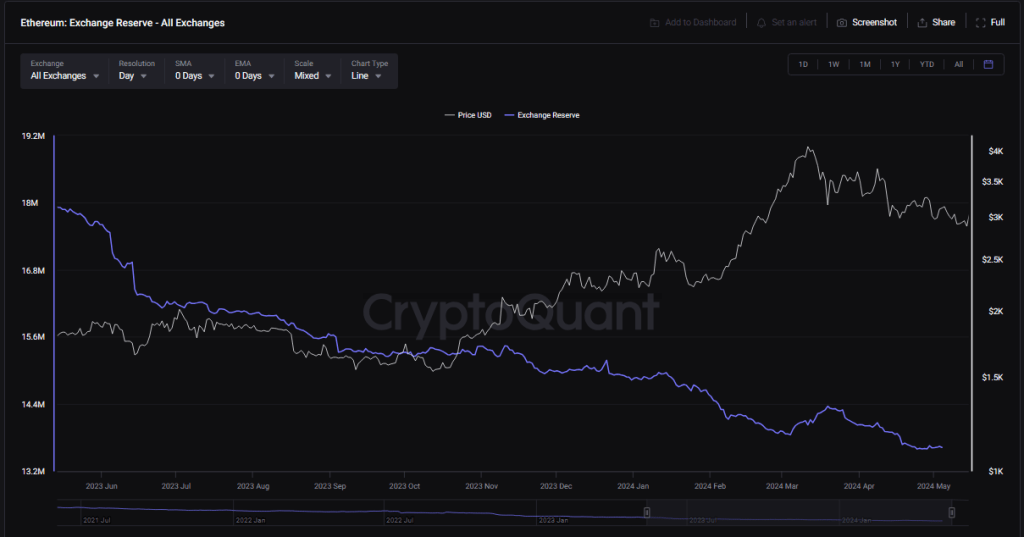

The winds of change are blowing through the Ethereum ecosystem. Since the long-awaited approval of spot Ether ETFs in the US on May 23rd, a quiet exodus of Ether has been underway. A massive amount of the world’s second-largest cryptocurrency, or around $3 billion, has vanished from centralized exchanges, marking the lowest level of Ether reserves in years. This flight of the digital asset has analysts buzzing with the possibility of a supply squeeze, potentially propelling Ether to new heights.

Related Reading

Exodus To Self-Custody: A Bullish Signal?

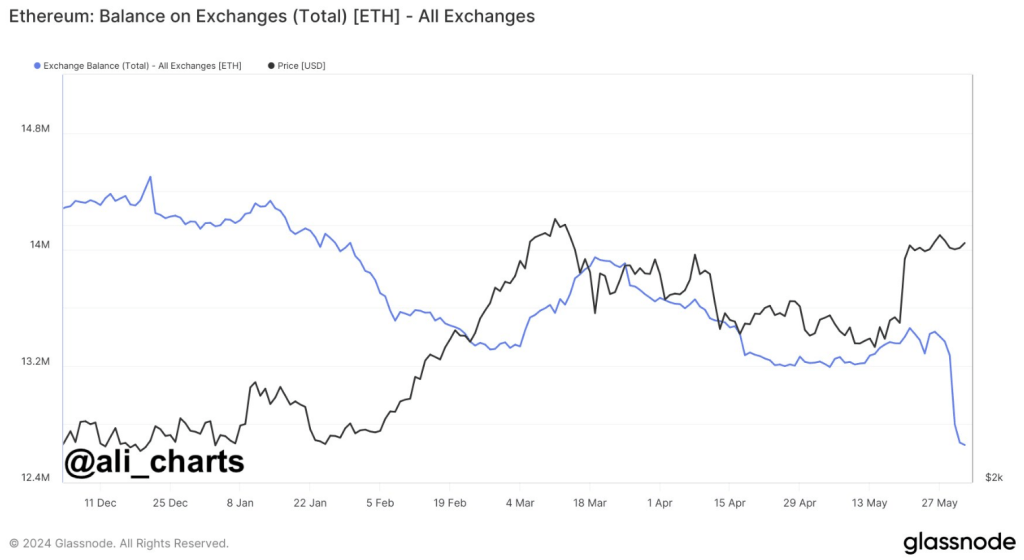

Crypto analyst Ali Martinez reported on X in a recent post that since the US legalized spot Ethereum ETF products, nearly 777,000 ETH, or almost $3 billion, have been removed from cryptocurrency exchanges. Even if the Ether ETF products haven’t formally begun trading on exchanges yet, the continuation of this trend could have a significant impact on how ETH prices behave over time.

Since the @SECGov approved spot #Ethereum ETFs, approximately 777,000 $ETH — valued at about $3 billion — have been withdrawn from #crypto exchanges! pic.twitter.com/EzQVC0cw27

— Ali (@ali_charts) June 2, 2024

Traditionally, high reserves on exchanges have indicated a selling-heavy market, with investors readily offloading their holdings. The current situation, however, paints a different picture. Analysts suggest this mass exodus signifies a shift in investor sentiment. Many are moving their Ether to personal wallets, a move known as self-custody, indicating a long-term bullish outlook.

The low exchange reserves suggest investors are treating Ether not just as a trading asset, but as a potential store of value, says Michael Nadeau, a DeFi report crypto analyst. This shift in mindset, coupled with the potential for increased demand from ETFs, could create a perfect storm for a price surge.

The Ethereum network itself may also be contributing to the supply squeeze. Unlike Bitcoin miners who face constant operational costs, Ethereum validators, responsible for securing the network under the Proof-of-Stake model, don’t have the same financial pressure to sell their holdings. This lack of “structural sell pressure,” as Nadeau terms it, further restricts the readily available supply of Ether.

Ethereum ETF Launch: A Double-Edged Sword?

The upcoming launch of Ether ETFs in late June adds another layer of intrigue. The success of spot Bitcoin ETFs in January, which saw a…

Click Here to Read the Full Original Article at NewsBTC…